Oswal Pump Limited IPO Company Profile:

Established in 2003, the Company began by manufacturing low-speed monoblock pumps and has since expanded its product range to include grid-connected high-speed monoblock pumps, submersible pumps, and electric motors. With over 22 years of experience, it now produces both solar-powered and grid-connected pumps, induction and submersible motors, and solar modules under the ‘Oswal’ brand. The Company serves diverse sectors: agriculture (irrigation), residential (gardens, fountains, water supply), commercial (malls, offices, hotels), and industrial (boilers, water treatment, sewage, machinery, and cooling systems). Its expertise spans engineering, design, manufacturing, and testing, enabling it to meet varied customer needs. The company has exported its products to 22 countries, including Australia, Bangladesh, Cyprus and Dubai.

| IPO-Note | Oswal Pump Ltd |

| Rs. 584– Rs. 614 per Equity share | Recommendation: May Apply |

Oswal Pump Limited IPO Details:

| Issue Details | |

| Objects of the issue |

· Capital Expenditure · For Funding Subsidiary · Repayment of Borrowings · General Corporate Expenses |

| Issue Size | Total Issue Size – Rs. 1,387.34 Cr

Fresh Issue – Rs. 890 Cr Offer For Sales – Rs. 497.34 |

| Face value |

Re . 1 |

| Issue Price | Rs. 584 – Rs. 614 per share |

| Bid Lot | 24 Shares |

| Listing at |

BSE, NSE |

| Issue Opens | June 13, 2025- June 17, 2025 |

| QIB | Not More than 50% of Net Issue Offer |

| HNI | Not Less than 15% of Net Issue Offer |

| Retail | Not Less than 35% of Net Issue Offer |

Oswal Pump Limited IPO Strengths:

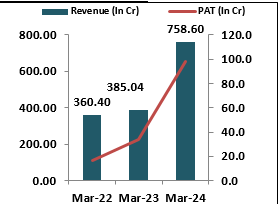

- The Company is one of the fastest-growing, vertically integrated solar pump manufacturers in India, based on revenue growth over the past three fiscal years. It achieved a robust compound annual growth rate (CAGR) of 45.07% in revenue between Fiscal 2022 and Fiscal 2024, reflecting strong market demand and operational excellence.

- As of December 31, 2024, the Company executed 38,132 turnkey solar pumping system orders under the PM-KUSUM Scheme across key states, including Haryana, Rajasthan, Uttar Pradesh, and Maharashtra. Within four years, it became one of the largest suppliers of solar-powered agricultural pumps under the scheme in Fiscal 2023 and 2024, showcasing rapid growth and execution strength.

- The Indian pumps market, valued at Rs 380.5 billion in FY25, is expected to reach Rs 591.9 billion by FY30 at a 9.2% CAGR. With just 5% of the global share, strong growth potential exists, fueled by agricultural demand, solar adoption, and efficient irrigation needs supported by government initiatives.

- The company’s Karnal facility, among India’s largest single-site pump plants (41,076 sq. m.), is strategically located near key agricultural states. As of Dec 31, 2024, it had an annual installed capacity of 1,160.07 MT for stainless steel and 2,366.04 MT for cast iron pumps.

- The manufacturing facility is equipped with advanced machines and equipment, including pneumatic and mechanical presses, computer numerical control (“CNC”) and automatic winding machines, induction furnace, pressure die casting, high-precision grinding, lapping and polishing machines and hydraulic injection moulding machines.

- The company reported revenue from operations of Rs 758.6 crore in FY24, reflecting a 97% increase from Rs 385.04 crore in FY23. PAT rose by 185.5%, from Rs 34.2 crore in FY23 to Rs 97.7 crore in FY24. For the nine-month period ended December 31, 2024, the company recorded revenue from operations of Rs 1,065.7 crore and PAT of Rs 215.8 crore.

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Oswal Pump Limited IPO Allotment Status

Oswal Pump Limited IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

-

Select Belrise Industries Ltd IPO

-

Enter your PAN Number or Application Id or DP Client Id.

Oswal Pump Limited IPO Risk Factors:

- The company faces intense competition from established players like Kirloskar Brothers Limited, Shakti Pumps (India) Limited, WPIL Limited, KSB Limited and Roto Pumps Limited poses a significant risk to the market share of the company, pricing power, and ability to attract and retain customers in the highly competitive sector.

- Fluctuations in prices of raw materials like stainless steel, copper, photovoltaic, aluminium, etc. can be highly volatile due to global trade policies and unfavourable economic conditions.

Oswal Pump Limited IPO Financial Performance:

Oswal Pump Limited IPO Shareholding Pattern:

| Particulars | Pre Issue | Post issue |

| Promoters Group | 99.88%

|

80.07% |

| Others | 0.12%

|

19.93% |

Oswal pump Limited IPO Outlook:

Oswal pump ltd reported strong financial, driven by strong execution under government schemes like PM-KUSUM, a robust distribution network, and advanced manufacturing capabilities. Its focus on solar and energy-efficient solutions aligns with India’s increasing demand for sustainable irrigation and water systems. However, it must navigate intense industry competition and raw material price volatility. Continued innovation, cost efficiency, and policy-driven demand are likely to support the Company’s expansion in the growing Indian and global pump markets. At the upper price band of Rs 614 per share, the issue is priced at a P/Ex of 62.54x based on FY24 earnings and 24.22x on estimated FY25 earnings. Keeping in mind the valuation and financial of the company, we recommend for aggressive investors apply to the issue for both listing gains and Medium to long term investment.

Oswal pump Limited IPO FAQ:

Ans. Oswal Pumps IPO is a main-board IPO of 22595114 equity shares of the face value of ₹1 aggregating up to ₹1,387.34 Crores. The issue is priced at ₹584 to ₹614 per share. The minimum order quantity is 24.

The IPO opens on June 13, 2025, and closes on June 17, 2025.

Link Intime India Private Ltd is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Oswal Pumps IPO opens on June 13, 2025 and closes on June 17, 2025.

Ans. Oswal Pumps IPO lot size is 24, and the minimum amount required is ₹14,736.

Ans. The Oswal Pumps IPO listing date is not yet announced. The tentative date of Oswal Pumps IPO listing is Friday, June 20, 2025.

Ans. The finalization of Basis of Allotment for Oswal Pumps IPO will be done on Wednesday, June 18, 2025, and the allotted shares will be credited to your demat account by Thursday, June 19, 2025.