Inox Green Energy Services Limited IPO Company Profile :

Inox Green Energy Services Limited (IGESL) is one of the major wind power operation and maintenance (O&M) service providers within India and is engaged in the business of providing long-term O&M services and common infrastructure facilities for wind farm projects, specifically for wind turbine generators (WTGs). The company is a subsidiary of Inox Wind Limited (IWL), part of the Inox GFL group of companies, which is principally engaged in the business of manufacturing WTGs. It has presence in the Gujarat, Rajasthan, Madhya Pradesh, Maharashtra, Andhra Pradesh, Karnataka, Kerala and Tamil Nadu. The company has O&M services portfolio of an aggregate 2,792 MW of wind farm capacity and 1,396 WTGs as of June 30, 2022.

| IPO-Note | Inox Green Energy Services Limited |

| Rs.61 – Rs.65 per Equity share | Recommendation: Avoid |

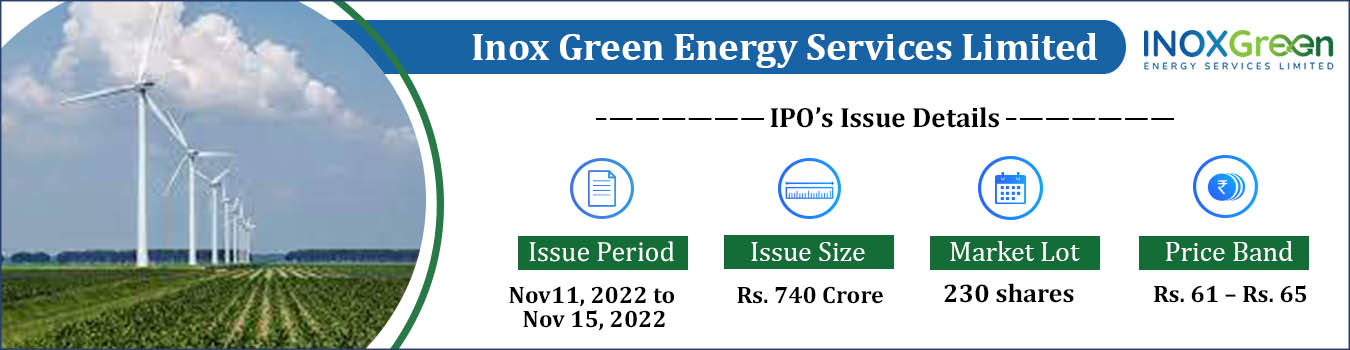

Inox Green Energy Services Limited IPO Details:

| Issue Details | |

| Objects of the issue |

· To repay/pre-pay the borrowings · To gain the listing benefits. |

| Issue Size |

Total issue Size – Rs. 740 Crore Fresh Issue – Rs. 370 Crore Offer For Sale – Rs. 370 Crore |

| Face value | Rs. 10.00 Per Equity Share |

| Issue Price | Rs. 61 – Rs. 65 |

| Bid Lot | 230 shares |

| Listing at | BSE, NSE |

| Issue Opens: | 11th November, 2022 – 15th November, 2022 |

| QIB | 75% of Net Issue Offer |

| Retail | 10% of Net Issue Offer |

| NII | 15% of Net Issue Offer |

Inox Green Energy Services Limited IPO Strengths:

- The company has diverse O&M Contracts, which consists of Independent Power Producers (72%), PSUs (14%), and Corporates (14%).

- It has strong CAGR growth of 40.16% from the past nine years in the operating portfolio of O&M contracts.

- Company is promoted and supported by its parent company IWL.

- IGESL has established supply chain with strong and experienced management.

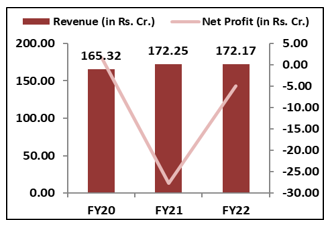

Inox Green Energy Services Limited IPO Financial Performance:

Inox Green Energy Services Limited IPO Shareholding Pattern:

| Shareholding Pattern | Pre- Issue | Post Issue |

| Promoters & Promoters Group | 93.84% | 56.04% |

| Others | 6.16% | 43.96% |

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Inox Green Energy Services Limited IPO Allotment Status

Go Inox Green Energy Services Limited IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Source: DRHP, EWL Research

Inox Green Energy Services Limited IPO Risk Factors:

- It derives its revenues from O&M services offered to WTGs supplied by IWL, any adverse development in the relationship with IWL may impact the business of the company.

- The order book of IWL may be delayed, modified or cancelled, this may impact the business of the IGESL.

- The customers may not renew their service contracts or that renewal terms may be less favorable to the company.

- It has certain outstanding legal proceedings involving the Company, its Subsidiaries, Directors, Promoter and Group Companies.

Inox Green Energy Services Limited IPO Outlook:

IGESL is a major wind power O&M service provider within India which is a part of the INOXGFL Group which principally operates in the specialty chemicals and renewable energy sectors. It has an established track record in the wind energy O&M industry of more than nine years due in large part to the synergistic relationship with its parent company, IWL, which commenced operations in the wind energy space in the FY 2010. The company is planning to expand its portfolio and scale of operations by entering into new long-term O&M contracts also transitioning to an asset light model with minimal capital expenditure which will result in better operating performance. In the Wind Power sector, CRISIL Research expects capacity additions of 17-20 GW over the next five years (fiscals 2023-2027). The long term outlook for the sector is positive, However IGESL has not performed well fundamentally. The company is currently in loss and has no listed peers in the market for comparison. Hence we recommend to avoid to the IPO.

Inox Green Energy Services Limited IPO FAQ

Ans.Inox Green Energy Services Limited IPO will comprise fresh share issue and new offer share issue. The company aims to go public to accelerate its growth and expansion plan.

Ans. The Inox Green Energy IPO opens on Nov 11, 2022 and closes on Nov 15, 2022.

Ans. The minimum lot size that investors can subscribe to is 230 shares.

Ans. The Inox Green Energy IPO listing date is not yet announced. The tentative date of Inox Green Energy IPO listing is Nov 23, 2022.

Ans. The minimum lot size for this upcoming IPO is 230 shares.