Sanathan Textiles Limited IPO Company Profile:

Incorporated in 2005, Sanathan Textiles Limited is a prominent yarn manufacturer in India, renowned for its diversified presence in polyester, cotton, and technical textiles. The company specializes in producing high-quality yarns that cater to a broad spectrum of end-use industries, including automotive, healthcare, construction, sports and outdoor, and protective clothing. As of Fiscal 2024, Sanathan Textiles holds a market share of 1.7% in the Indian textile yarn industry. The business operates across three distinct verticals:- (a) Polyester yarn products, (b) Cotton yarn products, and (c) Yarns for technical textiles and industrial applications.

| IPO-Note | Sanathan Textiles Limited |

| Rs.305– Rs.321 per Equity share | Recommendation: Apply |

Sanathan Textiles Limited IPO Details :

| Issue Details | |

| Objects of the issue |

· Repayment of Borrowing · Investment in Subsidiaries · General Corporate Purposes |

| Issue Size | Total issue Size – Rs.550 Cr

Fresh issue Size – Rs. 400 Cr Offer for sale- Rs.150 Cr |

| Face value |

Rs.10 |

| Issue Price | Rs.305 – Rs.321 per share |

| Bid Lot | 46 Shares |

| Listing at |

BSE, NSE |

| Issue Opens | December 19, 2024- December 23, 2024 |

| QIB | Not more than 50% of Net Issue Offer |

| HNI | Not less than 15% of Net Issue Offer |

| Retail | Not less than 35% of Net Issue Offer |

Sanathan Textiles Limited IPO Strengths:

-

Indian textile and apparel industry is projected to grow at a CAGR of 6.0-7.0% between fiscal 2024 and fiscal 2028, reaching a value of Rs. 12,400-12,500 billion in fiscal 2028. During this period, exports are expected to grow at a CAGR of 4.5-5.5% while domestic industry is expected to grow at slightly higher pace of 7.0-8.0%, presenting significant growth opportunities for the company.

-

The company specializes in value-added products, including dope-dyed, industrial and technical Yarn, cationic dyeable, and specialty yarns. These products are developed through comprehensive in-house research and are tailored to meet specific customer requirements, offering distinctive properties that differentiate them from standard offerings.

-

As of September 30, 2024, the company offers a diverse product portfolio with over 3,200 active yarn product varieties and more than 45,000 SKUs. The company possesses the capability to manufacture an extensive range of over 14,000 yarn product varieties and more than 190,000 SKUs, catering to various forms and a wide array of end-use applications.

-

The company manufactures its products at its Silvassa facility, as of June 30, 2024, has an installed capacity of 223,750 MTPA across three yarn verticals. Polyester yarn products remain the largest segment of production, reflecting the company’s focus on this key product category.

-

As of September 30, 2024, the company has a network of 925 distributors across 7 countries. This includes 916 distributors in India, 2 each in Argentina, Canada, and Singapore, and 1 each in Germany, Greece, and Israel, reflecting the company’s global distribution reach.

-

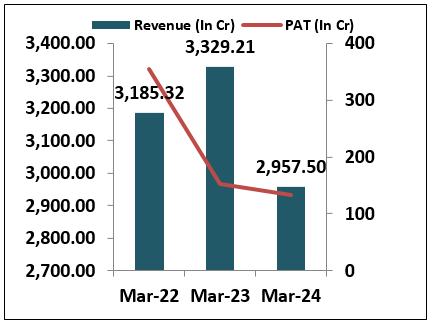

The company reported a revenue of Rs. 2,957.5 crores in FY24, reflecting an 11.16% decline compared to FY23. During the same period, the company posted a profit after tax (PAT) of Rs. 133.8 crores, marking a 12.37% decrease from FY23.

Sanathan Textiles Limited IPO Risk Factors:

-

The company faces intense competition from established players like K.P.R. Mill Ltd, Vardhman Textiles Ltd, and Indo Count Industries Ltd, poses a significant risk to the company’s market share, pricing power, and ability to attract and retain customers in the highly competitive sector.

Sanathan Textiles Limited IPO Financial Performance :

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Sanathan Textiles Limited IPO Allotment Status

Sanathan Textiles Limited IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Sanathan Textiles Limited IPO Shareholding Pattern:

| Particulars | Pre Issue | Post issue |

| Promoters Group | 100% | 79.70% |

| Others | – | 20.30% |

Sanathan Textiles Limited IPO Outlook:

Sanathan Textiles Limited is a leading yarn manufacturer in India, with a diverse portfolio spanning polyester, cotton, and technical textiles. While the industry in which the company operates is poised for strong growth, the company has faced a decline in both revenue and profit after tax (PAT) on a year-over-year basis. Additionally, the company also faces competitive pressure from established players in the industry. At the upper band price of Rs. 321, the company is priced at a P/E of 17.25 with the EPS of Rs 18.60 based on FY24 earnings, and a P/E of 13.53 based on FY25 estimated earnings with expected EPS of Rs.23.73. Thus we recommend investors to apply for the issue for both listing gains and long term capital appreciation.

Sanathan Textiles Limited IPO FAQ:

Ans. Sanathan Textiles IPO is a main-board IPO of 17133958 equity shares of the face value of ₹10 aggregating up to ₹550.00 Crores. The issue is priced at ₹305 to ₹321 per share. The minimum order quantity is 46.

The IPO opens on December 19, 2024, and closes on December 23, 2024.

Kfin Technologies Limited is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Sanathan Textiles IPO opens on December 19, 2024 and closes on December 23, 2024.

Ans. Sanathan Textiles IPO lot size is 46, and the minimum amount required is ₹14,766.

Ans. The Sanathan Textiles IPO listing date is on Friday, December 27, 2024.

Ans. The minimum lot size for this upcoming IPO is 46 shares.