Senco Gold IPO Company Details:

Senco Gold Limited is the largest organized jewellery retailer in the eastern region of India, with the most stores in the region. The company also has a wide presence in non-eastern states, making it the jewellery retailer with the widest geographical footprint in India. It sells a wide variety of jewellery, including gold, diamond, silver, platinum, precious and semi-precious stones, and other metals. The Company also offers costume jewellery, gold and silver coins, and utensils made of silver. Its products are sold under the “Senco Gold & Diamonds” trade name, through multiple channels, including its 75 company-operated showrooms, 61 franchisee showrooms, and various online platforms.

| IPO-Note | Senco Gold Limited |

| Rs.301 – Rs.317 per Equity share | Recommendation: Subscribe |

Senco Gold IPO Details:

| Issue Details | |

| Objects of the issue | · To fund working capital requirements

· To gain listing benefits |

| Issue Size | Total issue Size – Rs.405 Cr.

Fresh Issue – Rs.270 Cr. Offer for Sale – Rs.135 Cr. |

| Face value | Rs.10 |

| Issue Price | Rs.301 – Rs.317 |

| Bid Lot | 47 Shares |

| Listing at |

BSE, NSE |

| Issue Opens | 04th July, 2023 – 06th July, 2023 |

| QIB | 50% of Net Issue Offer |

| NIB | 15% of Net Issue Offer |

| Retail | 35% of Net Issue Offer |

Senco Gold IPO Strengths:

- Senco Gold has a strong base of company-operated showrooms, which is complemented by an established franchise model. This asset-light approach to growth has led to operating leverage for the co.

- The co. has efficient inventory management with quality control system and strong technology focus.

- has a targeted focus on light and affordable jewelry to appeal to the upwardly mobile and younger generations.

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Senco Gold IPO Allotment Status

Go Senco Gold IPOallotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Senco Gold IPO Key Highlights:

-

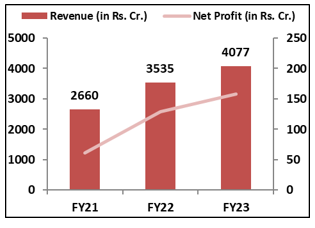

Revenue of the co. has increased from Rs.2,660 Cr. in FY21 to Rs.4,077 Cr. in FY23 with a CAGR of 15.3% and the Net Profit has increased from Rs.61 Cr. in FY21 to Rs.158 Cr. in FY23 with a strong CAGR of 37%.

-

’s EBITDA Margin & PAT Margin stands at 8.5% & 3.9% respectively in FY23.

-

As of March, 2023, ROCE and ROE ratio of the co. is 14.22% and 18.96% respectively.

-

Debt to Equity ratio of the company is 1.25 times in FY23.

Senco Gold IPO Financial Performance:

Senco Gold IPO Risk Factors:

-

The Indian jewellery market is highly competitive, and it faces the risk of losing customers and market share. This could have a negative impact on the business, financial condition, results of operations, and prospects.

-

The co. has been subject to regulatory scrutiny by the income tax, excise, and customs departments in the past. Any adverse outcome of these proceedings could have a negative impact on the co.’s business.

-

Senco Gold requires significant working capital to grow. If it can’t secure working capital on commercially acceptable terms, it could have a negative impact on its business.

Senco Gold IPO Shareholding Pattern:

| Particulars | Pre- Issue | Post Issue |

| Promoters Group | 76.92% | 63% |

| Others | 23.08% | 37% |

Source: RHP, EWL Research

Senco Gold IPO Outlook:

Senco Gold is a pan-India jewellery retailer primary selling gold and diamond jewellery along with a wide variety of other jewellery made from silver, platinum, and other precious stones. It is a leading jewellery retailer in Eastern India, with over 5 decades of experience and 136 showrooms across 13 states. The co. offers a wide variety of handcrafted jewellery designs, most of which are designed and manufactured in-house in close collaboration with over 170 skilled local craftsmen. In FY23, co. has generated 89.69% of revenue from Gold jewellery, 6.77% from diamond and precious/semi-precious stones and 2.04% from platinum jewellery. Senco Gold is focusing to further expand its presence in the country through a strong and diverse distribution channel along with focus on increasing the overall operating margins by adapting optimal product mix. It has also launched the Everlite and Gossip brands, as well as the Perfect Love Diamond Solitaires and Aham collections, to target the younger generation and the upwardly mobile in India with affordable pricing. The company is well-positioned for growth aligned with the Indian jewelry market based on its strong brand, distribution network, and expansion into affordable jewelry. Based on FY23 earnings, Senco Gold is offering the PE of 15.5x on the upper price band against the industry average of 55.2x. And we recommend investors to apply to the offering.

Senco Gold IPO FAQ

Ans. Senco Gold IPO is a main-board IPO of [.] equity shares of the face value of ₹10 aggregating up to ₹405.00 Crores. The issue is priced at ₹301 to ₹317 per share. The minimum order quantity is 47 Shares.

The IPO opens on Jul 4, 2023, and closes on Jul 6, 2023.

Kfin Technologies Limited is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Senco Gold IPO opens on Jul 4, 2023 and closes on Jul 6, 2023.

Ans. Senco Gold IPO lot size is 47 Shares and the minimum order quantity is .

Ans. The Senco Gold IPO listing date is not yet announced. The tentative date of Senco Gold IPO listing is Friday, 14 July 2023.

Ans. The minimum lot size for this upcoming IPO is 47 shares.