Sudeep Pharma Limited IPO Company Profile:

Sudeep pharma limited is a technology-driven manufacturer of excipients and specialty ingredients providing to the pharmaceutical, food, and nutrition industries. The Company has established a robust presence in both domestic and international markets, spanning approximately 100 countries across key regions, including the USA, South America, Europe, the Middle East, Africa, and Asia-Pacific. Sudeep pharma has in-house developed technologies across advanced processes such as encapsulation, spray drying, granulation, trituration, liposomal preparations, and blending. The company’s focus on innovation and process excellence enables it to deliver high-quality, reliable, and customized solutions to global clients, reinforcing its commitment to technological advancement, operational efficiency, and sustainable growth in the competitive pharmaceutical and specialty ingredients sectors.

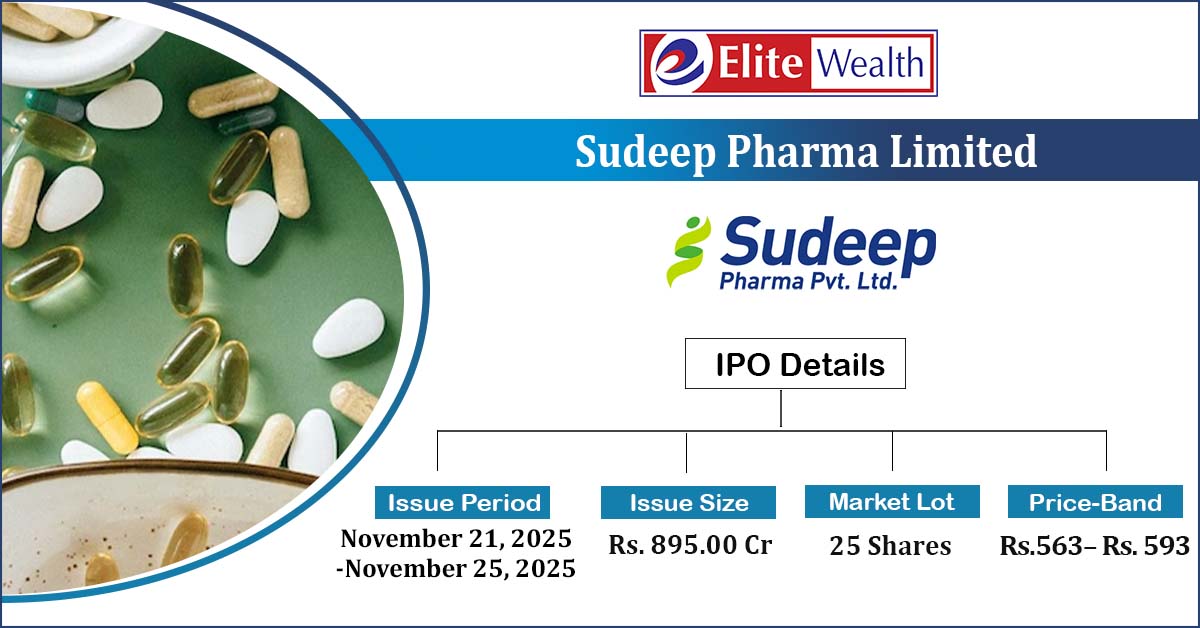

| IPO-Note | Sudeep Pharma limited (SPL) |

| Rs. 563 – Rs. 593 per Equity share | Recommendation: Apply |

| Issue Details | |

| Objects of the issue | · Funding Capital Expenditure.

· General Corporate Exp. |

| Issue Size | Total Issue Size-Rs. 895.00Cr

OFS Size- Rs. 800.00 Cr Fresh Issue Size- 95.00 Cr |

| Face value |

Re. 1 |

| Issue Price | Rs. 563 – Rs. 593 per share |

| Bid Lot | 25 Shares |

| Listing at |

BSE, NSE |

| Issue Opens | November 21, 2025- November 25, 2025 |

| QIB | Not More than 50% of Net Issue Offer |

| HNI | Not Less than 15% of Net Issue Offer |

| Retail | Not Less than 35% of Net Issue Offer |

Sudeep Pharma Limited IPO Strengths:

- As of Q1FY26, it operates four manufacturing facilities with a combined annual available capacity of 72,246 MT, spanning approx. 68,446 square meters. Three facilities are located in Vadodara, Gujarat, and following the acquisition of NSS as a material subsidiary effective May 22, 2025, it also operates a manufacturing facility in Ireland.

- As per the F&S Report, the Company ranks among the largest producers of food-grade iron phosphate for infant nutrition, clinical nutrition, and the food and beverage sectors, with a combined annual manufacturing capacity of 72,246 metric tons as of Q1FY26.

- As of Q1FY26, it has served over 1,100 customers, establishing longstanding relationships with marquee clients, including Pfizer Inc., Intas Pharma., Mankind Pharma, Merck Group, Alembic Pharma, Aurobindo Pharma, Cadila Pharma, IMCD Asia, Micro Labs, and Danone S.A., reflecting its strong market presence and trusted partnerships across the pharmaceutical and nutrition sectors.

- As per the F&S Report, It was the only entity in India and one of only nine globally to hold the Council of Europe (“CEP”) Certification of Suitability, along with written confirmation for the sale of calcium carbonate as an active pharmaceutical ingredient (“API”) in the European Union.

- As of Q1FY26 and FY25, the Company recorded product sales volumes of 4,852 MT and 18,922 MT, respectively, in its pharmaceutical, food, and nutrition segment, and 1,599 MT and 8,079 MT, respectively, in its specialty ingredients segment.

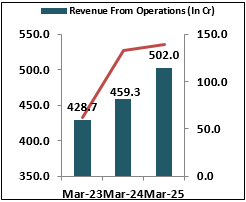

- In FY25, the Company reported revenue from operations of ₹501.99 crore, reflecting a 9.3% increase from ₹459.28 crore in FY24. Profit after tax for FY25 stood at ₹138.691 crore, marking a 4.13% growth over ₹133.187 crore in FY24. For Q1FY26, revenue from operations was ₹124.92 crore, while profit after tax was ₹31.27 crore.

- The global vitamins and minerals market, valued at USD 29 billion in 2024, is projected to reach USD 41 billion by 2029, driven by a 7% CAGR. Volumetric demand is expected to increase from 7,159 KT to 9,580 KT during the same period. The specialty food ingredients market, valued at USD 85 billion in 2024, is forecast to grow at a 6.8% CAGR to USD 118 billion by 2029, with volume rising from 55,518 KT to 73,598 KT.

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Sudeep Pharma Limited IPO Allotment Status

Sudeep Pharma Limited IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

-

Select Sudeep Pharma Ltd IPO

-

Enter your PAN Number or Application Id or DP Client Id.

Sudeep Pharma Limited IPO Risk Factors:

- It operates in a highly competitive landscape, facing direct and indirect competition from established players including Sun Pharma, Cipla, Torrent Pharma, Anupam Rasayan, Rossari Biotech, Balaji Amines, Fine Organic, Laxmi Organic, Manorama Industries, and Neogen Chemicals. Such strong competitive pressures may affect the Company’s revenue growth trajectory, market share position, and long-term profitability.

- Given the current political environment between India and the U.S., along with evolving tariff policies, the company may be exposed to higher external risks. These geopolitical and trade-related uncertainties could affect revenue visibility, alter cost structures, and put pressure on overall profitability in the near term.

- It operates in a highly regulated industry, where compliance with evolving standards is critical. Any adverse regulatory changes, delays in approvals, or additional compliance requirements could significantly affect its operations, increase costs, and negatively impact its revenue growth, profitability, and overall business performance.

Sudeep Pharma Limited IPO Outlook:

SPL is a technology-driven manufacturer of excipients and specialty ingredients serving the pharmaceutical, food, and nutrition industries. As of Q1FY26, it operates 4 manufacturing facilities with a combined annual capacity of 72,246 MT. It has built a strong domestic and global presence, supplying customers across approx. 100 countries, including key regions such as the USA, EME, Africa, and Asia-Pacific. It has served over 1,100 customers as of Q1FY26. It recorded product sales volumes of 4,852 MT in Q1FY26 and 18,922 MT in FY25. In FY25, it reported a 9.3% increase in revenue from operations and a 4.13% growth in PAT on YoY. At the upper price band of ₹593, the issue is valued at a P/E of 47.61x on a pre-IPO basis and 48.29x on a post-IPO basis, based on FY25 earnings. Keeping in mind the valuation and listed factors, we recommend subscribing for potential listing gains and for medium- to long-term investment, subject to an investor’s risk appetite.

Sudeep Pharma Limited IPO Financial Performance:

Sudeep Pharma Limited IPO Shareholding Pattern:

| Particulars | Pre Issue | Post issue |

| Promoters Group | 89.36% | 76.15% |

| Others | 10.64% | 23.85% |

Sources: Company Website, RHP.

Sudeep Pharma Limited IPO FAQ:

Ans. Sudeep Pharma IPO is a main-board IPO of 1,50,92,750 equity shares of the face value of ₹1 aggregating up to ₹895.00 Crores. The issue is priced at . The minimum order quantity is 25.

The IPO opens on November 21, 2025, and closes on November 25, 2025.

MUFG Intime India Pvt.Ltd. is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Sudeep Pharma IPO opens on November 21, 2025 and closes on November 25, 2025.

Ans. Sudeep Pharma IPO lot size is 25, and the minimum amount required for application is ₹14,825.

Ans. The Sudeep Pharma IPO listing date is not yet announced. The tentative date of Sudeep Pharma IPO listing is Friday, November 28, 2025.