Franklin India Arbitrage Fund :

- A hybrid scheme that aims to generate returns from arbitrage and other derivative strategies by investing predominantly in cash and derivative segments of the equity market and potential arbitrage opportunities available within the derivative segment. The balance will be invested in fixed income and money market instruments.

- It is suitable for investors seeking short term income generation opportunity.

How does the fund work?

- The fund invests minimum 65% in equity and equity related securities and maximum 35% in Debt & Money Market Instruments, cash & cash equivalent.

- The Scheme will invest in arbitrage opportunities between spot and futures prices of exchange traded equities and the arbitrage opportunities available within the derivative segment.

- If suitable arbitrage opportunities are not available in the opinion of the Fund Manager, the Scheme may invest in short term debt and money market securities.

(source:franklintempletonindia.com)

Franklin India Arbitrage Fund NFO Details:

| Mutual Fund | Franklin Templeton Mutual Fund |

| Scheme Name | Franklin India Arbitrage Fund |

| Objective of Scheme | The investment objective of the scheme is to generate capital appreciation and income by predominantly investing in arbitrage opportunities in the cash and derivative segments of the equity markets and the arbitrage opportunities available within the derivative segment and by investing the balance in debt and money market instruments. There is no assurance or guarantee that the investment objective of the scheme will be achieved. |

| Scheme Type | Open Ended |

| Scheme Category | Hybrid Scheme – Arbitrage Fund |

| New Fund Launch Date | 04-Nov-2024 |

| New Fund Earliest Closure Date | |

| New Fund Offer Closure Date | 18-Nov-2024 |

| Indicate Load Seperately | |

| Minimum Subscription Amount | 5000 |

(source:amfiindia)

Franklin India Arbitrage Fund NFO

Application Form

(source:franklintempletonindia.com)

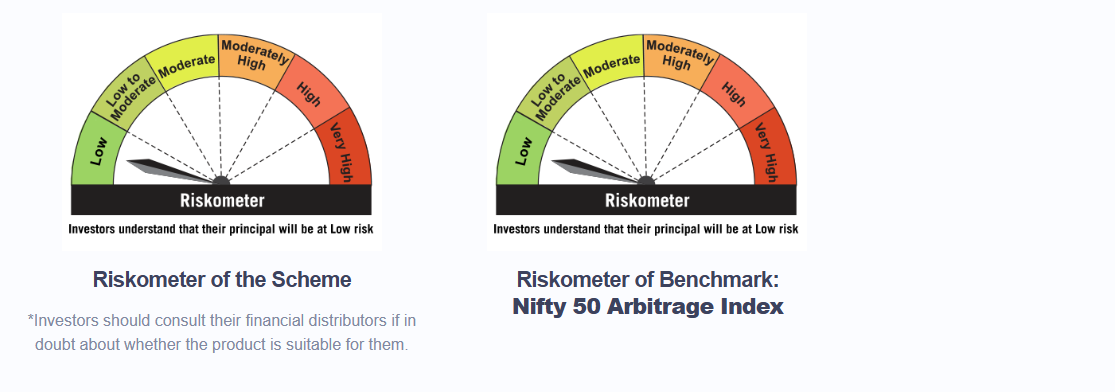

Franklin India Arbitrage Fund NFO Risko Meter:

(source:franklintempletonindia.com)