Physicswallah Limited IPO Company Profile:

Physicswallah limited delivers comprehensive test preparation and upskilling courses for competitive exams through multiple channels, including online platforms (website and apps), tech-enabled offline centers with live faculty-led classes, and hybrid centers employing a two-teacher model. The hybrid approach allows students to participate in live online classes at a physical center, while benefiting from on-site faculty for doubt resolution and revision. This multi-modal delivery enables flexible access to high-quality education, accommodating varied student needs and enhancing the overall learning experience.

| IPO-Note | Physicswallah limited |

| Rs. 103 – Rs. 109 per Equity share | Recommendation: Avoid |

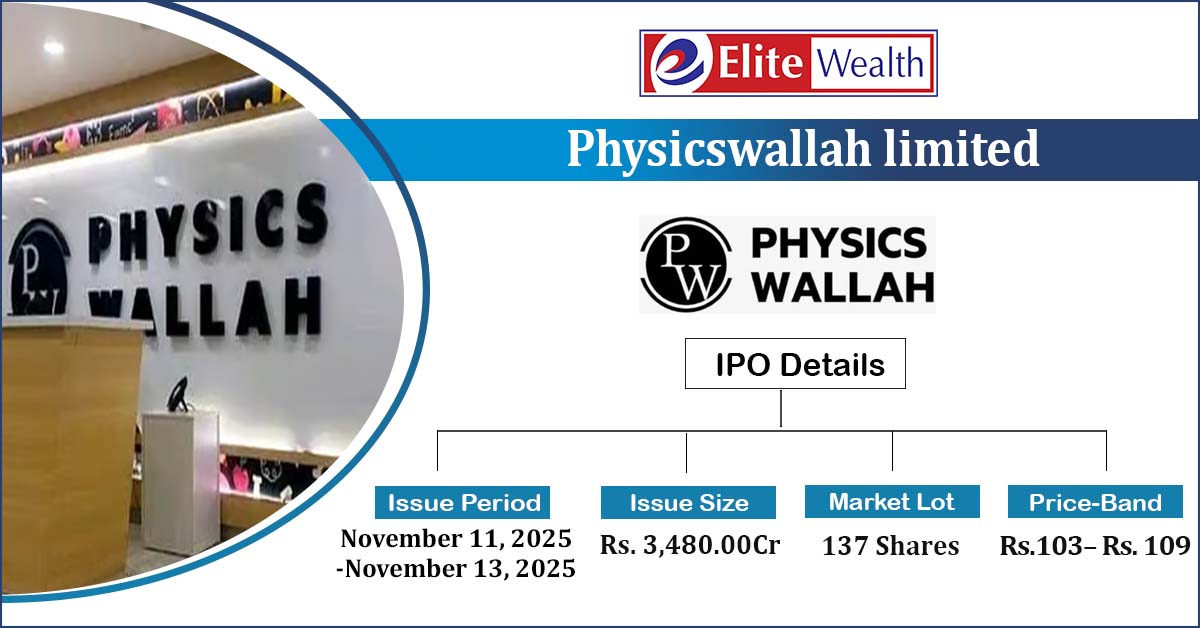

Physicswallah Limited IPO Details:

| Issue Details | |

| Objects of the issue | · Capital expenditure for new offline and hybrid centers.

· Pay lease payments · Investment in subsidiary · For new technology · Marketing expenses · General corporate Exp. |

| Issue Size | Total Issue Size-Rs. 3,480.00Cr

OFS Size- Rs. 380.00 Cr Fresh Issue- Rs. 3,100.00 Cr |

| Face value |

Re. 1 |

| Issue Price | Rs. 103 – Rs. 109 per share |

| Bid Lot | 137 Shares |

| Listing at |

BSE, NSE |

| Issue Opens | November 11, 2025- November 13, 2025 |

| QIB | Not less than 75% of Net Issue Offer |

| HNI | Not More than 15% of Net Issue Offer |

| Retail | Not More than 10% of Net Issue Offer |

| Employee Discount | Rs. 10 |

Physicswallah Limited IPO Strengths:

- The Company offers courses across 13 education categories, including flagship test preparation programs for JEE, NEET, and Foundation, preparation for various competitive exams for higher education and government careers, and upskilling courses designed for students and working professionals aiming to enhance their academic or career competencies.

- As of Q1FY26, the Company operated 888 channels and handles across YouTube and other social media platforms, with a cumulative follower or subscriber base of 119.27 million. Its content recorded a total of 22.85 billion cumulative views on YouTube, reflecting its extensive digital reach and strong engagement across online learning communities.

- For Fiscal 2025, Physicswallah reported a total of 4.46 million paid users, reflecting a CAGR of 59.19% between Fiscals 2023 and 2025. In Q1FY26, the number of paid users stood at 2.43 million, an increase from 1.87 million in Q1FY25, demonstrating continued strong momentum in user conversion and monetization.

- The Company aims to further leverage its proprietary technology stack to deliver content at scale, successfully integrate new offerings, and provide tech-enabled tools for students and teachers to support coursework planning, doubt resolution, test grading, and overall teaching efficiency, thereby enhancing learning outcomes and pedagogy.

- During FY25, it operated 216 residential hostels, comprising 192 hostels under the Xylem brand and 24 hostels operated through third-party facilities for Vidyapeeth students. In Q1FY26, the Company operated 166 residential hostels, all of which were under the Xylem brand, reflecting a consolidated and brand-focused approach to its residential offerings.

- The Company’s Average Collection Per User (Online) increased from ₹3,106.81 in FY23 to ₹3,682.79 in FY25, before moderating to ₹3,930.55 in Q1FY26 due to a shift toward lower-priced offerings. The Average Revenue Per User (Offline) rose from ₹34,467.15 in FY23 to ₹40,404.56 in FY25, and stood at ₹11,821.56 in Q1FY26.

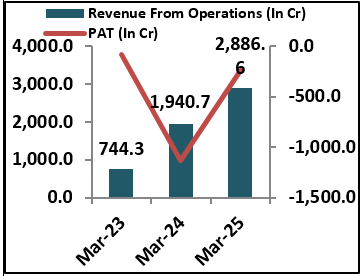

- It reported revenue from operations of ₹2,886.64 crore in FY25, reflecting a 48.74% increase from ₹1,940.71 crore in FY24, and incurred a loss of ₹243.26 crore in FY25. In Q1FY26, it reported revenue from operations of ₹847.09 crore and a loss of ₹127.01 crore.

- The Indian test preparation market is projected to grow at a CAGR of approx. 13% to reach ₹1.9–2.1 trillion by Fiscal 2030. Online education penetration is expected to rise from approx. 2% in FY22 to approx. 4% in FY25. Higher education, test preparation, and upskilling are growing steadily, while undergraduate and postgraduate markets are expected to grow at approx. 10% and approx. 13% CAGR, respectively, by Fiscal 2030.

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Physicswallah Limited IPO Allotment Status

Physicswallah Limited IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

-

Select Physicswallah Ltd IPO

-

Enter your PAN Number or Application Id or DP Client Id.

Physicswallah Limited IPO Risk Factors:

- The Company operates in a highly competitive environment and faces intense competition from listed, unlisted and local players, including Unacademy, BYJU’S/Aakash BYJU’S, Allen, Vedantu, Toppr, Khan Academy, FIITJEE, Motion, NIIT, Aptech, Navneet Education, Zee Learn, and Jetking Infotrain Ltd., among others. Such competition may exert pressure on pricing, market share, revenue growth, and overall profitability.

- The cyclical nature of the academic calendar impacts revenue generation, with peaks during enrolment periods and dips during exam or vacation seasons. This creates operational inefficiencies and financial variability for education providers.

Physicswallah Limited IPO Outlook:

PhysicsWallah Limited offers test preparation and upskilling programs across online, offline, and hybrid channels and reported revenue growth of 48.74% in FY25 and it incurred a loss of ₹243.26 crore. It is among the top five education companies by revenue and has the largest student community in India. In Q1FY26, it had 2.10 million online unique transacting users and operated 303 offline centers. Its strong digital presence includes 888 social media channels and 119.27 million followers. While industry growth remains favorable, intense competition may influence revenue and profitability. At the upper price band of ₹109, the issue appears to be valued on the higher side, particularly given the current loss-making position and negative earnings. Therefore, we recommend avoiding the issue. However, aggressive investors may consider subscribing solely for potential listing gains.

Physicswallah Limited IPO Financial Performance:

Physicswallah Limited IPO Shareholding Pattern:

| Particulars | Pre Issue | Post issue |

| Promoters Group | 81.64% | 72.30% |

| Others | 18.36% | 27.70% |

Sources: Company Website, RHP.

Physicswallah Limited IPO FAQ:

Ans. PhysicsWallah IPO is a main-board IPO of 31,92,66,054 equity shares of the face value of ₹1 aggregating up to ₹3,480.00 Crores. The issue is priced at . The minimum order quantity is 137.

The IPO opens on November 11, 2025, and closes on November 13, 2025.

MUFG Intime India Pvt.Ltd. is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The PhysicsWallah IPO opens on November 11, 2025 and closes on November 13, 2025.

Ans. PhysicsWallah IPO lot size is 137, and the minimum amount required for application is ₹14,933.

Ans. The PhysicsWallah IPO listing date is not yet announced. The tentative date of PhysicsWallah IPO listing is Tuesday, November 18, 2025.

Disclosure in pursuance of Section 19 of SEBI (RA) Regulation 214

Elite Wealth Limited does/does not do business with companies covered in its research reports. Investors should be aware that the Elite Wealth Limited may/may not have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only information in making their investment decision and must exercise their own judgment before making any investment decision.

For analyst certification and other important disclosures, see the Disclosure Appendix, or go to www.elitewealth.in. Analysts employed by Elite Wealth Limited are registered/qualified as research analysts with SEBI in India. (SEBI Registration No.: INH100002300)

Disclosure Appendix

Analyst Certification (For Reports)

Vindhyachal Prasad, Elite Wealth Limited, vindhyachal@elitestock.com

The analyst(s) certify that all of the views expressed in this report accurately reflect my/our personal views about the subject company or companies and its or their securities. I/We also certify that no part of my compensation was, is or will be, directly or indirectly, related to the specific recommendations or views expressed in this report. Unless otherwise stated, the individuals listed on the cover page of this report are analysts in Elite Wealth Limited.

As to each individual report referenced herein, the primary research analyst(s) named within the report individually certify, with respect to each security or issuer that the analyst covered in the report, that:

- all of the views expressed in the report accurately reflect his or her personal views about any and all of the subject securities or issuers; and

- No part of any of the research analyst’s compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed in the For individual analyst certifications, please refer to the disclosure section at the end of the attached individual notes.

Research Excerpts

This note may include excerpts from previously published research. For access to the full reports, including analyst certification and important disclosures, investment thesis, valuation methodology, and risks to rating and price targets, please visit www.elitewealth.in.

Company-Specific Disclosures

Important disclosures, including price charts, are available and all Elite Wealth Limited covered companies by visiting https://www.elitewealth.in, or emailing research@elitestock.com with your request. Elite Wealth Limited may screen companies based on Strategy, Technical, and Quantitative Research. For important disclosures for these companies, please e-mail research@elitestock.com.

Options related research:

If the information contained herein regards options related research, such information is available only to persons who have received the proper option risk disclosure documents. For a copy of the risk disclosure documents, please contact your Broker’s Representative or visit the OCC’s website at https://www.elitewealth.in

Other Disclosures

All research reports made available to clients are simultaneously available on our client websites. Not all research content is redistributed, e-mailed or made available to third-party aggregators. For all research reports available on a particular stock, please contact your respective broker’s sales person.

Ownership and material conflicts of interest Disclosure

Elite Wealth Limited policy prohibits its analysts, professionals reporting to analysts from owning securities of any company in the analyst’s area of coverage. Analyst compensation: Analysts are salary based permanent employees of Elite Wealth Limited. Analyst as officer or director: Elite Wealth Limited policy prohibits its analysts, persons reporting to analysts from serving as an officer, director, board member or employee of any company in the analyst’s area of coverage.

Country Specific Disclosures

India – For private circulation only, not for sale. Legal Entities Disclosures

Mr. Ravinder Parkash Seth is the Managing Director of Elite Wealth Ltd (EWL, henceforth), having its registered office at Casa Picasso, Golf Course Extension, Near Rajesh Pilot Chowk, Radha Swami, Sector-61, Gurgaon-122001 Haryana, is a SEBI registered Research Analyst and is regulated by Securities and Exchange Board of India. Telephone: 011-43035555, Facsimile: 011-22795783 and Website: www.elitewealth.in

EWL discloses all material information about itself including its business activity, disciplinary history, the terms and conditions on which it offers research report, details of associates and such other information as is necessary to take an investment decision, including the following:

- Reports

- a) EWL or his associate or his relative has no financial interest in the subject company and the nature of such financial interest;

- EWL or its associates or relatives, have no actual/beneficial ownership of one %. or more in the securities of the subject company, at the end of the month immediately preceding the date of publication of the research report or date of the public appearance;

- EWL or its associate or his relative, has no other material conflict of interest at the time of publication of the research report or at the time of public appearance;

- Compensation

- EWL or its associates have not received any compensation from the subject company in the past twelve months;

- EWL or its associates have not managed or co-managed public offering of securities for the subject company in the past twelve months;

- EWL or its associates have not received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

- EWL or its associates have not received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

- EWL or its associates have not received any compensation or other benefits from the Subject Company or third party in connection with the research

- In respect of Public Appearances

- EWL or its associates have not received any compensation from the subject company in the past twelve months;

- The subject company is not now or never a client during twelve months preceding the date of distribution of the research report and the types of services provided by EWL