HDFC Transportation and Logistics Fund NFO

HDFC Asset Management Company Limited (HDFC AMC) is a leading investment manager of HDFC Mutual Fund, which is one of the largest mutual funds in India. Incorporated under the Companies Act, 1956, on December 10, 1999, HDFC AMC was approved by SEBI to act as an Asset Management Company for HDFC Mutual Fund on July 3, 2000. HDFC AMC has a diversified asset class mix across equity and fixed income/others. It also has a widespread network of branches and distribution channels, including banks, mutual fund distributors, and national distributors.

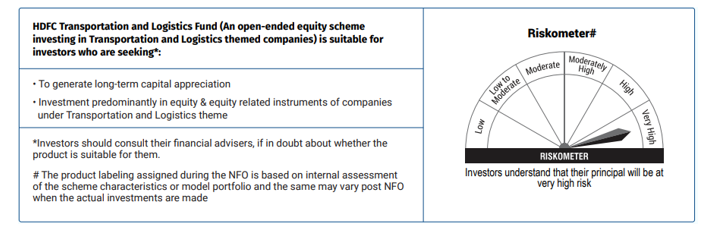

HDFC Asset Management Company Limited is coming up with the HDFC Transportation and Logistics Fund, an NFO scheme with an investment objective to provide long-term capital appreciation by investing predominantly in equity and equity-related securities under Transportation and Logistics theme. There is no assurance that the investment objective of the Scheme will be realized. The scheme opens on the 28th of July, 2023, and closes on the 11th of August, 2023.

HDFC Transportation and Logistics Fund NFO details:

| Mutual Fund: | HDFC Mutual Fund |

| Scheme Name: | HDFC Transportation and Logistics Fund |

| Objective of Scheme: | To provide long-term capital appreciation by investing predominantly in equity and equity related securities under Transportation and Logistics theme. There is no assurance that the investment objective of the Scheme will be realized. |

| Scheme Type: | An open-ended equity scheme following transportation and logistics theme |

| Scheme Category: | Equity Scheme – Sectoral/Thematic |

| New Fund Launch Date: | 28th of July, 2023 |

| New Fund Offer Closure Date: | 11th of August, 2023 |

| Fund Managers: | Mr. Priya Ranjan |

| Benchmark Index: | Nifty Transportation & Logistics Index (TRI) |

| Minimum Application Amount: | During NFO Period

Purchase: Rs. 100/- and any amount thereafter During continuous offer period (after scheme re-opens for repurchase and sale): Purchase / Additional Purchase: Rs. 100/- and any amount thereafter Note: Allotment of units will be done after deduction of applicable stamp duty and transaction charges, if any |

| Plans: | Regular and Direct |

| Investment Options: | Under Each Plan: Growth, Income Distribution cum Capital Withdrawal – Payout and Reinvestment of IDCW facility |

| Load Structure: | Entry Load : Nil

Exit Load : In respect of each purchase/switch-in of units, an Exit load of 1% is payable if units are redeemed/switched-out within 1 year from the date of allotment. No Exit Load is payable if units are redeemed / switched-out after 1 year from the date of allotment. In respect of Systematic Transactions such as SIP, Flex SIP, STP, Flex STP, Swing STP, Exit Load, if any, prevailing on the date of registration /enrolment shall be levied. |

$ Fund Manager Overseas investment – Mr Dhruv Muchhal

HDFC Transportation and Logistics Fund NFO Asset Allocation:

| Instrument | Indicative Allocation ( % of assets) | Risk Profile | |

| Minimum | Maximum | High/Moderate/Low | |

| Equity and Equity related instruments of transportation and logistics themed companies# | 80% | 100% | Very High |

| Equity and Equity related instruments of companies other than above | 0% | 20% | Very High |

| Units of REITs and InvITs | 0% | 10% | Medium to High |

| Debt securities*, money market instruments and Fixed Income Derivatives | 0% | 20% | Low to Medium |

| Units of Mutual Fund @ | 0% | 20% | Low to High |

# Includes following basic industries as per AMFI classification

2/3 Wheelers, Abrasives, Airline, Auto Components and equipment, Batteries-Automobile, Bearings, Castings and Forgings, Commercial Vehicles, Fastener, Logistics Solution Provider, Passenger Cars & Utility Vehicles, Port & Port services, Railway Wagons, Railways, Ship Building & Allied Services, Shipping, Toll bridge operator, Tour, Travel Related Services, Tractors, Trading – Automobiles, Tyres & Rubber Products, E-Commerce companies which are into delivery are eligible to be included

@ The Scheme may invest in the schemes of Mutual Funds i.e. such investments shall not exceed 5% of the net asset value of the mutual fund, in accordance with the applicable extant SEBI (Mutual Funds) Regulations as amended from time to time

* Including securitised debt, other structured obligations (SO), credit enhanced debt (CE), debt instruments with special features such as subordination to equity (absorbs losses before equity capital) and /or convertible to equity upon trigger of a pre-specified event for loss absorption (also referred to as “perpetual debt instruments”)

HDFC Transportation and Logistics Fund NFO Conclusion:

The Indian transportation and logistics sector is poised for growth, driven by a number of factors, including the country’s large and young population, rising per capita income, and low domestic penetration. The government’s focus on sustainability and safety, as well as the emphasis on the auto and auto ancillary industry in the PLI scheme, are also providing tailwinds to the sector. The sector is also expected to benefit from the government’s target to increase vehicle exports and reduce logistics costs. However, mid-cap stocks are highly volatile and susceptible to market risk. Therefore, this product is suitable for investors who are seeking long-term capital appreciation and are seeking Investment predominantly in equity and equity-related securities of companies under transportation and logistics theme. Investors may consult with financial advisers at Elite Wealth if in doubt about whether the product is suitable for them.