Kaynes Technology India Ltd IPO Company Profile :

Kaynes Technology India Ltd is an end-to-end and IoT solutions-enabled integrated electronics manufacturing player, having capabilities across the entire spectrum of electronics system design and manufacturing (“ESDM”) services. The company has experience in providing conceptual design, process engineering, integrated manufacturing, and life-cycle support for major players in the automotive, industrial, aerospace and defense, outer-space, nuclear, medical, railways, Internet of Things (“IoT”), Information Technology (“IT”) and other segments. The company has long-term relationships with a large customer base diversified across verticals and geographies. In the three months ended June 30, 2022, it served 229 customers in 21 countries globally and multiple industry verticals such as automotive, aerospace and defense, industrial, railways, medical, and IT / ITES.

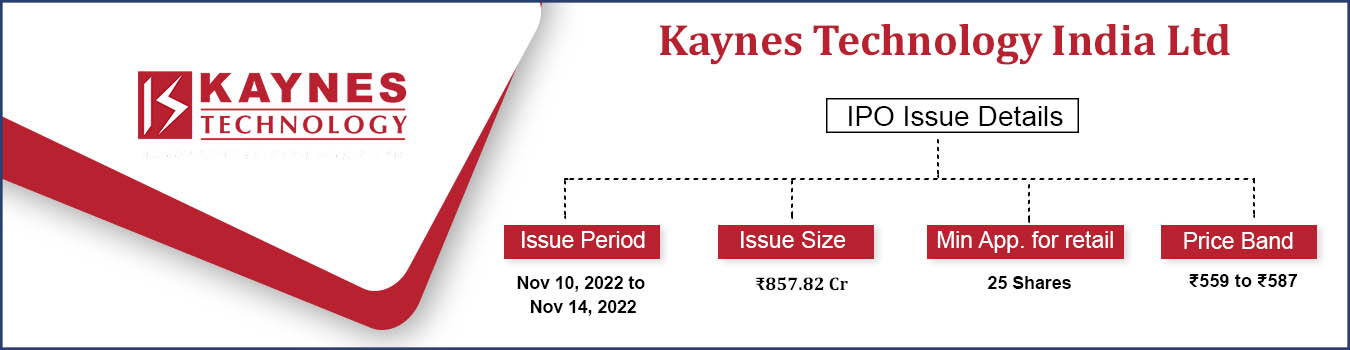

Kaynes Technology India Ltd IPO Details:

| IPO Open Date | 10th November 2022 |

| IPO Close Date | 14th November 2022 |

| Listing Date | 22nd November 2022 |

| Face Value | ₹10 per share |

| Price | ₹559 to ₹587 per share |

| Lot Size | 25 Shares |

| Issue Size | 14,613,624 shares (aggregating up to ₹857.82 Cr) |

| Fresh Issue | 9,028,960 shares

(aggregating up to ₹530.00 Cr) |

| Offer for Sale | 5,584,664 shares

(aggregating up to ₹327.82 Cr) |

| Employee Discount | 15 |

| Issue Type | Book Built Issue IPO |

| Listing At | BSE, NSE |

| QIB Shares Offered | Not more than 50% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

| Retail Shares Offered | Not less than 35% of the Offer |

| Company Promoters | Ramesh Kunhikannan, Savitha Ramesh, and RK Family Trust |

Kaynes Technology India classifies its operations under the following business verticals:

- OEM(“Original Equipment Manufacturer”) – Turnkey Solutions – Box Build (“OEM – Box Build”):

Kaynes Technology India undertakes “Build To Print” or “Build to Specifications” of complex box builds, sub-systems, and products across various industry verticals.

- OEM(“Original Equipment Manufacturer”) – Turnkey Solutions – Printed Circuit Board Assemblies (“PCBAs”) (“OEM – Turnkey Solutions”):

Kaynes Technology India undertakes turnkey electronics manufacturing services of PCBAs, cable harnesses, magnetics, and plastics ranging from prototyping to product realization including mass manufacturing.

- ODM(“Original Design Manufacturer”):

Kaynes Technology India offers ODM services in smart metering technology, smart street lighting, brushless DC (“BLDC”) technology, inverter technology, gallium nitride-based charging technology, and providing IoT solutions for making smart consumer appliances or devices IoT connected.

- Product Engineering and IoT Solutions:

Kaynes Technology India offers conceptual design and product engineering services in industrial and consumer segments. The services include PCB cladding or electrical schematics to embedded design and submitting proof of concept to prototyping. The company also offers connected product engineering and solutions. The company has a portfolio of hardware, software accelerators, and proprietary sensors along with cloud platform-based service and solution offerings in asset tracking, remote device management, and smart product development. The digital engineering offerings leverage the latest technologies including IoT, big data, machine learning, cloud and media to improve customers’ efficiency. The company also provides end-to-end IoT and cloud enablement solutions and offers IoT data and analytics platform and vertical IoT solutions.

Revenue from operations analysis:

| Segment | Q1 FY-23 (in cr.) | % | FY-22(in cr.) | % | FY-21(in cr.) | % | FY-20(in cr.) | % | CAGR |

| OEM – Turnkey Solutions – Box Build | 46.87 | 23.52 | 198.82 | 28.15 | 127.63 | 30.34 | 94.21 | 25.58 | 28.27% |

| OEM – Turnkey Solutions – Printed Circuit Board Assemblies | 132.70 | 66.60 | 443.62 | 62.81 | 250.90 | 59.65 | 229.00 | 62.19 | 24.66% |

| ODM | 9.89 | 4.96 | 27.80 | 3.94 | 18.42 | 4.38 | 7.62 | 2.07 | 53.94% |

| Product Engineering and IoT solutions | 9.80 | 4.92 | 36.10 | 5.11 | 23.67 | 5.63 | 37.41 | 10.16 | -1.18% |

| Total | 199.26 | 100.00 | 706.34 | 100.00 | 420.62 | 100.00 | 368.24 | 100.00 | 24.25% |

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Kaynes Technology India Ltd IPO Allotment Status

Go Kaynes Technology India Ltd IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Financial analysis:

| Particulars | Q1 FY-23(in cr.) | FY-22(in cr.) | FY-21(in cr.) | FY-20(in cr.) | CAGR |

| Revenue from operations | 199.27 | 706.25 | 420.63 | 368.24 | 24.2% |

| Other Income | 0.71 | 4.11 | 4.04 | 1.93 | |

| Cost Of Goods Sold | 140.53 | 489.43 | 286.12 | 241.68 | |

| Employee Cost | 18.39 | 60.24 | 45.90 | 42.43 | |

| Other expenses | 15.78 | 62.91 | 47.72 | 42.79 | |

| EBITDA | 25.27 | 97.78 | 44.92 | 43.27 | 31.2% |

| EBITDA margin% | 12.68% | 13.84% | 10.68% | 11.75% | |

| Depreciation | 4.6 | 13.2 | 10.1 | 8.4 | |

| Interest | 7.3 | 25.6 | 24.0 | 23.6 | |

| PBT | 13.44 | 59.03 | 10.87 | 11.28 | 73.6% |

| Total tax | 3.39 | 17.35 | 1.14 | 1.93 | |

| PAT | 10.04 | 41.68 | 9.73 | 9.36 | 64.5% |

| PAT margin% | 5.04% | 5.90% | 2.31% | 2.54% | |

| Dep./revenue% | 2.29% | 1.86% | 2.40% | 2.28% | |

| Int./revenue% | 3.65% | 362.29% | 570.08% | 640.94% |

Pre-Offer shareholding of the Selling Shareholders:

| S. No. | Name of the Selling Shareholder | No. of Equity Shares

held |

Percentage of the pre-Offer paid

Up equity share capital (%) |

| 1. | Ramesh Kunhikannan | 39,164,584 | 79.74% |

| 2. | Freny Firoze Irani | 5,298,924 | 10.79% |

| Total | 44,463,508 | 90.53% |

Offer for Sale Details:

| S. No. | Name of the Selling Shareholder | Number of Equity Shares

being offered in the Offer for Sale (Up to) |

| 1. | Ramesh Kunhikannan | 2,084,664 Equity Shares |

| 2. | Freny Firoze Irani | 3,500,000 Equity Shares |

Kaynes Technology India Ltd IPO Strengths:

-

Kaynes Technology India Ltd is an Internet of Things (“IoT”) solutions-enabled integrated electronics manufacturing player with end-to-end capabilities across the Electronics System Design and Manufacturing spectrum. The company possesses the ability to manufacture complex products through innovative engineering across various industry verticals.

-

Kaynes Technology India Ltd has a wide-ranging product portfolio having applications across industry verticals such as automotive, telecom, aerospace and defense, space, medical, IoT, and industrial, each of which is individually growing. The diverse portfolio limits the company’s exposure to downturns associated with a particular vertical. It also ensures that the revenues are consistent across periods on account of the customers serving different industry verticals with different business or industry cycles.

-

Kaynes Technology India Ltd has been profitable every year since its inception. The company believes that its operational and financial performance will allow it to capitalize on the tailwinds in the electronics industry.

-

Kaynes Technology India Ltd possesses a mature and reliable supply chain network. The company has a long-term relationship with its vendors within India and outside India, which has led to improvement in credit terms over the years. As of June 30, 2022, the company works with over 871 vendors and sources materials from various regions including North America, Europe, Singapore as well as locally within India. The top 10 suppliers of the company have an average relationship period of over 10.80 years, as of June 30, 2022.

-

Over the years, Kaynes Technology India Ltd has focused on creating robust manufacturing systems and processes. The company adheres to global standards and has obtained various global certifications. This ensures that the company processes comply with customer-specific, industry-specific, statutory health and safety, as well as environmental and social, and governance requirements.

Kaynes Technology India Ltd IPO Risk factors:

-

The business of the company is dependent on the sale of products of its customers. The top 10 customers of the company accounted for 53.61%, 46.03%, 51.02%, and 62.81% of the revenue from operations in Fiscal 2020, 2021, and 2022, and the three months ended June 30, 2022, respectively. Revenue contribution from our top 1, top 5, and top 10 customers has fluctuated in the last three Fiscals. Further, there has been a decline in the proportion of new customers the company has added in the last three Fiscals. In addition, the company does not have firm commitment agreements with the customers. The loss of one or more such customers or a reduction in demand for their products could adversely affect the company’s business, results of operations, financial condition, and cash flows.

-

Kaynes Technology India Ltd had negative cash flows from operating activities of ₹ (7.11) crores in the three months ended June 30, 2022. Any negative cash flows in the future would adversely affect the company’s cash flow requirements, which may adversely affect its ability to operate its business and implement the growth plans, thereby affecting its financial condition.

-

Kaynes Technology India Ltd relies on the constant supply of semiconductors from overseas markets for manufacturing its products. The imported raw materials accounted for 64.46% of the total purchases of raw materials in Fiscal 2022. Any shortage or issues in the timely availability of semiconductors or any particular semiconductor components required for the manufacturing of the products or fluctuations in the exchange rate between the Rupee and other currencies could affect the business, financial condition, results of operations, and prospects of the company.

-

Kaynes Technology India Ltd is reliant on the demand from various industries such as automotive, railways, industrial, medical, information technology, Internet of Things, aerospace, and defense, of which automotive and industrial industries accounted for 63.36% of the revenue from operations in Fiscal 2022. Any downturn in these industries could have an adverse impact on the business, growth and results of operations of the company.

Kaynes Technology India Ltd IPO Objects of the Offer:

Kaynes Technology India Ltd proposes to utilize the Net Proceeds towards funding the following objects:

-

Repayment/ prepayment, in full or part, of certain borrowings availed by the Company;

-

Funding capital expenditure towards the expansion of the existing manufacturing facility at Mysuru, Karnataka, and near the existing manufacturing facility at Manesar, Haryana;

-

Investment in the company’s wholly-owned subsidiary, Kaynes Electronics Manufacturing Private Limited, for setting up a new facility at Chamarajanagar, Karnataka;

-

Funding working capital requirements of the Company; and

-

General corporate purposes.

Kaynes Technology India Ltd Prospectus:

- Kaynes Technology India Ltd DRHP

- Kaynes Technology India Ltd RHP –

Registrar to the offer:

Link Intime India Private Limited

E-mail: kaynes.ipo@linkintime.co.in

Tel: +91 810 811 4949

Contact Person: Shanti Gopalkrishnan

Need An Assistance:

Kaynes Technology India Ltd IPO FAQ

Ans.Kaynes Technology India Ltd IPO will comprise fresh share issue and new offer share issue. The company aims to go public to accelerate its growth and expansion plan.

Ans. The Kaynes Technology IPO opens on Nov 10, 2022 and closes on Nov 14, 2022.

Ans. The minimum lot size that investors can subscribe to is 25 shares.

Ans. The Kaynes Technology IPO listing date is not yet announced. The tentative date of Kaynes Technology IPO listing is Nov 22, 2022.

Ans. The minimum lot size for this upcoming IPO is 25 shares.