Nippon India MNC Fund

MNCs typically bring together global research, innovation, and operational excellence. When combined with India’s growth landscape, they aim to offer a meaningful recipe for long-term growth.

Presenting Nippon India MNC Fund that taps into this opportunity by investing in companies that think globally and scale locally. By identifying businesses that are expanding in India, this fund offers an opportunity to build wealth in long term.

Why Invest in MNCs?

- Global Brands Recognized names trusted across continents

- Good Corporate Governance

- Research & Development Powerhouses Continuous innovation, deep Intellectual Property moats

- Leverage Global Scale Optimised operations, better unit economics

- Strong International Markets Diversified revenue and built in resilience

- Strong Balance Sheet with Lower Debt

Scheme Details

- Investment Objective

- The primary investment objective of the scheme is to achieve long-term capital appreciation for its investors. This objective will be pursued by strategically investing in a diversified portfolio of equity and equity-related instruments of multinational companies (MNCs). There is no assurance that the investment objective of the Scheme will be achieved.

- Asset Allocation

-

Instruments Indicative Asset Allocation

(% of total assets)Minimum Maximum Equity and Equity related Instruments of Multinational Companies (MNCs) 80% 100% Equity and Equity related instruments of companies other than those engaged in the multinational companies’ space 0% 20% Debt & Money Market Instruments 0% 20% - Type of Scheme

- An open-ended equity scheme following multinational company (MNC) theme

(source: invest.nipponindiaim.com)

Nippon India MNC Fund NFO Details:

| Mutual Fund | Nippon India Mutual Fund |

| Scheme Name | Nippon India MNC Fund |

| Objective of Scheme | The primary investment objective of the scheme is to achieve long-term capital appreciation for its investors. This objective will be pursued by strategically investing in a diversified portfolio of equity and equity-related instruments of multinational companies (MNCs). There is no assurance that the investment objective of the Scheme will be achieved. |

| Scheme Type | Open Ended |

| Scheme Category | Equity Scheme – Sectoral/ Thematic |

| New Fund Launch Date | 02-Jul-2025 |

| New Fund Earliest Closure Date | |

| New Fund Offer Closure Date | 16-Jul-2025 |

| Indicate Load Seperately | Exit Load: 1% if redeemed or switched out on or before completion of 1 year from the date of allotment of units. Nil, thereafter Exit load if charged, by NIMF to the unit holders shall be credited to the scheme immediately net of Goods & Service Tax, if any For any change in load structure NAM India will issue an addendum and display it on the website/Investor Service Centres. |

| Minimum Subscription Amount | Rs.500 & in multiples of Re. 1 thereafter |

| For Further Details Please Visit Website | https://mf.nipponindiaim.com |

(source: https://www.amfiindia.com/)

Nippon India MNC Fund – Details

- NFO Opens on: 2nd July 2025

- NFO Closes on: 16th July 2025

- Minimum application amount (during NFO & ongoing basis):

- During NFO:

- Initial Purchase: Rs.500/- and in multiples of Re.1 thereafter

- Additional Purchase :Rs.100/- and in multiples of Re.1 thereafter

- Plans : Direct & Regular

- Options :

- Under Each Plan: Growth & Payout of Income Distribution Cum Capital Withdrawal (IDCW) option and Re-investment of IDCW Option

- Benchmark Index: AMFI Tier, I Benchmark – NIFTY MNC TRI

- Fund Manager: Mr. Dhrumil Shah, Ms. Kinjal Desai (Overseas Investment)

- Exit Load: 1% if redeemed or switched out on or before completion of 1 year from the date of allotment of units. Nil, thereafter

(source: invest.nipponindiaim.com)

Scheme Documents

(source: invest.nipponindiaim.com)

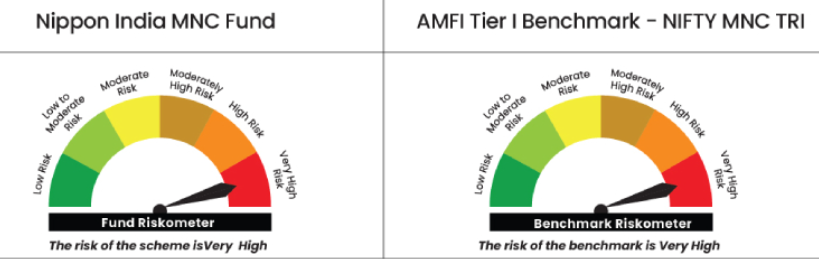

Nippon India MNC Fund NFO Riskometer: