Why invest in this fund now?

- The rate cutting cycle has begun

- The next cut is expected in April 2025 MPC meeting

- We expect at least 50bps cut in the repo rate, with the first rate cut in April 2025 and second rate cut by Oct 2025

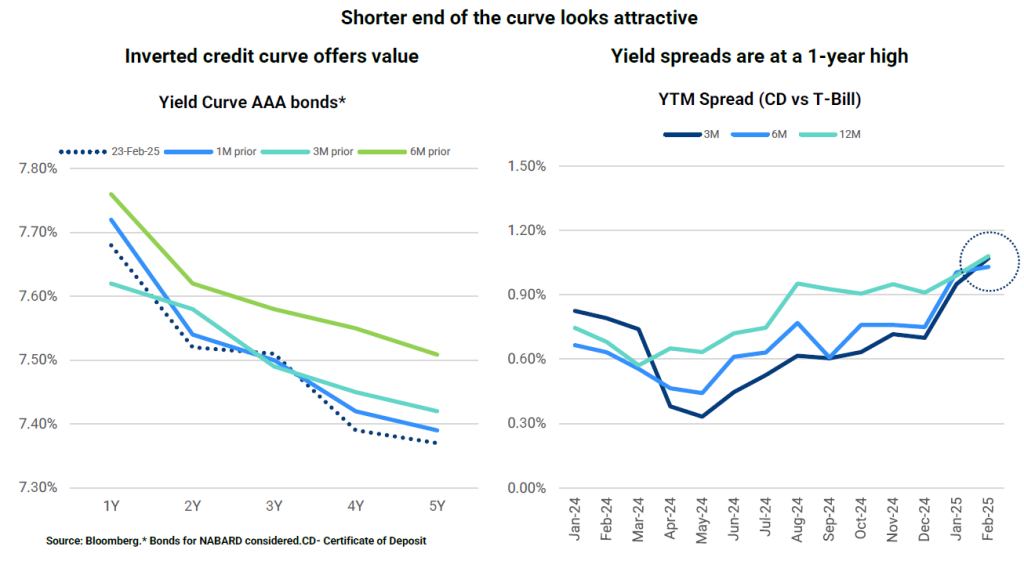

- However, the credit yield curve has remained unchanged

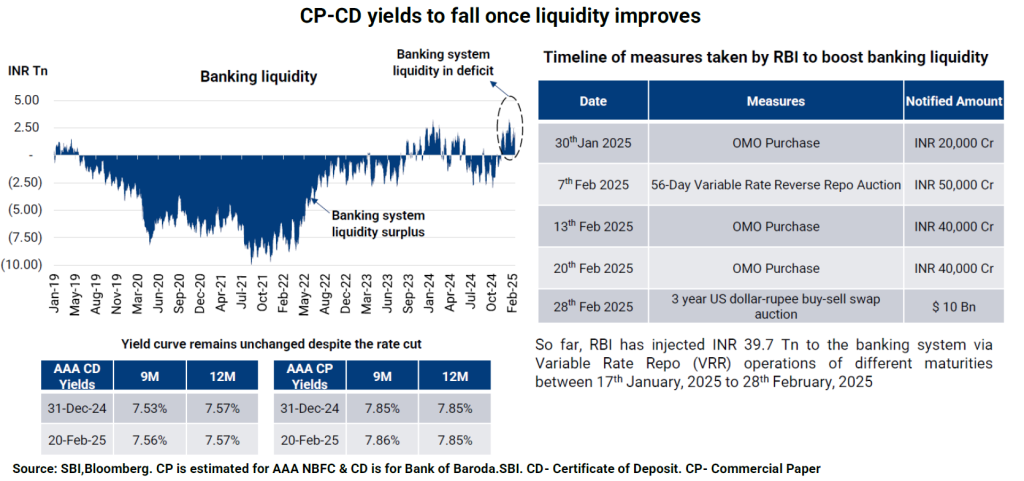

- Tight liquidity condition and year-end borrowing has kept CP-CD yields elevated

- We expect these conditions to change April 2025 onwards

- Government spending to pick up April 2025 onwards

- RBI is also expected to give a large dividend to the GOI in Q1FY26

- RBI is expected to conduct additional OMO bond purchases in FY26

- All these should result in gradual easing of short-term yields, generating additional returns for the fund

- The recent tax slab revisions have enhanced appeal of debt funds for investors earning up to ₹12 lakh p.a in taxable income

(source : https://www.edelweissmf.com)

Edelweiss Low Duration Fund NFO Details:

| Mutual Fund | Edelweiss Mutual Fund |

| Scheme Name | Edelweiss Low Duration Fund |

| Objective of Scheme | The primary objective of the Scheme is to generate income through investment primarily in low duration debt & money market securities. There is no assurance or guarantee that the investment objective of the scheme will be achieved |

| Scheme Type | Open Ended |

| Scheme Category | Debt Scheme – Low Duration Fund |

| New Fund Launch Date | 11-Mar-2025 |

| New Fund Earliest Closure Date | 11-Mar-2025 |

| New Fund Offer Closure Date | 18-Mar-2025 |

| Indicate Load Seperately | Nil |

| Minimum Subscription Amount | 100 |

(source:https://www.amfiindia.com/)

Scheme Documents

(source : https://www.edelweissmf.com)

Edelweiss Low Duration Fund NFO Riskometer: