KRN Heat Exchanger IPO Company Profile:

KRN heat exchanger is an emerging leader in fin tubes and other heat exchange products for the B2B segment, serving prestigious clients such as Daikin, Blue Star, Voltas, and Carrier Zircon. The Company specializes in manufacturing fin and tube heat exchangers for the HVAC&R industry. They primarily use non-ferrous metals, such as copper and aluminum, in their products. Their range includes condenser coils, evaporator units, evaporator coils, header and copper components, fluid and steam coils, and sheet metal parts. They produce heat exchangers in various shapes and sizes to meet customer specifications and market demands. Their products are designed for a wide array of applications in air conditioning, heating, ventilation, refrigeration, and process cooling.

| IPO-Note | KRN Heat Exchanger |

| Rs.209 – Rs.220 per Equity share | Recommendation: Apply |

KRN Heat Exchanger IPO Details:

| Issue Details | |

| Objects of the issue | · Setting of new manufacturing facility at Rajasthan

· General cooperate purposes. |

| Issue Size | Total issue Size – Rs.341.95 Cr

Fresh Issue – Rs 341.95 Cr |

| Face value | Rs.10 |

| Issue Price | Rs 209 – Rs 220 |

| Bid Lot | 65 Shares |

| Listing at | BSE, NSE |

| Issue Opens | September 25, 2024 – September 27, 2024 |

| QIB | Not more than 50% of Net Issue Offer |

| HNI | Not less than 15% of Net Issue Offer |

| Retail | Not less than 35% of Net Issue Offer |

KRN Heat Exchanger IPO Strengths:

-

KRN heat exchanger is a leading manufacturer and exporter of aluminum and copper fins, copper tube heat exchangers, water coils, as well as condenser and evaporator coils, all of which are widely utilized by OEMs in heating, ventilation, air conditioning, and refrigeration.

-

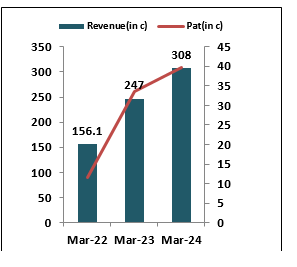

The company’s standalone revenue for FY24 was ₹308.23 crore, marking a 24% increase compared to FY23. Profit after tax (PAT) was ₹39.8 crore, which represents an 18% growth over the previous fiscal year.

-

For FY24, the ROE and ROCE stood at 40.86% and 31.21%, respectively. This demonstrates that the company has delivered good return on capital and has efficiently leveraged its overall resources.

-

Company has reduced its debt to equity ratio from 0.87 in FY22 to 0.45 in FY24.

KRN Heat Exchanger IPO Risk Factors:

-

The company operates in a highly competitive HVAC industry, facing competition from both international firms and well-established domestic companies, including Prijai Heat Exchangers, Spirotech Heat Exchangers, and others.

-

The company’s inventory turnover days have risen from 38 days to 112 days over the past three years, indicating that it is taking longer to convert inventory into sales.

-

Company had negative cash flow from operations in FY24. Cash flow from operation stood at -7.13 crores.

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check KRN Heat Exchanger IPO Allotment Status

KRN Heat Exchanger IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

KRN Heat Exchanger IPO Financial Performance:

KRN Heat Exchanger IPO Shareholding Pattern:

| Particulars | Pre Issue | ||

| Promoters Group | 94.39% | ||

| Others | – |

KRN Heat Exchanger IPO Outlook:

KRN Heat Exchanger is a promising new player in the HVAC industry, demonstrating robust financial performance. In FY24, the company experienced a 21% increase in revenue and an 18% rise in profit after tax compared to FY23. However, the company is currently facing a challenge with inventory conversion, as turnover days have increased to 112 in FY24. We recommend that investors may apply for the issue for long-term gains and potential listing gains.

KRN Heat Exchanger IPO FAQ:

Ans. KRN Heat Exchanger IPO is a main-board IPO of 15,543,000 equity shares of the face value of ₹10 aggregating up to ₹341.95 Crores. The issue is priced at ₹209 to ₹220 per share. The minimum order quantity is 65 Shares.

The IPO opens on September 25, 2024, and closes on September 27, 2024.

Bigshare Services Pvt Ltd is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The KRN Heat Exchanger IPO opens on September 25, 2024 and closes on September 27, 2024.

Ans. KRN Heat Exchanger IPO lot size is 65 Shares, and the minimum amount required is ₹14,300.

Ans. The KRN Heat Exchanger IPO listing date is not yet announced. The tentative date of KRN Heat Exchanger IPO listing is Thursday, October 3, 2024.

Ans. The minimum lot size for this upcoming IPO is 65 shares.