About the fund

Investment Objective

The investment objective of the scheme is to generate long-term capital appreciation by investing predominantly in equity and equity related securities with a focus on companies engaged in financial services sectors. However, there is no assurance that the investment objective of the scheme will be achieved.

Investment Strategy

- Bottom-up stock selection focused on identifying high-quality financial services businesses

- Alpha driven benchmark agnostic investing approach

- FAIR investment philosophy to evaluate businesses based on Forensics, Acceptable Price, Investment Style Agnostic, and Robustness

- Targeting structural compounders with strong profitability and potential for valuation re-rating

Asset Allocation

| Asset Allocation | Indicative Allocation (% to net assets) | |

|---|---|---|

| Instruments | Minimum | Maximum |

| Equity & Equity related instruments selected on the basis of Financial Services sector@@ | 80% | 100% |

| Other Equity & Equity related instruments | 0% | 20% |

| Debt$ and money market instruments# | 0% | 20% |

| Units issued by InvITs | 0% | 10% |

(source: edelweissmf.com)

Investment philosophy

Our FAIR investment framework helps in identifying robust and clean businesses available at acceptable prices without being biased toward either value or growth investing styles.

ForensicsUse forensic framework to check accounting quality, board governance standards and ownership background

Acceptable PriceEmphasize reasonably priced businesses with earnings power over the medium term, rather than focusing on the short ter

Investment Style AgnosticEmphasize investing in strong businesses capable of delivering long-term returns, while remaining agnostic to value or growth investing styles.

Robustness

Pick well managed businesses having scalable opportunities and superior return on capital employed

Our investment process

Quantitative Screening

Robust businesses

Investment style

Investment styleagnostic

Analyse quality using

Analyse quality usingForensics

Acceptable price

(source: edelweissmf.com)

Fund details

The investment objective of the scheme is to generate long-term capital appreciation by investing predominantly in equity and equity related securities with a focus on companies engaged in financial services sectors.

However, there is no assurance that the investment objective of the scheme will be achieved.

- If the units are redeemed /switched out on or before 90 days from the date of allotment – 1% of the appliable NAV

- If the units are redeemed /switched out after 90 days from the date of allotment – NIL

(source: edelweissmf.com)

Edelweiss Financial Services Fund NFO:

| Mutual Fund | Edelweiss Mutual Fund |

| Scheme Name | Edelweiss Financial Services Fund |

| Objective of Scheme | The investment objective of the scheme is to generate long-term capital appreciation by investing predominantly in equity and equity related securities with a focus on companies engaged in financial services sectors. |

| Scheme Type | Open Ended |

| Scheme Category | Equity Scheme – Sectoral/ Thematic |

| New Fund Launch Date | 27 Jan 2026 |

| New Fund Earliest Closure Date | |

| New Fund Offer Closure Date | 10 Feb 2026 |

| Indicate Load Separately | If the units are redeemed /switched out on or before 90 days from the date of allotment – 1% of the appliable NAV. If the units are redeemed /switched out after 90 days from the date of allotment – NIL |

| Minimum Subscription Amount | Minimum of Rs. 100/- and multiples of Re. 1/- ther |

| For Further Details Please Visit Website | https://www.edelweissmf.com |

(source: https://www.amfiindia.com/)

Scheme Documents

(source: edelweissmf.com)

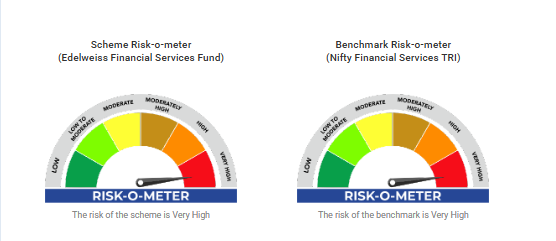

Edelweiss Financial Services Fund NFO Riskometer:

(source: edelweissmf.com)