Popular Vehicles & Services IPO Company Details:

Popular Vehicles & Services Limited (PVSL) is an automobile dealership company in India which provides a wide range of services including new vehicles sales, repairs, distribution of spare parts, sales and exchanges of pre-owned cars, driving instruction, and the assistance of third-party finance and insurance products.

The company’s car dealership division is divided into three main sectors:

- Passenger vehicles including luxury vehicles

- Commercial vehicles

- Electric two-wheeler and three-wheeler vehicles

PVSL has an extensive network of 61 showrooms, 133 sales outlets and booking offices, 32 pre-owned vehicle showrooms and outlets, 139 authorized service centers, 43 retail outlets, and 24 warehouses. It has strong presence across 12 districts in Tamil Nadu, 9 districts in Maharashtra, 8 districts in Karnataka, In 2021, the business increased the scope of its activities by acquiring 8 showrooms, 17 service centers, 3 sales outlets, and booking offices of BharatBenz in Tamil Nadu and Maharashtra, in addition to 11 service centers and 2 showrooms from a Maruti Suzuki dealer in Kerala. During the previous three fiscal years, it has also increased the scope of its repair and post-sale services sectors. During Fiscal 2023, Popular Vehicles and Services Limited was recognized as the ‘All India Highest in the Bodyshop Load’ for Maruti Suzuki. In the six months that concluded on September 30, 2023, the company used its network of 137 authorized service centers spread across its dealerships to service 419,729 passenger vehicles, including 2,762 luxury vehicles, 103,116 commercial vehicles, 4,118 electric two-wheeler vehicles, and 883 electric three-wheeler vehicles.

| IPO-Note | Popular Vehicles & Services Limited |

| Rs.280 – Rs.295 per Equity share | Recommendation: Apply for Long-Term |

Popular Vehicles & Services IPO Details :

| Issue Details | |

| Objects of the issue | · To pay borrowings

· To gain listing benefits |

| Issue Size | Total issue Size – Rs.601.55 Cr.

Fresh Issue – Rs.250 Cr. Offer for Sale – Rs.351.55 Cr. |

| Face value | Rs.2 |

| Issue Price | Rs.280 – Rs.295 |

| Bid Lot | 50 Shares |

| Listing at | BSE, NSE |

| Issue Opens | 12th March, 2024 – 14th March, 2024 |

| QIB | 50% of Net Issue Offer |

| NIB | 15% of Net Issue Offer |

| Retail | 35% of Net Issue Offer |

Popular Vehicles & Services IPO Strengths :

-

Company has long standing presence in the automobile industry and well-established leading OEMs as its clients.

-

PVSL has comprehensive business ensuring stability and improved margins.

-

It has proven ability to identify and capitalize on both inorganic and organic growth opportunities.

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Popular Vehicles & Services IPO Allotment Status

Popular Vehicles & Services IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Popular Vehicles & Services IPO Risk Factors:

-

The company’s profit margins from vehicle sales and related industries are under strain due to the growing competition among automobile dealerships, both online and offline.

-

PVSL’s economic prospects may be severely impacted if its OEMs decide not to renew, terminate, or make any unfavorable material revisions to dealership agreements.

-

Maruti Suzuki & Tata Motors account for more than 80% of company’s revenue.

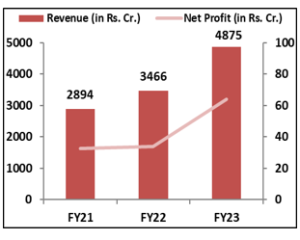

Popular Vehicles & Services IPO Financial Performance:

Popular Vehicles & Services IPO Shareholding Pattern:

| Particulars | Pre- Issue | Post Issue |

| Promoters Group | 69.45% | 44.44% |

| Others | 30.55% | 55.56% |

Source: RHP, EWL Research

Popular Vehicles & Services IPO Outlook:

PVSL is well-positioned in its industry and benefits from a strategic alliance with Maruti, one of the leading automobile company. The organization has a significant foothold in India, with over 400 touchpoints distributed across four states. The PE of PVSL stands at 32.78x on the upper price band which seems fully priced in when compared to its peer’s average of 34.84x. Considering its market position, key clients and financial performance, we recommend investors to apply to the offering for long term horizon.

Popular Vehicles & Services IPO FAQ

Ans.

opular Vehicles & Services IPO is a main-board IPO of 20,391,651 equity shares of the face value of ₹2 aggregating up to ₹601.55 Crores. The issue is priced at ₹280 to ₹295 per share. The minimum order quantity is 50 Shares.

The IPO opens on March 12, 2024, and closes on March 14, 2024.

Link Intime India Private Ltd is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Popular Vehicles & Services IPO opens on March 12, 2024 and closes on March 14, 2024.

Ans. Popular Vehicles & Services IPO lot size is 50 Shares, and the minimum amount required is ₹14,750.

Ans. The Popular Vehicles & Services IPO listing date is not yet announced. The tentative date of Popular Vehicles & Services IPO listing is Tuesday, March 19, 2024.

Ans. The minimum lot size for this upcoming IPO is 50 shares.