Quality Power Electrical Equipments Limited IPO Company Profile:

Quality Power is an Indian player serving global clients in critical energy transition equipment and power technologies. The business model of the company is built around providing critical high-voltage electrical equipment and advanced power solutions, focusing on the global energy transition. This transition primarily involves the shift from traditional energy sources to renewable energy, and the company plays a pivotal role in ensuring the reliability, efficiency, and stability of power systems involved in this transition.

| IPO-Note | Quality Power Electrical Equipments Limited |

| Rs.401– Rs.425 per Equity share | Recommendation: Apply |

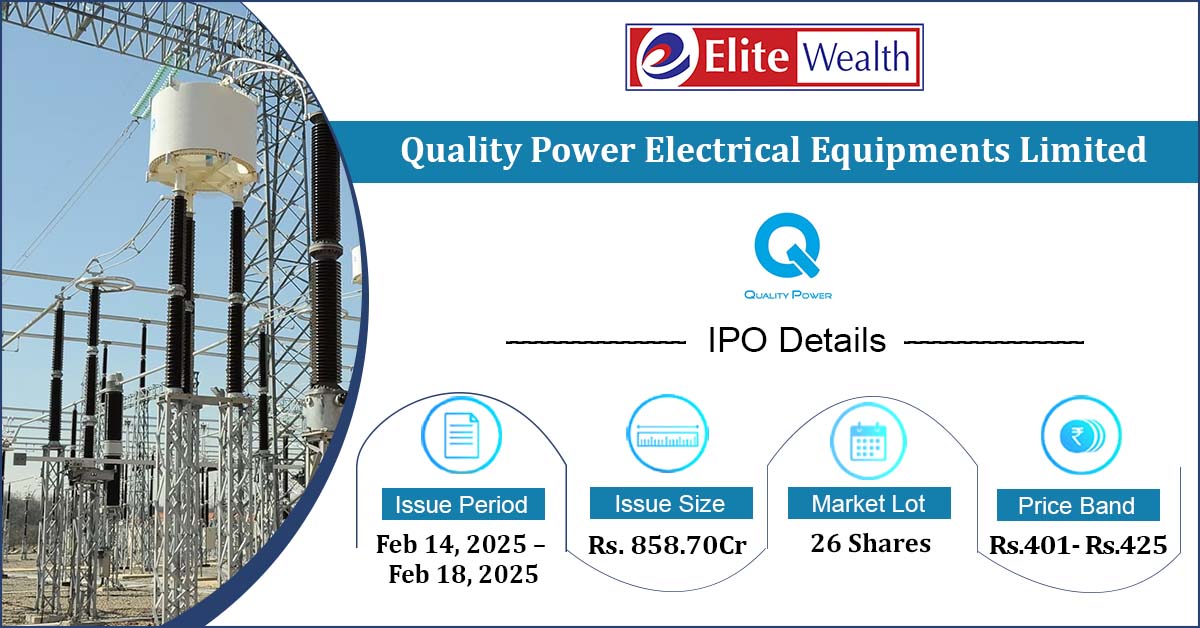

Quality Power Electrical Equipments Limited IPO Details:

| Issue Details | |

| Objects of the issue |

· Purchase consideration acquisition of Mehru Electrical and Mechanical Engineers Private Limited · Funding Capital Expenditure |

| Issue Size | Total issue Size – Rs.858.70Cr

Offer for sale- Rs 633.70 Cr Fresh Issue- Rs 225 Cr |

| Face value |

Rs.10 |

| Issue Price | Rs.401- Rs.425 per share |

| Bid Lot | 26 shares |

| Listing at |

BSE, NSE |

| Issue Opens | February 14, 2025 – February 18, 2024 |

| QIB | Not less than 75% of Net Issue Offer |

| HNI | Not less than 15% of Net Issue Offer |

| Retail | Not less than 10% of Net Issue Offer |

Quality Power Electrical Equipments Limited IPO Strengths:

- The company offers diverse product offerings which include high voltage equipment (reactors, transformers, line traps, instrument transformers, capacitor banks, converters, harmonic filters), advanced power technology(High Voltage Direct Current and Flexible AC Transmission Systems) and grid interconnection solutions ( STATCOM and SVC) which enhance grid stability, ensuring that energy flow remains uninterrupted even as renewable energy sources fluctuate.

- The power transmission sector is further poised for shift given rising demand for energy efficient energy sources. This gives opportunity for the company to further expand in Domestic and International market and increase its market share.

- The part of proceeds from IPO will be used for purchase consideration of Mehru Electrical, this acquisition could help the company to enhance their product offerings and will enjoy synergy benefits.

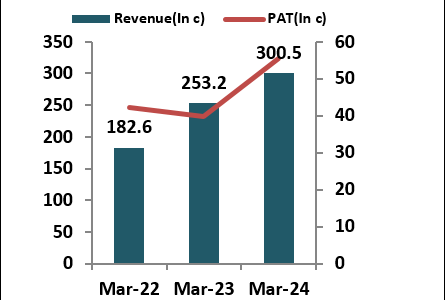

- The company reported Revenue of Rs 300.59 crores in FY24 which was 18.57% higher than FY23. PAT for the same period was Rs 55.4 crores which was 39.1% higher than FY23. Company has PAT of Rs 50.07 crores for 6m ended 30 Sept, 2024.

- The company had cash flow from operations at Rs 51.5 crores in FY24 which was 15% higher than FY23.

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Quality Power Electrical Equipments Limited IPO Allotment Status

Quality Power Electrical Equipments Limited IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Quality Power Electrical Equipments Limited IPO Risk Factors:

- The industry in which the company operates is highly competitive, with key competitor like GE T&D, Siemens Limited, Hitachi Energy Limited.

- The company primarily drives revenue from exports with more than 80% of revenue coming from export only.

Quality Power Electrical Equipments Limited IPO Financial Performance:

Quality Power Electrical Equipments Limited IPO Shareholding Pattern:

| Particulars | Pre- Issue | Post issue |

| Promoters Group | 99.99% | 73.9% |

| Others | 0.01% | 26.1% |

Quality Power Electrical Equipments Limited IPO Outlook:

Quality Power has firmly established itself as a leading player in the energy transition equipment sector. The company has demonstrated robust performance, achieving strong revenue and profit growth, underpinned by its strategic focus on energy-efficient solutions. The industry outlook remains favourable, driven by increasing demand for sustainable energy sources and advanced power technologies. From a valuation perspective, the company’s shares will be offered at a post-issue P/E ratio of 32.8, based on an expected FY25 annualized EPS of Rs 12.9. This appears to be reasonably valued, considering the company’s growth prospects and sectoral dynamics. We recommend that investors with a medium-to-long-term horizon consider applying for this issue. The investment presents potential for both listing gains and long-term capital appreciation.

Quality Power Electrical Equipments Limited IPO FAQ:

Ans. Quality Power IPO is a main-board IPO of 20204618 equity shares of the face value of ₹10 aggregating up to ₹858.70 Crores. The issue is priced at ₹401 to ₹425 per share. The minimum order quantity is 26.

The IPO opens on February 14, 2025, and closes on February 18, 2025.

Link Intime India Private Ltd is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Quality Power IPO opens on February 14, 2025 and closes on February 18, 2025.

Ans. Quality Power IPO lot size is 26, and the minimum amount required is ₹11,050.

Ans. The Quality Power IPO listing date is not yet announced. The tentative date of Quality Power IPO listing is Friday, February 21, 2025.

Ans. The minimum lot size for this upcoming IPO is 26 shares.