| Recommendation | CMP | Target Price | Time Horizon |

| Buy | Rs. 218 | Rs. 275 | 12 Months |

Triveni Engineering & Industries Ltd. (‘Triveni’) is the second largest integrated sugar producer in the country. Its Sugar business consist production of Sugar, alcohol and Co-generation. Apart from Sugar business it also has Power transmission (formerly known as gears business) and water/wastewater treatment business. The Company currently operates 6 co-generation power plants located across five sugar units and two molasses-based distilleries in U.P. India, located at Muzaffarnagar and Sabitgarh. The Company holds 21.85% equity capital of Triveni Turbine Limited.

Stock Details |

|

| Market Cap. (Cr.) | 5281.14 |

| Face Value | 1.00 |

| Equity (Cr.) | 24.18 |

| 52 Wk. high/low | 235.00/62.45 |

| BSE Code | 532356 |

| NSE Code | TRIVENI |

| Book Value (Rs) | 70.43 |

| Industry | Sugar |

| P/E | 14.48 |

Share Holding Pattern % |

|

Promoter |

68.43 |

| FIIs | 4.74 |

| Institutions | 5.12 |

| Non Promoter Corp. | 2.04 |

| Public & Others

Government |

19.68

0.24 |

| Total | 100.00 |

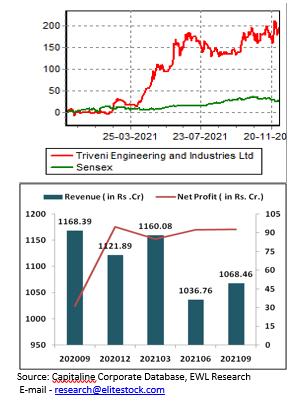

Price Chart

Key Investment Rationale:

-

The company plans to invest Rs 350 crore to double its alcohol manufacturing capacity over the next nine months, as it seeks to gain from the government’s push for ethanol blending in petrol.

-

Company’s new distillery with capacity of 160 KLPD and grain based distillery of 60 KLPD are expected to be commissioned in Q4FY22 with a total estimated capex of Rs 250 Crore. Other expansions of distillery capacity, that will increase the total capacity to 660 KLPD from current capacity of 320 KLPD, will be commissioned in Q3FY23.

-

Distillery segment revenue is increased at a CAGR of 34% from FY17-21 with its contribution in total revenue increased from 5.1% in FY17 to 10.7% in FY21 and further 21% in H1FY22. The company expects that revenue from its distillery segment will increase to about Rs 1,500 Cr. Annually once total capacity of distillery increased to 660 KLPD by Q3FY23

-

Ethanol blending with petrol has touched 8.1 per cent in the 2020-21 marketing year (December-November) and is expected to reach 10 per cent in the next year and 20 per cent blending target by 2025. Govt. hiked the price of ethanol extracted from sugarcane for blending in petrol by up to Rs 1.47 per litre for 2021-22 marketing year ( December- November) starting December which would help the company to expand its margins.

-

The company signed a 10-year business agreement with GEAE Technology USA to locally manufacture the LM2500 gas turbine base and enclosure. Over the next years, the growth in revenue of the company will be aided more by its engineering businesses

Outlook:

Triveni Engineering & Industries Ltd. Is one of the largest integrated Sugar manufacturers in India and also emerged as the market leader in high-speed industrial gears and gearboxes. The sugar industry witnessed significant reduction in sugar inventory in the last one year, which along with the increasing sugarcane diversion towards ethanol is leading to increase in sugar prices. Sugar companies like Triveni has been largely benefiting from relatively better sugarcane availability in 2020-21 sugar season, ramping up of ethanol capacities & higher domestic sugar prices. On performance front we expect company to report EPS of Rs.17.01 for FY23E, at CMP of Rs.218 PE works out to be 12.81x. Hence, investors can buy the stock at CMP of Rs.218 for target price of Rs.275. Time frame should be 9-12months.

Business Overview

Sugar: Triveni Engineering is the among the largest integrated sugar manufacturers in India and their association with Indian farmers is as old as the industry itself. It also Produce power from coproduct Bagasse – a residue of sugarcane crushing. Power generated by the company is used to meet captive needs, and surplus sold to Uttar Pradesh Power Corporation Limited.

Alcohol: Producers of ENA (which is used to produce Potable Alcohol) & Fuel-Grade Ethanol. It Has 2 state-of-the-art distilleries at Muzaffarnagar (MZN) & Sabitgarh (SBT) with 320 KLPD current capacity. The Company aims to double its Production capacity to 660 KLPD by Q3FY23. Currently the company is setting up two new distilleries of (i) 40 KLPD (grain based) at Muzaffarnagar, Uttar Pradesh ; and (ii) 160 KLPD (molasses/cane juice & syrup/grain based) at sugar unit situated at Milak Narayanpur, U.P raising total distillation capacity to 520 KLPD which would get operational by Q4FY22.

Power Transmission – Triveni is the India’s largest manufacturer of industrial high-speed gears and gearboxes. Company’s Defence Business, a strategic business unit, is an OEM for many important defence products and solutions to Indian Navy & Indian Coast Guard. Triveni is the approved supplier of Propulsion Gearboxes, Gas Turbine Generators, Steam Turbines, Turbo auxiliaries and special application turbo & motor-driven pumps for the Indian Navy and Coast Guard.Water & Wastewater Treatment Solutions – Leading solutions provider for efficient water management for industrial/municipal/urban applications. 10,000 Million Litres Per Day (MLD) water treated

Source: Annual Report

Indian Sugar Industry and Outlook for Season 2021-2022:

Sugar production for the season 2020-21 was around 311.81 lakh tones with domestic sales of around 265.55 lakh tonnes and exports of around 70.72 lakh tonnes during the season. Approximately 20 lakh tonnes of sugar were diverted for ethanol production in 2020-21.

In July 2021, Indian Sugar Mills Association (ISMA) had released its preliminary estimates of net sugar production at 310 lakh tonnes for 2021-22 SS (Sugar Season). This was estimated after considering a diversion of 34 lakh tonnes of sugar for production of Ethanol using B heavy molasses / juice / syrup.

The Cabinet Committee on Economic Affairs (CCEA), headed by Prime Minister Narendra Modi, raised the price of ethanol extracted from sugarcane juice to Rs. 63.45 per litre from the current Rs. 62.65 per litre for the supply year beginning December 2021.

Domestic sugar prices rose to around Rs 34,000-36,000 per tonne in August-September 2021 after three years following sharp increase in global prices as well as onset of the festive season. Sugar prices expected to remain firm above Rs. 36,000 per tonne for the rest of FY22.

The international raw sugar prices firmed up to USD 420-440 per tonne in August-September 2021 compared to USD 270-280 per tonne in August-September 2020 in the anticipation of decline in Brazilian sugar production and thus, balanced global supply position.

In light of surged global sugar prices, the export prospects look promising for the upcoming sugar season even if export policy isn’t announced. The government has set a target of 20% ethanol blending by 2025. Along with the ENA and rectified sprit, total distillery demand is likely to be 1350 crore litre by 2025-26. The government is also encouraging usage of flex fuel vehicles (can run on both petrol & ethanol).

On the back of favourable pricing environments domestically and globally as well as increased share of ethanol in revenue mix, the revenues of a sample of sugar companies are expected to grow by 5-7 per cent in FY22 on a year-on-year basis.

(Source: Economic Times. NDTV)

Quarterly Performance:

| Particulars (in Rs. Cr.) | Q2FY22 | Q1FY22 | Q2FY21 | QoQ | YoY | H1FY22 | |

| Revenue from Operations | 1068.46 | 1036.76 | 1168.39 | 3.1% | -9% | 2105.22 | |

| Other Income | 8.64 | 3.63 | 7.91 | 138.0% | 9% | 12.27 | |

| Total Income | 1115.06 | 1046.45 | 1176.3 | 6.6% | -5% | 2161.51 | |

| Raw Material Consumed | 71.68 | 568.2 | 61.78 | -87.4% | 16% | 639.88 | |

| Stock Adjustment | 714.42 | 145.57 | 872.07 | 390.8% | -18% | 859.99 | |

| Purchase of Finished Goods | 3.18 | 5.92 | 3.12 | -46.3% | 2% | 9.1 | |

| Employee Expenses | 65.76 | 67.75 | 60.58 | -2.9% | 9% | 133.51 | |

| Other Expenses | 106.15 | 99.73 | 93.91 | 6.4% | 13% | 205.88 | |

| EBITDA | 107.27 | 149.59 | 76.93 | -28.3% | 39% | 256.86 | |

| Finance Cost | 12.13 | 15.64 | 14.09 | -22.4% | -14% | 27.77 | |

| Depreciation | 20.28 | 19.75 | 19.67 | 2.7% | 3% | 40.03 | |

| PBT | 83.5 | 117.83 | 51.08 | -29.1% | 63% | 201.33 | |

| Profit After Tax | 92.47 | 92.3 | 31.18 | 0.2% | 197% | 184.77 | |

| EBITDA Margin (%) | 10.0% | 14.4% | 6.6% | -439 | 784 | 12.2% | |

| PATM (%) | 8.3% | 8.8% | 2.7% | -53 | 617 | 8.5% | |

Segment Finance

| Particulars (in Rs. Cr.) | Revenue | YoY | As % of Revenue | PBIT Margin | |||

| Segment | H1FY22 | H1FY21 | % | H1FY22 | H1FY21 | H1FY22 | H1FY21 |

| Sugar | 1695.18 | 2067.27 | -18% | 69.5% | 81.0% | 7.3% | 7.3% |

| Others | 56.51 | 31.54 | 79% | 2.3% | 1.2% | 2.2% | -0.2% |

| Distillery | 512 | 278.6 | 84% | 21.0% | 10.9% | 16.2% | 16.1% |

| Water | 91.42 | 119.43 | -23% | 3.8% | 4.7% | 11.0% | 7.7% |

| Power Trans. | 82.63 | 55.83 | 48% | 3.4% | 2.2% | 35.2% | 27.6% |

| Total | 2437.74 | 2552.67 | -5% | 100.0% | 100.0% | – | – |

Cash Flow Statement

| Particulars (in Rs. Cr.) | FY21 | FY20 | FY19 |

| Cash and Cash Equivalents at Beginning of the year | 32.04 | 14.62 | 3.67 |

| Net Cash from Operating Activities | 790.79 | 510.35 | -168.7 |

| Net Cash Used in Investing Activities | -107.86 | -107.24 | -214.74 |

| Net Cash Used in Financing Activities | -703.69 | -385.69 | 394.39 |

| Net Inc/(Dec) in Cash and Cash Equivalent | -20.76 | 17.42 | 10.95 |

| Cash and Cash Equivalents at End of the year | 11.28 | 32.04 | 14.62 |

Balance Sheet

| Particulars (in Rs. Cr.) | H1FY22 | FY21 | FY20 |

| EQUITY & LIABILITIES | |||

| Shareholders Fund | 1702.72 | 1555.67 | 1338.66 |

| Share Capital | 24.18 | 24.18 | 24.79 |

| Reserves & Surplus | 1678.54 | 1531.49 | 1313.87 |

| Total Non Current Liabilities | 513.69 | 515.19 | 600.92 |

| – Long Term Borrowings | 300.74 | 308.91 | 443.6 |

| – Deferred Tax Liabilities(Net) | 143.24 | 134.09 | 78.24 |

| – Other Long Term Liabilities | 16.26 | 20.44 | 31.15 |

| – Long Term Provisions | 53.45 | 51.75 | 47.93 |

| Total Current Liabilities | 666.43 | 1549.09 | 2106.43 |

| – Short Term Borrowings | 272.35 | 561.58 | 943.44 |

| – Trade Payables | 103.11 | 624.3 | 756.42 |

| – Other Current Liabilities | 253.47 | 325.93 | 374.74 |

| – Short Term Provisions | 37.5 | 37.28 | 31.83 |

| TOTAL EQUITY & LIABILITIES | 2882.84 | 3619.95 | 4046.01 |

| ASSETS | |||

| Total Non Current Assets | 1529.01 | 1407.31 | 1395.72 |

| – Fixed Assets(incl. Capital Work in Progress) | 1138.34 | 1094.55 | 1112.69 |

| -Tangible Assets | 1054.44 | 1071.08 | 1085.6 |

| -Intangible Assets | 2.03 | 1.92 | 0.93 |

| -Capital Work in Progress | 82.55 | 22.23 | 26.16 |

| – Goodwill on Consolidation | 0.68 | 0.68 | 0 |

| – Non Current Investments | 186.07 | 145.67 | 141.66 |

| – Deferred Tax Asset(Net) | 0.29 | 0.27 | 0.18 |

| – Long Term Loans & Advances | 160.8 | 133.81 | 90.26 |

| – Other Non Current Assets | 42.83 | 32.33 | 50.93 |

| Total Current Assets | 1353.83 | 2212.64 | 2650.29 |

| – Inventories | 862.5 | 1733.75 | 1912.13 |

| – Trade Receivables | 174.4 | 208.39 | 267.96 |

| – Cash & Cash Equivalents | 102.94 | 12.6 | 32.88 |

| – Short Term Loans & Advances | 0.41 | 18.44 | 3.38 |

| – Other Current Assets | 213.58 | 239.46 | 433.94 |

| TOTAL ASSETS | 2882.84 | 3619.95 | 4046.01 |

| KEY RATIOS | |||

| Debt Equity Ratio | 0.34 | 0.56 | 1.04 |

| Current Ratio | 2.03 | 1.43 | 1.26 |

| Debtors Days | 14.51 | 16.27 | 22.05 |

| Creditors Days | 11.17 | 61.47 | 78.71 |

| RONW % | 21.4 | 18.94 | 25.03 |

| ROCE % | 25.06 | 20.9 | 19.04 |

Financial Extracts:

-

Sugar business of the company in H1FY22 was impacted due to lower domestic sales quota and Exports.

-

EBITDA margin was improved YoY in Q2FY22 to 10% on better sugar realizations (34212/MT – Domestic Realization price in H1 FY 22)

-

Sugar inventory as on Sep 30, 2021 was 23.93 lakh quintals, which is valued at around Rs. 29.2/kg. Inventory at lower prices should help the company to improve realizations.

-

Lower tax and higher Profit from the associates helped the company in 195% YoY increase in Net Profit against the EBITDA growth of 39% YoY.

-

Distillery segment of the company is gaining traction with revenue contribution increased from 10.9% in H1FY21 to 21% in H1FY22.

-

Reported higher profitability in Power Transmission business in Q2FY22 due to the highest ever quarterly revenue of Rs 54.36 Crore in Q2FY22. Closing order booking for the segment stood at Rs 160 Crore in Q2FY22.

-

Turnover in the Water business was lower in H1FY22 as compared to corresponding period of last year, due to slow progress in certain projects and delays in lifting of equipment

-

In Water Segment, Company has participated in large number of tenders which are in various stages of finalization and is expected to close some of these in the coming quarters.

-

Return on Capital Employed improved from 20.9% in FY21 to 25.06% in H1 FY22

-

Debt to Equity Ratio improved from 0.56 in FY21 to 0.34 in H1FY22.

Disclosure in pursuance of Section 19 of SEBI (RA) Regulation 2014

Elite Wealth Limited does/does not do business with companies covered in its research reports. Investors should be aware that the Elite Wealth Limited may/may not have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only information in making their investment decision and must exercise their own judgment before making any investment decision.

For analyst certification and other important disclosures, see the Disclosure Appendix, or go to www.elitewealth.in. Analysts employed by Elite Wealth Limited are registered/qualified as research analysts with SEBI in India.( SEBI Registration No.: INH100002300)

Disclosure Appendix

Analyst Certification (For Reports)

Israil Khan, Elite Wealth Limited, suhail@elitewealth.in

The analyst(s) certify that all of the views expressed in this report accurately reflect my/our personal views about the subject company or companies and its or their securities. I/We also certify that no part of my compensation was, is or will be, directly or indirectly, related to the specific recommendations or views expressed in this report. Unless otherwise stated, the individuals listed on the cover page of this report are analysts in Elite Wealth Limited.

As to each individual report referenced herein, the primary research analyst(s) named within the report individually certify, with respect to each security or issuer that the analyst covered in the report, that:

(1) all of the views expressed in the report accurately reflect his or her personal views about any and all of the subject securities or issuers; and

(2) no part of any of the research analyst’s compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed in the report.

For individual analyst certifications, please refer to the disclosure section at the end of the attached individual notes.

Research Excerpts

This note may include excerpts from previously published research. For access to the full reports, including analyst certification and important disclosures, investment thesis, valuation methodology, and risks to rating and price targets, please visit www.elitewealth.in.

Company-Specific Disclosures

Important disclosures, including price charts, are available and all Elite Wealth Limited covered companies by visiting https://www.elitewealth.in, or emailing research@elitestock.com with your request. Elite Wealth Limited may screen companies based on Strategy, Technical, and Quantitative Research. For important disclosures for these companies, please e-mail research@elitestock.com.

Options related research:

If the information contained herein regards options related research, such information is available only to persons who have received the proper option risk disclosure documents. For a copy of the risk disclosure documents, please contact your Broker’s Representative or visit the OCC’s website at https://www.elitewealth.in

Other Disclosures

All research reports made available to clients are simultaneously available on our client websites. Not all research content is redistributed, e-mailed or made available to third-party aggregators. For all research reports available on a particular stock, please contact your respective broker’s sales person.

Ownership and material conflicts of interest Disclosure

Elite Wealth Limited policy prohibits its analysts, professionals reporting to analysts from owning securities of any company in the analyst’s area of coverage. Analyst compensation: Analysts are salary based permanent employees of Elite Wealth Limited. Analyst as officer or director: Elite Wealth Limited policy prohibits its analysts, persons reporting to analysts from serving as an officer, director, board member or employee of any company in the analyst’s area of coverage.

Country Specific Disclosures

India – For private circulation only, not for sale.

Legal Entities Disclosures

Mr. Ravinder Parkash Seth is the Managing Director of Elite Wealth Ltd (EWL, henceforth), having its registered office at Casa Picasso, Golf Course Extension, Near Rajesh Pilot Chowk, Radha Swami, Sector-61, Gurgaon-122001 Haryana, is a SEBI registered Research Analyst and is regulated by Securities and Exchange Board of India. Telephone:011-43035555, Facsimile: 011-22795783 and Website: www.elitewealth.in

EWL discloses all material information about itself including its business activity, disciplinary history, the terms and conditions on which it offers research report, details of associates and such other information as is necessary to take an investment decision, including the following:

1. Reports

a) EWL or his associate or his relative has no financial interest in the subject company and the nature of such financial interest;

(b) EWL or its associates or relatives, have no actual/beneficial ownership of one per cent. or more in the securities of the subject company, at the end of the month immediately preceding the date of publication of the research report or date of the public appearance;

(c) EWL or its associate or his relative, has no other material conflict of interest at the time of publication of the research report or at the time of public appearance;

2. Compensation

(a) EWL or its associates have not received any compensation from the subject company in the past twelve months;

(b) EWL or its associates have not managed or co-managed public offering of securities for the subject company in the past twelve months;

(c) EWL or its associates have not received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

(d) EWL or its associates have not received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

(e) EWL or its associates have not received any compensation or other benefits from the Subject Company or third party in connection with the research report.

3 In respect of Public Appearances

(a) EWL or its associates have not received any compensation from the subject company in the past twelve months;

(b) The subject company is not now or never a client during twelve months preceding the date of distribution of the research report and the types of services provided by EWL