Standard Glass Lining Limited IPO Company Profile:

Standard Glass Lining is recognized as one of the top five specialized engineering equipment manufacturers for the pharmaceutical and chemical sectors in India, based on revenue for Fiscal 2024 (Source: F&S Report). They offer comprehensive in-house capabilities across the entire value chain, encompassing design, engineering, manufacturing, assembly, installation, commissioning, and the establishment of standard operating procedures (SOPs) for pharmaceutical and chemical manufacturers, on a turnkey basis. Their portfolio includes core equipment used in the production of pharmaceutical and chemical products, which can be categorized into Reaction Systems, Storage, Separation and Drying Systems, and Plant, Engineering, and Services (including ancillary parts), reinforcing their commitment to delivering integrated, and high-quality solutions to their clients.

| IPO-Note | Standard Glass Lining Limited |

| Rs.133– Rs.140 per Equity share | Recommendation: Apply |

Standard Glass Lining Limited IPO Details:

| Issue Details | |

| Objects of the issue |

· Capital expenditure · Repayment of debt · Investment in subsidiaries |

| Issue Size | Total issue Size – Rs.410.05 Cr

Offer for sale- Rs 200.05Cr Fresh issue- Rs 210 Cr |

| Face value |

Rs.10 |

| Issue Price | Rs. 133 – Rs. 140 per share |

| Bid Lot | 107 Shares |

| Listing at |

BSE, NSE |

| Issue Opens | January 6, 2025- January 8,2025 |

| QIB | Not more than 50% of Net Issue Offer |

| HNI | Not more than 15% of Net Issue Offer |

| Retail | Not less than 35% of Net Issue Offer |

Standard Glass Lining Limited IPO Financial Performance:

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Standard Glass Lining Limited IPO Allotment Status

Standard Glass Lining Limited IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Standard Glass Lining Limited IPO Shareholding Pattern:

| Particulars | Pre Issue | Post issue |

| Promoters Group | 72.49% | 59.97% |

| Others | 27.51% | 40.13% |

Standard Glass Lining Limited IPO Strengths:

- The engineering solutions provided by company are used across many industries like pharmaceutical, chemical, food and beverage, biotechnology and fertilizer sectors.

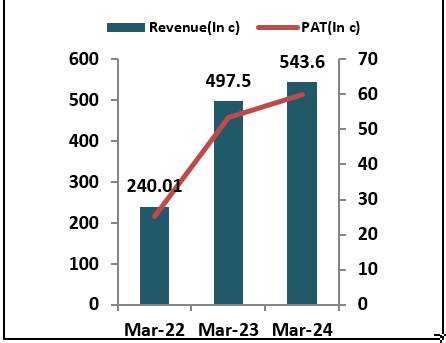

- The company generated a revenue of ₹543.6 crores in FY24, marking a 9% increase compared to FY23.CAGR of revenue from FY22 to FY24 was 50.4%. Company also reported PAT of Rs 60.51 crores in FY24 13.2% more than FY23.

- The Indian pharmaceutical sector is expected to experience significant growth, driven by an increase in formulations, the “China plus One” strategy, and favorable government policies. As the industry expands, the demand for the company’s products is also likely to increase.

- The company achieved a Return on Equity (ROE) of 20.74% and a Return on Capital Employed (ROCE) of 25.49%, demonstrating strong profitability and efficient use of equity.

Standard Glass Lining Limited IPORisk Factors:

- The digital market is highly competitive, with the company facing strong competition from players like GMM Pfaudler Ltd,HLE Glascoat Ltd, Thermax Ltd and Praj Industries

- The company experienced negative cash flow from operations in FY24, with a Cash flow operations of -65 crores.

Standard Glass Lining Limited IPO Outlook:

Standard Glass Lining has firmly established itself as a key player in the engineering equipment manufacturing sector, demonstrating strong growth in both revenue and profitability. The company has secured a robust client base, including prominent names such as Aurobindo Pharma Limited, CCL Food and Beverages Private Limited, Cohance Lifesciences Limited, and Cadila Pharmaceuticals Limited. In terms of valuation, the company’s shares are priced at a P/E ratio of Rs 38.57, based on an expected annualized earnings per share (EPS) of Rs 3.62. This valuation reflects the company’s market position and growth prospects, and is considered to be appropriately priced. Given the company’s solid fundamentals, growth trajectory, and competitive position, we recommend investors to consider applying for the issue. This presents a potential opportunity for both short-term listing gains and long-term value creation.

Standard Glass Lining Limited IPO FAQ:

Ans. Standard Glass Lining IPO is a main-board IPO of 29289367 equity shares of the face value of ₹10 aggregating up to ₹410.05 Crores. The issue is priced at ₹133 to ₹140 per share. The minimum order quantity is 107.

The IPO opens on January 6, 2025, and closes on January 8, 2025.

Kfin Technologies Limited is the registrar for the IPO. The shares are proposed to be listed on NSE, BSE.

Ans. The Standard Glass Lining IPO opens on January 6, 2025 and closes on January 8, 2025.

Ans. Standard Glass Lining IPO lot size is 107, and the minimum amount required is ₹14,980.

Ans. The Standard Glass Lining IPO listing date is not yet announced. The tentative date of Standard Glass Lining IPO listing is Monday, January 13, 2025.

Ans. The minimum lot size for this upcoming IPO is 107 shares.