Link PAN With Your LIC Policy

LIC IPO FAQ’s

Check Life Insurance Corporation of India (LIC) IPO Allotment Status

Go Life Insurance Corporation of India (LIC) IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Life Insurance Corporation of India (LIC) IPO Company Profile :

LIC is the oldest and largest Government owned insurance company formed by the LIC Act 1956. Government started LIC with an initial capital contribution of Rs 5 crores, and today it has reached ₹ 40 lakh crore. Until 2000, the company had a monopoly over the Indian insurance market. LIC( LIC IPO) holds roughly 61.6% market share in terms of premium. LIC ( LIC IPO) has its presence all over India, LIC also has international presence through its branches/joint venture and wholly-owned subsidiary and is present in 14 countries. Product mix of LIC includes conventional insurance plans along with unit plans, special plans, pension plans, micro insurance plans, and health plans. LIC has over 13.5 lakh agents who play brings most of the business. Post listing Market Cap is expected to be around ₹ 6 lakh crore.

| IPO-Note | Life insurance Corporation of India |

| ₹ 902 – ₹ 949 per Equity share | Recommendation: Subscribe |

LIC IPO Details-

| Issue Details | |

| Objects of the issue | ·Since this IPO is complete OFS, proceeds will go the government of India

· Achieve the benefits of listing on the stock exchange. |

| Issue Size | Total issue Size – ₹ 20557 Cr.

Offer for Sale – ₹ 20557 Cr. |

| Face value | ₹10.00 Per Equity Share |

| Issue Price | ₹ 902 – ₹ 949 |

| Bid Lot | 15 shares |

| Listing at | BSE, NSE |

| Issue Opens: | 4th May, 2022 – 9th May, 2022 |

| QIB | 50% of Net Issue Offer |

| Retail | 35% of Net Issue Offer |

| NIB | 15% of Net Issue Offer |

| Retail & Employee Discount | ₹45/share |

| Policyholders Discount | ₹60/share |

Trade AnyTime AnyWhere With Elite Empower Mobile App

Life Insurance Corporation of India (LIC) IPO Strengths:

- LIC as a brand enjoys a very high trust in the eye of public. LIC is synonymous with insurance in India.

- LIC has a very strong network as it has around 14 lakhs agents all over India, so it has that reach which no other insurance company can replicate.

- Company being a market leader has a great customer offering, always innovate its products, and are leaders in launching new products.

- LIC holds roughly 61.6% market share in terms of premium. a 71.8% market share in terms of number of individual policies issued, and 88.8% market share in terms of number of group policies issued.

- LIC has a AUM of almost ₹ 40 trillion, which is almost 15 times more than the second insurance player Life Insurance Corporation of India (LIC) IPO

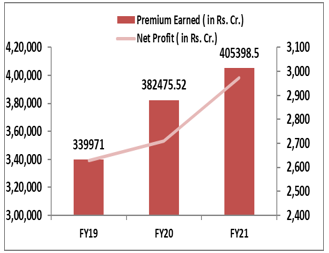

Life Insurance Corporation of India (LIC) IPO Financial Performance:

LIC IPO Risks :

- Company is constantly losing market share to private players.

- LIC Cost Ratio compared to private player is very high.

- LIC Persistency ratio is low compared to other peers.

- IPO Proceeds are going to the government, capital will not come into the company, government is just selling 3.5% stake so they might sell in near future so this risk will always be there on the stock.

Life Insurance Corporation of India (LIC) IPO Shareholding Pattern:

| Shareholding Pattern | Pre- Issue | Post Issue |

| Promoters & Promoter Group | 100 % | 96.50% |

| Public | – | 3.5% |

Source: RHP, EWL Research

Life Insurance Corporation of India (LIC) IPO Positive outlook of the Firm:

- LIC has a very strong network as it has 14 lakhs agents all over India, so it has that reach which no other insurance company can replicate.

- In 2020 LIC is a market leader with 69% market share.

- LIC enjoys sovereign guarantee so policyholder always prefer LIC product over private products.

- LIC being a market leader has a great customer offering always innovate its products, and are leaders in launching new products in the market.

Life Insurance Corporation of India (LIC) IPO Key Highlights:

- Premium Earned saw a growth at a CAGR of 9.2% from FY19-21 and profit grew at a CAGR of 6%.

- LIC’s VNB margin for FY21 and 1HFY22 stood at 9.9% and 9.3% respectively, broadly reflecting the Par-heavy product mix.

- LIC’s total cost ratios stood at 33% in 1HFY22 and is higher than top 5 private sector

- Embedded Value as on 31st Dec 2021 stand at ₹ 5, 39,686 crore.

- Company reported RONW of 45.56% in FY21

- The NBP on a consolidated basis increased at a CAGR of 13.49% from Fiscal 2019 to Fiscal 2021.

- LIC persistency rates for 13th month stand at 88% and 61st month at 79%

Life Insurance Corporation of India (LIC) IPO Promoters of the company:

- Government of India is the company promoter.

Life Insurance Corporation of India (LIC) IPO Outlook:

LIC accounts for 60%+ of life insurance new premiums and 40%+of retail APE, driven primarily by its industry leading agency force of 14 lakh personnel and it also has 72 Banca partnerships. . It is the biggest asset manager amongst life Insurers with ₹ 40 trillion in AUM. LIC operating metrics is quiet weak compared to its peers as its cost ratio are very high and VNB Margin is very low, company is constantly losing market share. At the higher end of the IPO band stock trade 1x of its embedded value which is cheap compared to its private player which trade at 2x- 3x. We recommend SUBSCRIBE to the IPO.

How to apply for LIC IPO?

Here is your quick checklist for LIC IPO:

UPI

- Link your bank account to a UPI ID.

- Register your UPI id with your Demat account.

- Subscribe for LIC IPO and approve the payment on your UPI ID.

Lead Manager Details

1) Kotak Mahindra Capital Company Limited:

1st Floor, 27 BKC Plot No. C-27, ‘G’ Block Bandra Kurla Complex, Bandra (East) Mumbai 400 051 Maharashtra, India

Tel: +91 22 4336 0000

E-mail: lic.ipo@kotak.com

Website: https://investmentbank.kotak.com

Investor Grievance ID: kmccredressal@kotak.com

Contact Person: Ganesh Rane

SEBI Registration Number: INM000008704

2) Axis Capital Limited

Axis Capital Limited 1st Floor, Axis House C-2 Wadia International Centre P.B. Marg, Worli Mumbai 400 025 Maharashtra, India

Tel: +91 22 4325 2183

E-mail: lic.ipo@axiscap.in

Website: www.axiscapital.co.in

Investor Grievance ID: complaints@axiscap.in

Contact Person: Mayuri Arya

SEBI Registration Number: INM000012029

3) BofA Securities India Limited

Ground Floor, “A” Wing One BKC, “G” Block Bandra Kurla Complex Bandra (East), Mumbai 400 051 Maharashtra, India

Tel: +91 22 6632 8000

E-mail: dg.lici_ipo@bofa.com

Website: www.ml-india.com

Investor Grievance ID: dg.india_merchantbanking@bofa.com

Contact Person: Abhay Agarwal

SEBI Registration Number: INM000011625

4) Citigroup Global Markets India Private Limited

1202, 12th Floor First International Finance Centre, G-Block Bandra Kurla Complex, Bandra (East) Mumbai 400 098 Maharashtra, India

Tel: +91 22 6175 9999

E-mail: licindia.ipo@citi.com

Investor Grievance ID: investors.cgmib@citi.com

Website: www.online.citibank.co.in/rhtm/citigroupglobal screen1.htm

Contact Person: Huzefa Bodabhaiwala

SEBI Registration Number: INM000010718

5) Goldman Sachs (India) Securities Private Limited

951-A, Rational House Appasaheb Marathe Marg, Prabhadevi Mumbai 400 025 Maharashtra, India

Tel: +91 22 6616 9000

E-mail: licipo@gs.com

Website: www.goldmansachs.com

Investor Grievance ID: india-clientsupport@gs.com

Contact Person: Chirag Jasani

SEBI Registration Number: INM000011054

6) ICICI Securities Limited

ICICI Venture House Appasaheb Marathe Marg, Prabhadevi Mumbai 400 025 Maharashtra, India

Tel: +91 22 6807 7100

E-mail: lic.ipo@icicisecurities.com

Website: www.icicisecurities.com

Investor Grievance ID: customercare@icicisecurities.com

Contact Person: Sameer Purohit/ Sumit Singh

SEBI Registration Number: INM000011179

7) JM Financial Limited

7 th Floor, Cnergy Appasaheb Marathe Marg Prabhadevi, Mumbai 400 025 Maharashtra, India

Tel: +91 22 6630 3030/ 3262

E-mail: lic.ipo@jmfl.com

Website: www.jmfl.com

Investor Grievance ID: grievance.ibd@jmfl.com

Contact Person: Prachee Dhuri SEBI Registration Number: INM000010361

8) J.P. Morgan India Private Limited

J.P. Morgan Tower, Off. C.S.T. Road Kalina, Santacruz (East) Mumbai 400 098 Maharashtra, India

Tel: +91 22 6157 3000

E-mail: LIC_IPO@jpmorgan.com

Website: www.jpmipl.com Investor

Grievance ID: investorsmb.jpmipl@jpmorgan.com

Contact Person: Saarthak K Soni

SEBI Registration Number: INM000002970

9) Nomura Financial Advisory and Securities (India) Private Limited

Ceejay House, Level 11 Plot F Shivsagar Estate, Dr. Annie Besant Road, Worli, Mumbai 400 018 Maharashtra, India

Tel: +91 22 4037 4037

E-mail: licipo@nomura.com

Website: www.nomuraholdings.com/company/ group/asia/india/index.html

Investor Grievance ID: investorgrievances-in@nomura.com

Contact Person: Vishal Kanjani/ Sandeep Baid

SEBI Registration Number: INM000011419

10) SBI Capital Markets Limited

202, Maker Tower “E”, Cuffe Parade Mumbai 400 005 Maharashtra, India

Tel: +91 22 2217 8300

E-mail: lic.ipo@sbicaps.com

Website: www.sbicaps.com

Investor Grievance ID: investor.relations@sbicaps.com

Contact Person: Sambit Rath/Mounika T

SEBI Registration Number: INM000003531

Registrar Details

- KFin Technologies Private Limited

Selenium, Tower B, Plot No- 31 and 32 Gachibowli, Financial District Nanakramguda, Serilingampally Hyderabad 500 032 Telangana, India

Tel: +91 40 6716 2222

E-mail: lic.ipo@kfintech.com

Investor Grievance ID: einward.ris@kfintech.com

Website: www.kfintech.com

Contact Person: M Murli Krishna

SEBI Registration Number: INR000000221