Niva Bupa Health Insurance Limited IPO Company Profile:

Niva Bupa Health Insurance Company Limited, established in 2008, is an Indian health insurance provider. The company is a joint venture between Fettle Tone LLP and Bupa Singapore Holdings Pte. Limited, a UK-based healthcare services expert. The company offers a range of health insurance products and services designed to help customers navigate their healthcare journey by providing access to a comprehensive health ecosystem. The company holds a market share of 17.29% in the Indian health insurance market.

| IPO-Note | Niva Bupa Health Insurance Limited |

| Rs.70– Rs.74 per Equity share | Recommendation: May Apply |

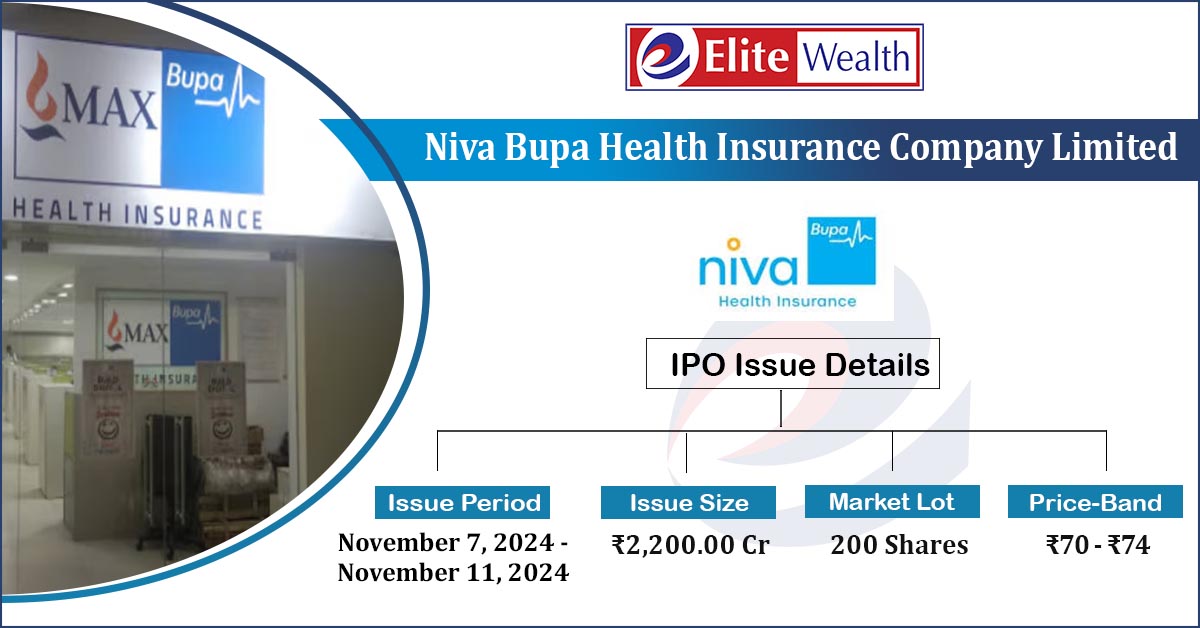

Niva Bupa Health Insurance Limited IPO Details:

| Issue Details | |

| Objects of the issue |

· Strengthening solvency levels. · General corporate purposes. |

| Issue Size | Total issue Size – Rs.2200 Cr

Fresh Issue – Rs 800 Cr Offer for sale- Rs 1400 Cr |

| Face value |

Rs.10 |

| Issue Price | Rs.70 – Rs.74 per share |

| Bid Lot | 200 Shares |

| Listing at |

BSE, NSE |

| Issue Opens | November,7, 2024- November 11, 2024 |

| QIB | Not less than 75% of Net Issue Offer |

| HNI | Not less than 15% of Net Issue Offer |

| Retail | Not less than 10% of Net Issue Offer |

Niva Bupa Health Insurance Limited IPO Strengths:

- The company benefits from the strong brand reputation of its parent, the Bupa Group, which has a global presence, giving Niva Bupa access to international healthcare expertise.

- Company has built a range of health insurance products that are applicable to different customer groups based on income, age and health status.

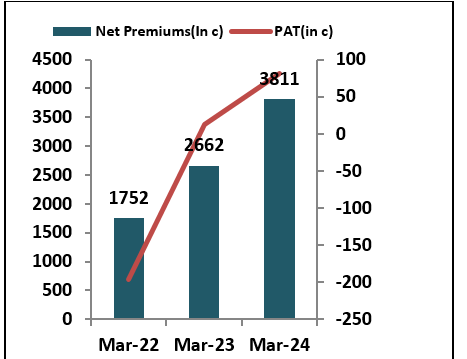

- The company earned premiums of ₹3,811.2 crores in FY24, marking a 43% increase compared to FY23. Its Profit after Tax (PAT) for the same period was ₹81.85 crores, reflecting a 575% growth over FY23.

- The company reported assets under management (AUM) of Rs 5,458 crores, reflecting a 62% increase compared to FY23. The compound annual growth rate (CAGR) of AUM from FY22 to FY24 stood at 50.77%

- As of FY24, the company had 1.47 crore people insured, marking a 49% increase compared to FY23.

- As per the Redseer Report, company has the highest percentage of pre-authorized claims processed within 1 hour among all

Niva Bupa Health Insurance Limited IPO Risk Factors:

- They face intense competition with public sector insurers, which include government-owned health and non-life insurers, and private sector insurers as well.

Niva Bupa Health Insurance Limited IPO Financial Performance:

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Niva Bupa Health Insurance Limited IPO Allotment Status

Niva Bupa Health Insurance Limited IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Niva Bupa Health Insurance Limited IPO Shareholding Pattern:

| Particulars | Pre Issue | |

| Promoters Group | 62.27% | |

| Others | 37.73% |

Niva Bupa Health Insurance Limited IPO Outlook:

Niva Bupa has established a strong presence in the health insurance sector over the past 15 years. The company’s expansion strategy is further bolstered by the growing emphasis on digital health services and favorable government initiatives. As awareness of healthcare issues increases and the demand for comprehensive health solutions rises, Niva Bupa’s diverse service portfolio and advanced digital capabilities position it uniquely to capitalize on these emerging market opportunities. The company’s strong fundamentals are evident in its growing net premiums and net profit. Additionally, the rising client base reflects the confidence that customers have in the company’s offerings. There is ongoing discussion in the Ministry regarding a potential reduction in the GST rate on insurance premiums. If this change occurs, it could be a game-changer for the industry, making health insurance more affordable and accessible, while driving significant growth in the sector. Thus we recommend investors with long term horizon to apply for the issue.

Niva Bupa Health Insurance Limited IPO FAQ:

Ans. Niva Bupa Health Insurance IPO is a main-board IPO of 297,297,297 equity shares of the face value of ₹10 aggregating up to ₹2,200.00 Crores. The issue is priced at ₹70 to ₹74 per share. The minimum order quantity is 200 Shares.

The IPO opens on November 7, 2024, and closes on November 11, 2024.

Kfin Technologies Limited is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Niva Bupa Health Insurance IPO opens on November 7, 2024 and closes on November 11, 2024.

Ans. Niva Bupa Health Insurance IPO lot size is 200 Shares, and the minimum amount required is ₹14,800.

Ans. The Niva Bupa Health Insurance IPO listing date is not yet announced. The tentative date of Niva Bupa Health Insurance IPO listing is Thursday, November 14, 2024.

Ans. The minimum lot size for this upcoming IPO is 200 shares.