India’s growth story is evolving beyond consumption to creation, encompassing sectors such as Automobile and Auto Components, Capital Goods, Healthcare and more1. How about the idea of participating in this growth story.

Presenting Nippon India Nifty India Manufacturing Index Fund that offers a simple, low-cost way to invest in companies that are part of this evolving ecosystem. Get exposure to a wide range of manufacturing stocks through one simple investment!

![]() Investment across manufacturing industries

Investment across manufacturing industries

![]() Selection from 300 stocks across Large, Mid, and Small Cap^

Selection from 300 stocks across Large, Mid, and Small Cap^

![]() Low cost#

Low cost#

![]() Investment via SIP@

Investment via SIP@

(source: https://invest.nipponindiaim.com)

Why Invest In Nippon India Nifty India Manufacturing Index Fund?

-

Exposure to Manufacturing Sectors

Aims to provide exposure to manufacturing companies

-

Rules Based

The entry and exit of stocks are determined on specific rules as per the index methodology

-

Reduced Risk

Elimination of non-systematic risks like stock picking and portfolio manager selection, via investing in Nippon India Nifty India Manufacturing Index Fund

-

SIP Investments

Investors can avail the benefit of Systematic Investment Plan (SIP)@

-

Low Cost

Exposure to a basket of companies via low cost^ index fund

(source: https://invest.nipponindiaim.com)

Scheme Details

- Investment Objective

- The investment objective of the scheme is to provide investment returns that commensurate to the total returns of the securities as represented by the Nifty India Manufacturing Index before expenses, subject to tracking errors. However, there is no assurance that the investment objective of the Scheme will be achieved

- Asset Allocation

-

Instruments Indicative Asset Allocation

(% of total assets)Risk Profile Minimum Maximum Securities constituting Nifty India Manufacturing Index 95% 100% Very High Cash & cash equivalents and Money Market instruments 0% 5% Low to Moderate The Scheme may invest upto 5% net assets in money market / liquid schemes of Nippon India Mutual Fund and/ or any other mutual fund without charging any fees, provided that aggregate inter-scheme investment made by all schemes under the same management company or in schemes under the management of any other AMC shall not exceed 5% of the NAV of the Mutual Fund in accordance with Clause 4 of Seventh Schedule of SEBI (Mutual Funds) Regulations, 1996. For more details, please refer Scheme Information Document (SID).

- Type of Scheme

- An open-ended scheme replicating/ tracking Nifty India Manufacturing Index

(source: https://invest.nipponindiaim.com)

Nippon India Nifty India Manufacturing Index Fund NFO Details:

| Mutual Fund | Nippon India Mutual Fund |

| Scheme Name | Nippon India Nifty India Manufacturing Index Fund |

| Objective of Scheme | The investment objective of the scheme is to provide investment returns that commensurate to the total returns of the securities as represented by the Nifty India Manufacturing Index before expenses, subject to tracking errors. However, there is no assurance that the investment objective of the Scheme will be achieved. |

| Scheme Type | Open Ended |

| Scheme Category | Other Scheme – Index Funds |

| New Fund Launch Date | 06-Aug-2025 |

| New Fund Earliest Closure Date | |

| New Fund Offer Closure Date | 20-Aug-2025 |

| Indicate Load Seperately | Exit Load: NIL Exit load if charged, by NIMF to the unit holders shall be credited to the scheme immediately net of Goods & Service Tax, if any |

| Minimum Subscription Amount | Rs.1,000 and in multiples of Re.1 thereafter |

| For Further Details Please Visit Website | https://mf.nipponindiaim.com |

(source: https://www.amfiindia.com/)

Scheme Documents

(source: https://invest.nipponindiaim.com)

Nippon India Nifty India Manufacturing Index Fund – Details

- NFO Opens on: August 06th 2025

- NFO Closes on: August 20th 2025

- Benchmark Index: Nifty India Manufacturing TRI

- Fund Manager: Himanshu Mange

- Load Structure: Exit Load : NIL

- Minimum application amount (during NFO & ongoing basis):

- During NFO:

- Minimum amount of Rs.1,000 and in multiples of Re.1 thereafter

- During Ongoing Basis :

- Minimum amount of Rs.1,000 and in multiples of Re.1 thereafter

- Additional amount of Rs.1,000 and in multiples of Re.1 thereafter

- Plans :

- The Scheme offers following Plans under Direct Plan and Regular Plan:

- a) Growth Plan

- b) Income Distribution cum capital withdrawal Plan

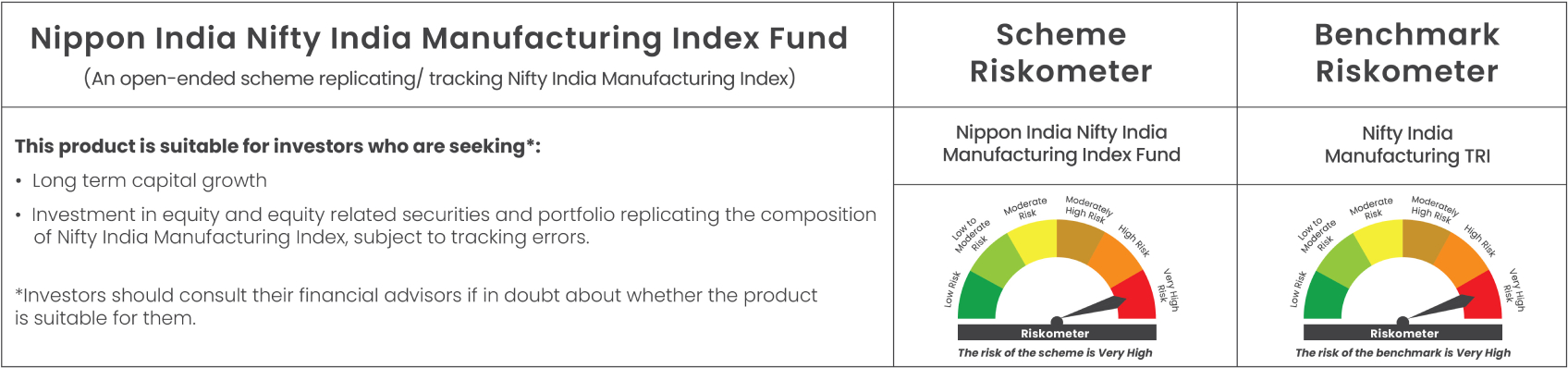

Nippon India Nifty India Manufacturing Index Fund NFO Riskometer:

(source: https://invest.nipponindiaim.com)