| Result Analysis: HDFC bank (CMP: Rs.1679.20) | Result Update: Q1FY24 |

HDFC Bank Ltd. is India’s leading private bank with banking network of 7,860 branches and 20,352 ATMs in 3,825 cities/towns. It offers a wide range of commercial and transactional banking services and treasury products to wholesale and retail customers. The bank has three key business segments: Wholesale Banking Services, Retail Banking Services and Treasury. The services offered by the bank include Personal Accounts & Deposits, Loans, Cards, Forex, Investments and Insurance.

| Stock Details | |

| Market Cap. (Cr.) | 12,65,708 |

| Equity (Cr.) | 753.76 |

| Face Value | 1 |

| 52 Wk. high/low | 1758 / 1338 |

| BSE Code | 500180 |

| NSE Code | HDFCBANK |

| Book Value (Rs) | 384.25 |

| Sector | Banks |

| Key Ratios | |

| ROE (%): | 16.69 |

| TTM EPS: | 64.73 |

| P/BV: | 4.37 |

| TTM P/E: | 25.94 |

Result Highlights:

-

HDFC bank reported a strong 30% YoY increase in the consolidated net profit and 38% YoY increase in the total income in June’24 quarter.

-

Net Interest Income of the bank grew by 21.1% YoY to Rs.23,599 cr. while Net Interest Margin slightly increased by 30 bps to 4.30% on YoY basis.

-

Banks’s deposits growth is ahead of its advances growth in the Q1FY24 with 19.2% Vs 15.8% YoY.

-

On yearly basis, Domestic retail loans grew by 20%, commercial and rural banking loans grew by 29.1% and corporate and other wholesale loans grew by 11.2%. Overseas advances constituted 2.6% of total advances.

-

CASA deposits grew by 10.7% YoY with savings account deposits at Rs.5,60,604 cr. and current account deposits at Rs.2,52,350 cr. CASA ratio declined in the quarter with 330 bps YoY to 42.5%.

-

Asset quality of the bank has declined slightly in the quarter with Gross NPA at 1.17% Vs 1.12% QoQ and Net NPA ratio at 0.30% Vs 0.27% QoQ. The NPA majorly increased in the commercial and rural segment.

-

The cost to income ratio of the bank has increased in Q1 from 42% to 42.8%.

-

HDB Financial Services, subsidiary of HDFC Bank reported strong growth of 19% YoY in disbursements across segments.

-

Bank has added 39 branches in the quarter and also added 2mn customers to its customer’s base making it to 85 mn.

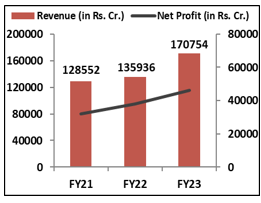

Financial Performance:

Shareholding Pattern:

| Particulars (In %) | Q1FY24 | Q1FY23 |

| Promoters Group | 20.83 | 20.97 |

| FIIs | 27.39 | 44.99 |

| DIIs | 22.03 | 22.09 |

| Public | 28.29 | 10.25 |

| Others | 1.47 | 1.70 |

Conference Call Highlights:

- The merger between HDFC Bank and HDFC Ltd. aims to enhance the opportunity for upselling a range of HDFC Bank products to existing Home Loan customers of HDFC Ltd.

- Management highlighted that economic activity is strong in Q1 with healthy GST collections and continuous growth in remittances, retail, and consumer spends.

- The bank has seen 14% growth in RTGS/ NEFT transactions, while 44% growth in UPI transactions in Q1FY24.

- CRB distribution has reached 0.19m villages as on Q1FY24 and the target is to reach 0.20m villages in the near term.

- Payzapp App reported 13mn transactions during the quarter.

- Express car loan volumes contributes 30% of the total car loans acquired during the quarter.

- The bank is aiming at an ROA of 1.9-2.1% for the merged entity and is estimating a 17-18% credit growth going forward.

Outlook:

HDFC Bank reported steady performance in the Q1FY24 with 30% YoY growth in the Net profits, supported by lower provisioning and 38% YoY growth in the Income. Loan growth was healthy at 15.8% YoY driven by strong traction in Commercial and Rural Banking. Bank’s asset quality remained broadly stable, NNPA was affected QoQ due to higher seasonal slippages in agri segment. Healthy PCR and a contingent provisioning buffer should support asset quality further. We remain positive on the bank’s longer term perspective given its large network and stable asset quality.

Results:

| Particulars (In Rs. Cr.) | Q1FY24 | Q4FY23 | Q1FY23 | QoQ% | YoY% |

| Interest Earned | 48,587 | 45,119 | 35,172 | 7.7% | 38.1% |

| Interest Expended | 24,988 | 21,768 | 15,691 | 14.8% | 59.3% |

| Net Interest Income | 23,599 | 23,352 | 19,481 | 1.1% | 21.1% |

| Operating Profit | 18,772 | 18,621 | 15,368 | 0.8% | 22.2% |

| Provisions | 2,860 | 2,685 | 3,188 | 6.5% | -10.3% |

| Tax | 3,960 | 3,888 | 2,984 | 1.9% | 32.7% |

| Net Profit after tax | 11,952 | 12,047 | 9,196 | -0.8% | 30.0% |

| Deposits | 19,13,096 | 18,83,395 | 16,04,760 | 1.6% | 19.2% |

| Advances | 16,15,672 | 16,00,586 | 13,95,068 | 0.9% | 15.8% |

| Ratios (%) | Q1FY24 | Q4FY23 | Q1FY23 | QoQ | YoY |

| Gross NPA | 1.17 | 1.12 | 1.28 | 50 bps | -110 bps |

| Net NPA | 0.30 | 0.27 | 0.35 | 30 bps | -50 bps |

| Net Interest Margin | 4.30 | 4.28 | 4.00 | 20 bps | 30 bps |

| Capital Adequacy Ratio | 18.9 | 19.3 | 17.5 | -330 bps | 141 bps |

| CASA Ratio | 42.5 | 40.0 | 45.8 | 250 bps | -330 bps |

Source: Company website, EWL Research

Disclosure in pursuance of Section 19 of SEBI (RA) Regulation 2014

Elite Wealth Limited does/does not do business with companies covered in its research reports. Investors should be aware that the Elite Wealth Limited may/may not have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only information in making their investment decision and must exercise their own judgment before making any investment decision.

For analyst certification and other important disclosures, see the Disclosure Appendix, or go to www.elitewealth.in. Analysts employed by Elite Wealth Limited are registered/qualified as research analysts with SEBI in India.( SEBI Registration No.: INH100002300)

Disclosure Appendix

Analyst Certification (For Reports)

Kiran Tahlani, Elite Wealth Limited, kirantahlani@elitestock.com

The analyst(s) certify that all of the views expressed in this report accurately reflect my/our personal views about the subject company or companies and its or their securities. I/We also certify that no part of my compensation was, is or will be, directly or indirectly, related to the specific recommendations or views expressed in this report. Unless otherwise stated, the individuals listed on the cover page of this report are analysts in Elite Wealth Limited.

As to each individual report referenced herein, the primary research analyst(s) named within the report individually certify, with respect to each security or issuer that the analyst covered in the report, that:

(1) all of the views expressed in the report accurately reflect his or her personal views about any and all of the subject securities or issuers; and

(2) no part of any of the research analyst’s compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed in the report.

For individual analyst certifications, please refer to the disclosure section at the end of the attached individual notes.

Research Excerpts

This note may include excerpts from previously published research. For access to the full reports, including analyst certification and important disclosures, investment thesis, valuation methodology, and risks to rating and price targets, please visit www.elitewealth.in.

Company-Specific Disclosures

Important disclosures, including price charts, are available and all Elite Wealth Limited covered companies by visiting https://www.elitewealth.in, or e-mailing research@elitestock.com with your request. Elite Wealth Limited may screen companies based on Strategy, Technical, and Quantitative Research. For important disclosures for these companies, please e-mail research@elitestock.com.

Options related research:

If the information contained herein regards options related research, such information is available only to persons who have received the proper option risk disclosure documents. For a copy of the risk disclosure documents, please contact your Broker’s Representative or visit the OCC’s website at https://www.elitewealth.in

Other Disclosures

All research reports made available to clients are simultaneously available on our client websites. Not all research content is redistributed, e-mailed or made available to third-party aggregators. For all research reports available on a particular stock, please contact your respective broker’s sales person.

Ownership and material conflicts of interest Disclosure

Elite Wealth Limited policy prohibits its analysts, professionals reporting to analysts from owning securities of any company in the analyst’s area of coverage. Analyst compensation: Analysts are salary based permanent employees of Elite Wealth Limited. Analyst as officer or director: Elite Wealth Limited policy prohibits its analysts, persons reporting to analysts from serving as an officer, director, board member or employee of any company in the analyst’s area of coverage.

Country Specific Disclosures

India – For private circulation only, not for sale.

Legal Entities Disclosures

Mr. Ravinder Parkash Seth is the Managing Director of Elite Wealth Ltd (EWL, henceforth), having its registered office at Casa Picasso, Golf Course Extension, Near Rajesh Pilot Chowk, Radha Swami, Sector-61, Gurgaon-122001 Haryana, is a SEBI registered Research Analyst and is regulated by Securities and Exchange Board of India. Telephone: 011-43035555, Facsimile: 011-22795783 and Website: www.elitewealth.in

EWL discloses all material information about itself including its business activity, disciplinary history, the terms and conditions on which it offers research report, details of associates and such other information as is necessary to take an investment decision, including the following:

- Reports

- a) EWL or his associate or his relative has no financial interest in the subject company and the nature of such financial interest;

(b) EWL or its associates or relatives, have no actual/beneficial ownership of one per cent. or more in the securities of the subject company, at the end of the month immediately preceding the date of publication of the research report or date of the public appearance;

(c) EWL or its associate or his relative, has no other material conflict of interest at the time of publication of the research report or at the time of public appearance;

- Compensation

(a) EWL or its associates have not received any compensation from the subject company in the past twelve months;

(b) EWL or its associates have not managed or co-managed public offering of securities for the subject company in the past twelve months;

(c) EWL or its associates have not received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

(d) EWL or its associates have not received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

(e) EWL or its associates have not received any compensation or other benefits from the subject company or third party in connection with the research report.

3 In respect of Public Appearances

(a) EWL or its associates have not received any compensation from the subject company in the past twelve months;

(b) The subject company is not now or never a client during twelve months preceding the date of distribution of the research report and the types of services provided by EWL

Provided that research analyst or research entity shall not be required to make a disclosure as per sub-clauses (c), (d) and (e) of clause (ii) or sub-clauses (a) and (b) of clause (iii) to the extent such disclosure would reveal material non-public information regarding specific potential future investment banking or merchant banking or brokerage services transactions of the subject company.

(4) EWL or its proprietor has never served as an officer, director or employee of the subject company;

(5) EWL has never been engaged in market making activity for the subject company;

(6) EWL shall provide all other disclosures in research report and public appearance as specified by the Board under any other regulations.