Sah Polymers IPO Company Profile:

Sah Polymers Limited is an ISO 9001:2015 certified company, primarily engaged in manufacturing and selling of Polypropylene (PP)/High-Density Polyethylene (HDPE) FIBC Bags, Woven Sacks, HDPE/PP woven fabrics, woven polymer-based products of different weights, sizes, and colors as per customers specifications. The company offers customized bulk packaging solutions to business-to-business (“B2B”) manufacturers catering to different industries such as Agro Pesticides Industry, Cement Industry, Chemical Industry, Food Products Industry, Fertilizer Industry, Basic Drug Industry, Textile Industry Ceramic Industry, and Steel Industry. The company enters into arrangements as third-party manufacturers to manufacture our tape and fabric based on customers’ requirements.

Presently, Sah Polymers Limited has one manufacturing facility with an installed production capacity of 3960 m.t. p.a. located at Udaipur, Rajasthan. Over the years, the company has made investments, from time to time, in its manufacturing infrastructure to support its product portfolio requirements and its reach. Furthermore, in line with the company’s strategic expansion plans, it intends to use part of the Net Proceeds to establish a new facility with an additional installed capacity of 3960 m.t p.a. to manufacture different variants of FIBC products.

| IPO-Note | Sah Polymers Limited |

| Rs. 61 – Rs. 65 per Equity share | Recommendation: Aggressive investors may apply |

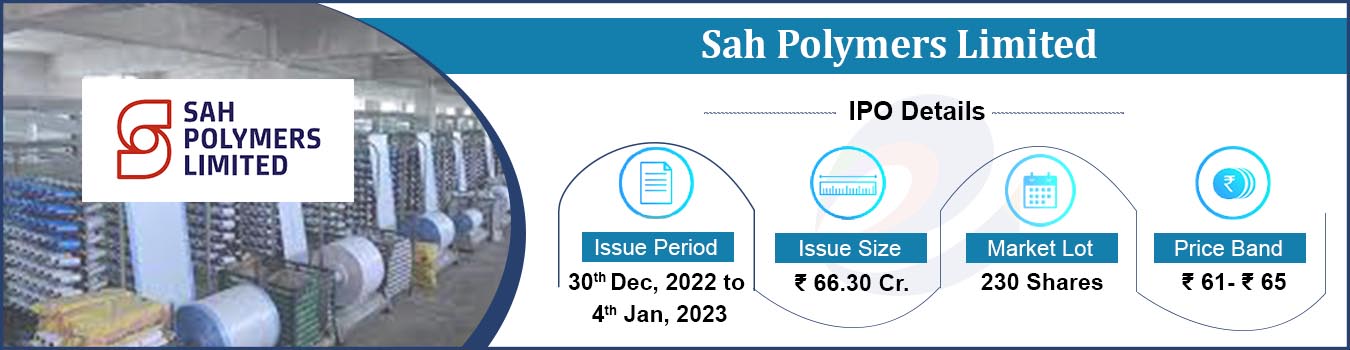

Sah Polymers IPO Details:

| Issue Details | |

| Objects of the issue | · To fund working capital and capital expenditure requirements

· To repay the debt |

| Issue Size | Total issue Size – Rs. 66.30 Cr.

Fresh Issue – Rs. 66.30 Cr. |

| Face value | Rs. 10.00 Per Equity Share |

| Issue Price | Rs. 61 – Rs. 65 |

| Bid Lot | 230 Shares |

| Listing at | BSE, NSE |

| Issue Opens | 30th Dec, 2022 – 04th Jan, 2023 |

| QIB | 75% of Net Issue Offer |

| Retail | 10% of Net Issue Offer |

| NIB | 15% of Net Issue Offer |

Sah Polymers IPO Financial Analysis (Standalone):

| Particulars | FY-22(in cr.) | FY-21(in cr.) | FY-20(in cr.) | CAGR (FY-20 to FY-22) |

| Revenue from Operations | 75.73 | 55.07 | 49.10 | 15.5% |

| Other Income | 0.74 | 0.27 | 0.81 | |

| Operational Cost | 54.32 | 38.51 | 33.42 | |

| Employee Cost | 2.18 | 2.24 | 2.16 | |

| Other expenses | 12.81 | 11.29 | 11.71 | |

| EBITDA | 7.15 | 3.30 | 2.61 | 39.9% |

| EBITDA margin% | 9.45% | 5.99% | 5.32% | |

| Depreciation | 0.83 | 0.81 | 0.77 | |

| Interest | 1.18 | 0.87 | 1.33 | |

| PBT | 5.14 | 1.62 | 0.51 | 115.4% |

| Total tax | 1.12 | 0.35 | 0.22 | |

| PAT | 4.02 | 1.27 | 0.30 | 138.5% |

| PAT margin% | 5.31% | 2.31% | 0.60% |

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Sah Polymers IPO Allotment Status

Go Sah Polymers IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Shareholding Pattern:

| Shareholding Pattern | Pre- Issue | Post Issue |

| Promoters & Promoter Group | 100% | 60.46% |

| Others | 0% | 39.54% |

Sah Polymers IPO Strengths:

-

Sah Polymers Limited’s product portfolio includes FIBC (Flexible Intermediate Bulk Containers), Container bags, PP woven Fabric & HDPE woven fabric, woven sacks, PP fabric, box bags, fabric rolls, and bags for flexible packaging. Maintaining a variety of products in the business allows the company to cater to the diverse needs of different customer segments. Sah Polymers Limited’s products undergo quality checks at various levels of production to ensure that any quality defects or product errors are rectified on a real-time basis.

-

Domestically Sah Polymers Limited has a presence in over 6 states and 1 union territory and an international presence in Africa, Caribbean, Middle East, Europe, Australia, and USA for the nine months ended December 31,2021 and in the last financial year. Sah Polymers Limited’s customer base across various industries and at varied geographies reduces its dependence on any one industry or location and provides a natural hedge against market instability in a particular industry or location.

-

Given the breadth of Sah Polymers Limited’s product offering, and the scale of other manufacturing and customer network, the company is well-positioned to grow inorganically within its industry. The company has gained a competitive advantage due to its recent acquisition of Fibcorp Polyweave Private Limited on January 5, 2022, which will leverage to generate incremental synergies.

- SPL has diversified set of product portfolio to cater wide set of customers.

- The company has well diversified customer base across multiple industry and has presence across all geographies.

- The company has shown strong financial growth with experienced management team.

Sah Polymers IPO Risk Factors:

-

Sah Polymers Limited derives a portion of its revenue from certain customers, and the loss of one or more such customers, the deterioration of their financial condition or prospects, or a reduction in their demand for the company’s products could adversely affect the business, results of operations, financial condition and cash flows of the company.

-

Sah Polymers Limited has entered into Del Credere Associate Operated Polymers Warehouse Agreement with Indian Oil Corporation Ltd. (“IOCL”). Termination or non-renewal of the Agreement or any material modification to the existing terms under such agreement adverse to the company’s interest will materially and adversely affect its ability to continue the business and operations and the future financial performance

-

There is an increased awareness of controlling pollution and many economies including India have joined in the efforts to ban plastic products. In case any plastic packaging products manufactured by Sah Polymers Limited are banned in India or in any of the markets where it exports its products, it could have a material and adverse effect on the business and results of operations.

-

Sah Polymers Limited’s existing and proposed manufacturing facility are concentrated in a single region i.e., Rajasthan, and the inability to operate and grow its business in this particular region may have an adverse effect on the business, financial condition, results of operations, cash flows and future business prospects.

- The company had negative cash flows from operations in the FY22 and it may have negative cash flows in the future also.

- One of its promoter group company, Aeroflex Industries Limited is appearing in the RBI willful defaulters list related to default in payment.

- Top 10 customers of the company contribute to average 68.3% in the total revenue of the company; any loss of such customers may impact the business of the company.

- The company operates in highly competitive industry; its current market share is extremely small and hard to ascertain.

Objects of the Issue:

Sah Polymers Limited proposes to utilize the Net Proceeds towards funding of the following objects:

-

Setting up of a new manufacturing facility to manufacture new variant of Flexible Intermediate Bulk Containers (FIBC) (hereinafter referred to as the “Project”);

-

Repayment/ Prepayment of certain secured and unsecured borrowings in full or part availed by the Company and the Subsidiary Company;

- Funding the working capital requirements of the Company; and

- General corporate purposes.

Sah Polymers Limited IPO Prospectus:

- Sah Polymers Limited IPO DRHP –

- Sah Polymers Limited IPO RHP –

Registrar to the Issue:

Link Intime India Private Limited

Tel: +91 22 4918 6200

Email: Sahpolymers.ipo@linkintime.co.in

Investor grievance Email: Sahpolymers.ipo@linkintime.co.in

Website: www.linkintime.co.in:

Contact person: Shanti Gopalkrishnan

SEBI Registration no: INR000004058

Outlook:

SPL is one of the pioneers in the manufacturing and exporting of Polypropylene (PP)/ High Density Polyethylene (HDPE) Woven Bags and BOPP Laminated Bags in India and other 14 countries. Company is promoted by SAT Industries Ltd. – a BSE/NSE listed company. The company enters into arrangements as third-party manufacturers to manufacture tape and fabric based on customers’ requirements. It has two business divisions; domestic sales and exports. Revenue from the exports contributed to average 53.4% from FY20 to June 30, 2022. Company is planning for strategic expansion through setting up a new manufacturing facility with an additional installed capacity of 3,960 m.t. p.a. in Udaipur, Rajasthan, to widen its product portfolio. It is also focusing to increase its customer base in domestic and international markets. The Indian packaging market is among the high growth industries in India and it is going to reach USD 204.81 billion by 2025, registering a CAGR of 26.7% during the period 2020-2025. On the basis of FY22 earnings, SPL is offering the PE of 38.32 times on the upper price band against the industry average PE of 14. Analyzing all the parameters, we recommend only aggressive investors to apply in the offering.