NTPC Green Energy Limited IPO Company Profile:

NTPC Green Energy Limited, a wholly owned subsidiary of NTPC Limited, is a leading player in the renewable energy sector and the largest public sector enterprise (excluding hydro) in terms of operating capacity as of September 30, 2024. The company’s diverse portfolio includes solar and wind power assets strategically located across multiple sites. These projects generate clean, renewable energy, which is fed into the grid to supply power to utilities and off-takers, contributing significantly to its client’s renewable energy goals.

| IPO-Note | NTPC Green Energy Limited |

| Rs.102 – Rs.- 108 per Equity share | Recommendation- Avoid |

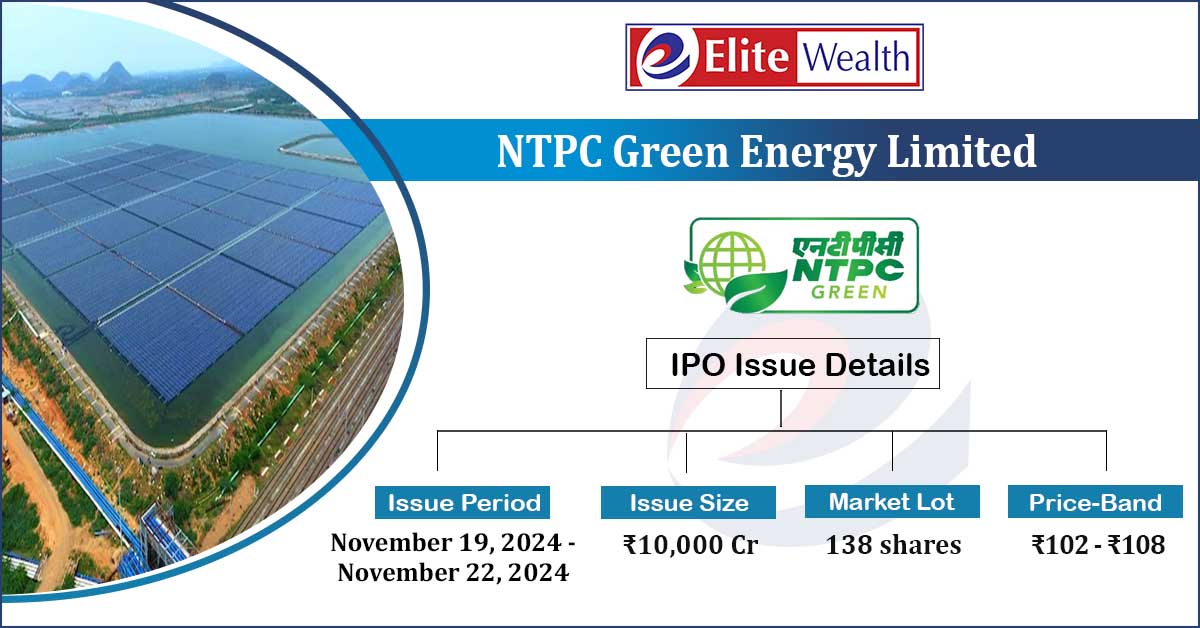

NTPC Green Energy Limited IPO Details:

| Issue Details | |

| Objects of the issue | Investment in subsidiary NTPC renewable energy limited. General cooperate expenses. |

| Issue Size | Total issue size- Rs 10,000 Cr

Fresh Issue – Rs 10,000 Cr Employee discount – Rs 5 per share |

| Face value | Rs 10 per share |

| Issue Price | Rs 102 to Rs 108 per share |

| Bid Lot | 138 shares |

| Listing at | BSE,NSE |

| Issue Opens | November 19, 2024 to November 22, 2024 |

| QIB | Not less than 75% of Net Issue |

| HNI | Not more than 15% of Net Issue |

| Retail | Not more than 10% of Net Issue |

NTPC Green Energy Limited IPO Strengths:

- NTPC Green Energy Limited enjoys the strong brand and resources of its parent, NTPC Limited, benefiting from its vision, experience, and the support of its subsidiaries, associates, and joint ventures to drive growth in the renewable energy sector.

- The renewable energy sector is poised for significant growth, driven by the shift away from coal and other harmful sources of energy. As India aims to meet its growing energy demand, projected to reach 15,820 TWh by 2040 as per IBEF, renewable energy will play a key role in this transition, creating substantial opportunities for the company.

- The Company’s current portfolio consists of 16,896 MWs including 3,320 MWs of operating projects and 13,576 MWs of contracted and awarded projects.

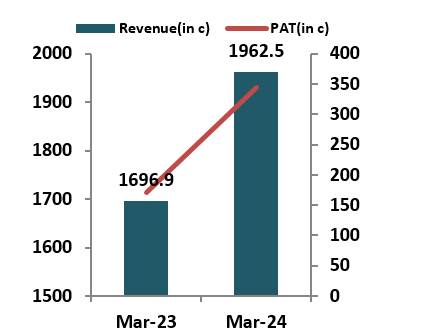

- In FY24, the company’s revenue reached Rs 1962.5 crores, reflecting a 1057% increase over FY23. PAT in FY24 was Rs 344.7 crores which 101% more as compared with FY23.

- To expand its footprint and enhance future competitiveness, the company is investing in hydrogen, green chemicals, battery storage solutions, and related technologies, which will help increase its market share.

- The Company’s cash flow from operations in FY24 stood at Rs 1579.1 crores as compared with Rs 17.2 crores in FY23 .To support their expansion and future plans they have invested Rs 8463 crores in purchase of property, plant and equipment in FY24.

NTPC Green Energy Limited IPO Risk Factors:

- The company faces strong competition from both domestic and international developers in the renewable energy sector.

- Renewable energy projects can be impacted by changes in government policies, which may affect the company’s revenue and profitability.

NTPC Green Energy Limited IPO Financial Performance:

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check NTPC Green Energy Limited IPO Allotment Status

NTPC Green Energy Limited IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

NTPC Green Energy Limited IPO Shareholding Pattern:

| Particulars | Pre- Issue | Post issue |

| Promoters Group | 100% | 89.02% |

| Others | 0% | 10.98% |

NTPC Green Energy Limited IPO Outlook:

NTPC Green Energy Limited has established itself as a formidable player in the solar wind and energy sectors. The company is well-positioned for further growth, driven by the increasing demand for renewable energy as a replacement for traditional sources. Benefiting from the strong brand equity of its parent, NTPC Limited, NTPC Green Energy has demonstrated solid performance in terms of revenue and profitability. The company also maintains a robust order book, highlighting its strong future The Company’s shares are being offered at a P/E ratio of Rs 258 based on FY24 earnings, which seems overpriced, although we are confident that this business will do well in years to come but we advise investors to buy through secondary market instead of applying for the issue.

NTPC Green Energy Limited IPO FAQ:

Ans. NTPC Green Energy IPO is a main-board IPO of 925,925,926 equity shares of the face value of ₹10 aggregating up to ₹10,000.00 Crores. The issue is priced at ₹102 to ₹108 per share. The minimum order quantity is 138 Shares.

The IPO opens on November 19, 2024, and closes on November 22, 2024.

Kfin Technologies Limited is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The NTPC Green Energy IPO opens on November 19, 2024 and closes on November 22, 2024.

Ans. NTPC Green Energy IPO lot size is 138 Shares, and the minimum amount required is ₹14,904.

Ans. The NTPC Green Energy IPO listing date is not yet announced. The tentative date of NTPC Green Energy IPO listing is Wednesday, November 27, 2024.

Ans. The minimum lot size for this upcoming IPO is 138 shares.