Le Travenues Technology Limited (IXIGO) IPO Company Profile:

Le Travenues Technology Limited (IXIGO) is a technology company focused on empowering Indian travelers to plan, book, and manage their trips across rail, air, buses, and hotels. The company assists travelers in making smarter travel decisions by leveraging artificial intelligence, machine learning, and data science-led innovations on its OTA (“Online Travel Agency”) platforms, comprising its websites and mobile applications. It is the largest Indian OTA in the online train bookings segment and its train-centric mobile applications, ixigo trains, and ConfirmTkt, were collectively the leading B2C distribution platforms for IRCTC with 51% market share, in terms of rail bookings among the OTAs and B2C distributors of IRCTC in Fiscal 2021. Company’s bus-focused app, AbhiBus, was the second largest bus-ticketing OTA in India, with 11.5% market share in online bus ticket bookings, in Fiscal 2023. The company has a market share of 5.2% of the total airline OTA volume in the first half of FY 2024 up from 3.3% in FY 2023. Along with this, Company has the highest app usage among OTAs with 83 million Monthly Active Users cumulatively across all of its apps, as per data.ai in September 2023.

| IPO-Note | Le Travenues Technology Limited (IXIGO) |

| Rs.88 – Rs.93 per Equity share | Recommendation: Apply for Long-Term |

Le Travenues Technology Limited (IXIGO) IPO Details:

| Issue Details | |

| Objects of the issue |

· To Part-fund working capital requirements · To invest in cloud infrastructure & technology · To fund inorganic growth through acquisitions · To gain listing benefits |

| Issue Size | Total issue Size – Rs.740.10 Cr.

Offer for Sale – Rs.620.10 Cr. Fresh Issue – Rs. 120 Cr. |

| Face value | Rs.1 |

| Issue Price | Rs.88 – Rs.93 |

| Bid Lot | 161 Shares |

| Listing at | BSE, NSE |

| Issue Opens | 10th June, 2024 – 12th June, 2024 |

| QIB | 75% of Net Issue Offer |

| NIB | 10% of Net Issue Offer |

| Retail | 15% of Net Issue Offer |

Le Travenues Technology Limited (IXIGO) IPO Strengths:

- The company is a market leader with deep penetration in the underserved ‘next billion user’ segment with the highest Monthly Active Users across all OTAs. The number of transactions booked through the OTA platforms has increased at a CAGR of 139.43% from 8.56 mn in FY21 to 49.07 mn in FY23.

- Ixigo is a strong consumer travel brand built with a user-first approach and it had the highest usage and engagement among all key OTA players and standalone transactional train mobile apps in India in September 2023 in terms of MAUs and sessions per user per month.

- Company’s business model encompasses a wide range of product and service offerings that are present in the rail, flight, bus, and hotel industries. This allows it to fully cater to the Indian internet travel industry and monetise every facet of its OTA platforms.

Le Travenues Technology Limited (IXIGO) IPO Risk Factors:

- The company’s train ticketing services depend on its agreement with IRCTC. The termination of its agreement with IRCTC could have adverse impact on its business.

- If the company fails to maintain and enhance its brands “ixigo”, “ConfirmTkt” and “AbhiBus” or if it fails to maintain the quality of customer service, it may face difficulty in maintaining existing and acquiring new users and business partners and its business may be harmed.

- The Co. has a limited experience and operating history in certain of its businesses, particularly in hotel offerings which makes it difficult to accurately assess its future growth prospects and may negatively affect its business.

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Le Travenues Technology Limited (IXIGO) IPO Allotment Status

Le Travenues Technology Limited (IXIGO) IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

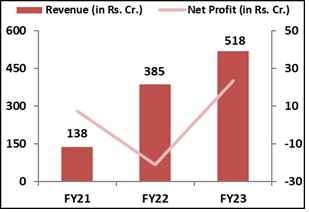

Le Travenues Technology Limited (IXIGO) IPO Financial Performance:

Le Travenues Technology Limited (IXIGO) Shareholding Pattern:

| Particulars | Pre- Issue | Post Issue |

| Promoters Group | 0% | 0% |

| Others | 100% | 100% |

Source: RHP, EWL Research

Le Travenues Technology Limited (IXIGO) IPO Outlook:

IXIGO is a fastest-growing travel platform with a dominant market share in rail bookings and growing presence in bus & air bookings. The PE of IXIGO stands at 154x on the upper price band which is high compared to its peers’ average of 121.39x. But considering Company’s strong brand, diversified business model and long-term growth potential of the travel sector, we recommend investors to apply in the offering with long-term perspective.

Le Travenues Technology Limited (IXIGO) IPO FAQ:

Ans. Le Travenues Technology Limited (IXIGO) IPO is a main-board IPO of 79,580,900 equity shares of the face value of ₹1 aggregating up to ₹740.10 Crores. The issue is priced at ₹88 to ₹93 per share. The minimum order quantity is 161 Shares.

The IPO opens on June 10, 2024, and closes on June 12, 2024.

Link Intime India Private Ltd is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Le Travenues Technology Limited (IXIGO) IPO opens on June 10, 2024 and closes on June 12, 2024.

Ans.Le Travenues Technology Limited (IXIGO) IPO lot size is 161 Shares, and the minimum amount required is ₹14,973.

Ans. The Le Travenues Technology Limited (IXIGO)IPO listing date is not yet announced. The tentative date of Le Travenues Technology Limited (IXIGO) IPO listing is Tuesday, June 18, 2024.

Ans. The minimum lot size for this upcoming IPO is 161shares.