Elin Electronics IPO Company Profile :

Elin Electronics Limited (EEL) is a leading electronics manufacturing services (EMS) manufacturer of end-to end product solutions for major brands of lighting, fans, and small kitchen appliances in India, and is one of the largest fractional horsepower motors manufacturers in India. (Source: F&S Report) It manufactures and assembles a wide array of products and provide end-to-end product solutions. The product portfolio includes LED lighting, fans and switches; small appliances; fractional horsepower motors; medical diagnostic cartridges; plastic molded and sheet metal parts and components; and other miscellaneous products such as terminal block, stainless steel blade, die casting and radio sets. The company started its operations in 1998 and has expanded to 112 outlets in 8 Indian states and Union Territories, comprising 59 sales showrooms and 53 after-sales services and spares outlets as of June 30, 2022. The company has currently three manufacturing facilities located in Ghaziabad (Uttar Pradesh), Baddi (Himachal Pradesh) and Verna (Goa).

| IPO-Note | Elin Electronics Limited |

| Rs. 234 – Rs. 247 per Equity share | Recommendation: Subscribe |

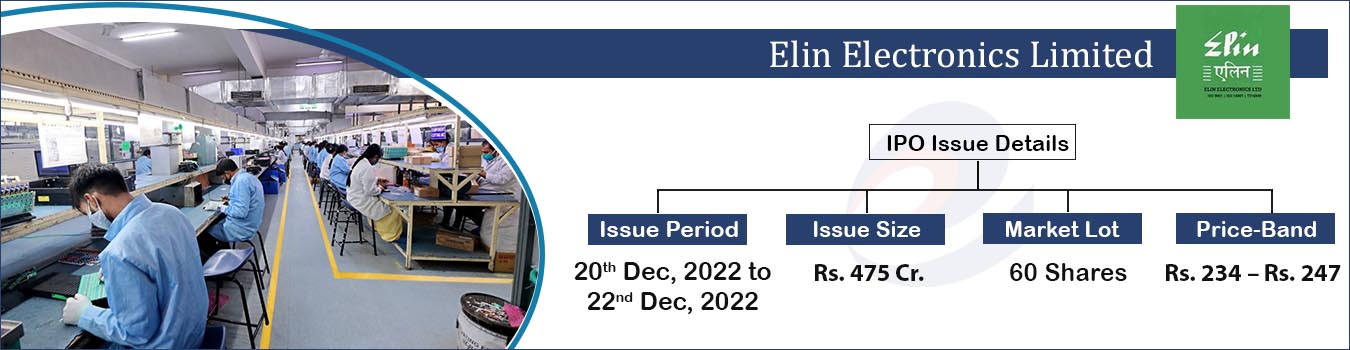

Elin Electronics IPO Details:

| Issue Details | |

| Objects of the issue | · To repay the borrowings

· To fund the capital expenditure · To gain the listing benefits |

| Issue Size | Total issue Size – Rs. 475 Cr.

Fresh Issue – Rs. 175 Cr. Offer for Sale – Rs. 300 Cr. |

| Face value | Rs. 5.00 Per Equity Share |

| Issue Price | Rs. 234 – Rs. 247 |

| Bid Lot | 60 Shares |

| Listing at | BSE, NSE |

| Issue Opens | 20th Dec, 2022 – 22nd Dec, 2022 |

| QIB | 50% of Net Issue Offer |

| Retail | 35% of Net Issue Offer |

| NIB | 15% of Net Issue Offer |

Elin Electronics IPO Financial Performance:

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Elin Electronics IPO Allotment Status

Go Elin Electronics IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Elin Electronics IPO Strengths:

- EEL is the market leader in small electric motor manufacturing and comes under the top 5 manufacturer in small appliances segment.

- The diversified product portfolio and customer base help the company to minimize the risk related to products or customer.

- The company has established long term relationship with well-known domestic and international customers.

Elin Electronics IPO Key Highlights:

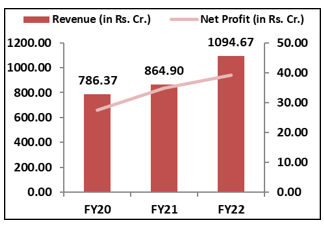

- Revenue of EEL has grown with a CAGR of 11.7% from Rs.786.37 Cr. in FY20 to Rs.1094.67 Cr. in FY22.

- Net Profit of the company has shown the CAGR growth of 12.5% from Rs.27.94 Cr. in FY20 to Rs.39.15 Cr. in FY22.

- ROE and ROCE of the company was 13.85% and 15.82% in FY22; Debt to Equity was 0.32 for the same year.

Elin Electronics IPO Risk Factors:

- Top 5 customers contributed to average 65% in the total revenue from FY 2020 to September 30, 2022. Any loss of such customers can affect the business of the company.

- Company source raw materials from domestic and international markets. Any disruptions in the supply chain may impact the operations of the company.

Elin Electronics IPO Shareholding Pattern:

| Shareholding Pattern | Pre- Issue | Post Issue |

| Promoters & Promoter Group | 53.98% | 21.82% |

| Others | 46.02% | 78.18% |

Source: DRHP, EWL Research

Elin Electronics IPO Outlook:

EEL is a leading electronics manufacturing services manufacturer which serves under original equipment manufacturer (OEM) and original design manufacturer (ODM) business models. Under the OEM model, company manufacture and supply products on the basis of designs developed by its customers, who then further distribute these products under their own brands. Under the ODM model, apart from manufacturing it conceptualize and design the lighting products and small appliances, which are then marketed to its customers’ prospective customers under their brands. The key customers of the company include Signify Innovations, Eveready, Philips, Bosch, Panasonic, Usha, Havells and IFB. The current customer base of the company is 297 as on October 31, 2022 and it is further focusing to enhance it and relationship through cross selling and product development. The company generated 78.2%, 1.53% and 14.95% from EMS, Medical Diagnostic cartridges and molded & sheet metal parts respectively. The total EMS market in India is expected to grow with a CAGR of 30.3% till FY26 due to continuous increase in consumer electronics, appliances and lighting segment consumption. EEL is offering the PE of 31.33 times on the basis of FY22 earnings on the upper price band as compared to the industry average of 101.63. So, we recommend to subscribe to the offering.