DOMS Industries Limited IPO Company Profile:

DOMS Industries Limited (DIL) is one of the leading Indian stationery and art materials manufacturing company. The company manufactures a wide range of stationery and art materials, including Pens and pencils, Crayons and markers, Paper products, Craft materials and office supplies. Its products are marketed under our flagship brand ‘DOMS’ along with other brand/sub-brands including ‘C3’, ‘Amariz’, and ‘Fixyfix’. The company operates manufacturing facilities at Bari Brahma, Jammu and Kashmir, and Umbergaon, Gujarat. Its vast multi-channel distribution network reaches over 45 countries across America, Africa, Asia Pacific, Europe, and the Middle East as of September 30, 2023. The company has a varied sales strategy in the domestic market, engaging customers through institutions, modern trade, general trade, and e-commerce in addition to original equipment manufacturers (OEM).

| IPO-Note | DOMS Industries Limited |

| Rs.750 – Rs.790 per Equity share | Recommendation: Apply for Listing Gains |

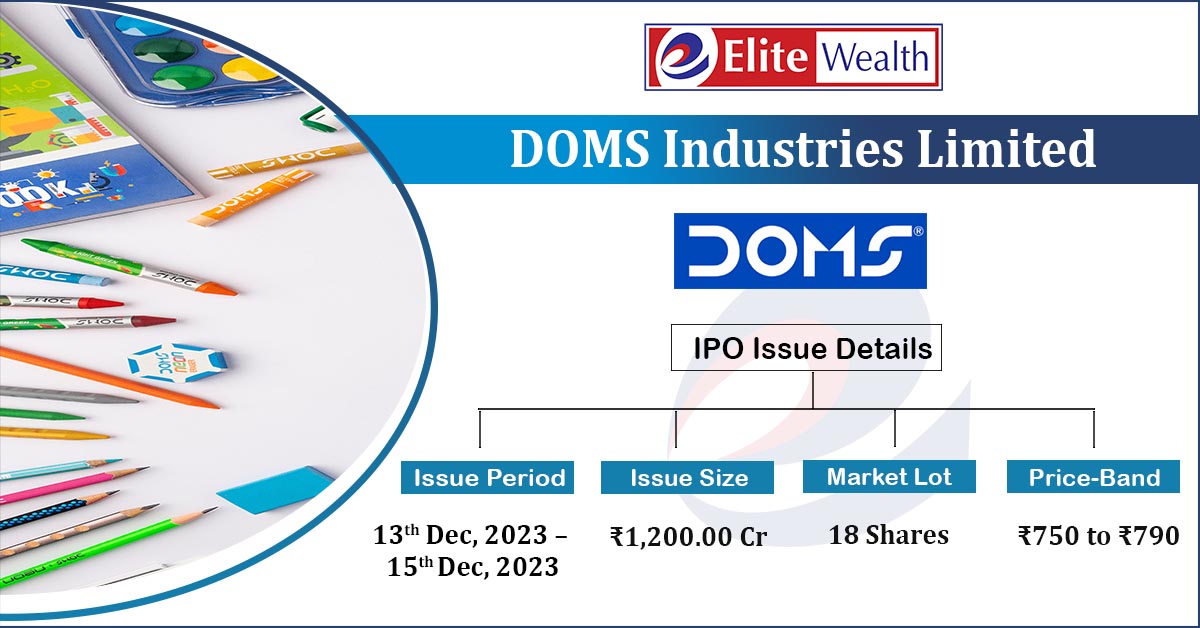

DOMS Industries Limited IPO Details:

| Issue Details | |

| Objects of the issue | · To fund the cost of establishment of new manufacturing facility

· To gain listing benefits |

| Issue Size | Total issue Size – Rs.1200 Cr.

Fresh Issue – Rs.350 Cr. Offer for Sale – Rs.850 Cr. |

| Face value | Rs.10 |

| Issue Price | Rs.750 – Rs.790 |

| Bid Lot | 18 Shares |

| Listing at | BSE, NSE |

| Issue Opens | 13th Dec, 2023 – 15th Dec, 2023 |

| QIB | 75% of Net Issue Offer |

| NIB | 15% of Net Issue Offer |

| Retail | 10% of Net Issue Offer |

DOMS Industries Limited IPO Strengths:

-

DIL is the second largest player in India’s branded ‘stationery and art’ products market, with a market share of ~12% by value, as of FY23. Its core products such as ‘pencils’ and ‘mathematical instrument boxes’ enjoy high market shares; 29% and 30% market share by value in FY23 respectively.

-

It is one of the fastest growing ‘stationery and art material’ products company in India in terms of revenue over the period from FY20 to FY23.

-

Co. has a strong brand name and is supported by an extensive network of domestic distributors and international partners.

DOMS Industries Limited IPO Key Highlights:

-

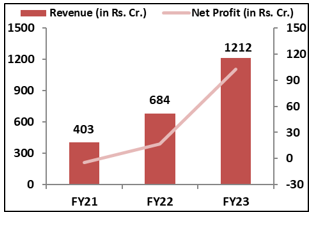

Revenue of the co. has increased from Rs.403 Cr. in FY21 to Rs.1,212 Cr. in FY23 with a strong CAGR of 44.4%; while it’s profits have grown to Rs.103 cr. in FY23 from the loss of Rs.5 cr.

-

Co’s EBITDA Margin & PAT Margin stands at 15.4 & 8.5% respectively in FY23.

-

As of FY23, ROCE & ROE ratios are healthy at 33.31% and 33.54% respectively.

-

As of 30th Sep, 2023, debt to equity of the co. stands at comfortable level of 0.4x.

Trade AnyTime AnyWhere With Elite Empower Mobile App

DOMS Industries Limited IPO Allotment Status

DOMS Industries Limited IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

DOMS Industries Limited IPO Risk Factors:

-

DIL is exposed to the concentration risk as 30% of revenue comes from the wooden pencil.

-

It does not have formal contracts or exclusive supply agreements which poses the risk of potential disruptions in its supply chain.

-

The FILA Group accounts for about 60% of the company’s total export sales, which is why the company depends on them for export sales. Any harm to the FILA Group’s reputation could have a negative impact on its operations, financial situation, and business.

DOMS Industries Limited IPO Financial Performance:

DOMS Industries Limited IPO Shareholding Pattern:

| Particulars | Pre- Issue | Post Issue |

| Promoters Group | 100% | 74.97% |

| Others | 0% | 25.03% |

Source: RHP, EWL Research

DOMS Industries Limited IPO Outlook:

DIL is a prominent player in the ‘stationery and art’ sector in India, manufacturing a wide variety of artistic products that include office and school supplies, art supplies, and more. Its flagship products, like ‘pencils’ and ‘mathematical instrument boxes’, command significant market shares in the country. For six months period ended September 30, 2023, the company generated ~46% of revenue from scholastic stationery, ~26% from scholastic art material, ~10% from paper stationery, ~9% from kits & combos and rest from other items. DIL is focusing on the expansion of manufacturing capacities, strengthening of its distribution network & expansion into modern trade channels along with undertaking inorganic growth through acquisitions or strategic partnerships. The company has been able to build a strong brand recall among consumers owing to its multichannel pan-India distribution network, research and development (R&D), product engineering, and backward integrated manufacturing operations. DIL is offering the P/E of 46.61x on the upper price band which seems overpriced compared to the industry average of 35.99x. Moreover, a significant portion of the issue size constitutes OFS, with the proceeds flowing back to the promoters. Therefore, we advise investors to consider applying for potential listing gains in the offering.

DOMS Industries Limited IPO FAQ

Ans. DOMS IPO is a main-board IPO of 15,189,873 equity shares of the face value of ₹10 aggregating up to ₹1,200.00 Crores. The issue is priced at ₹750 to ₹790 per share. The minimum order quantity is 18 Shares.

The IPO opens on December 13, 2023, and closes on December 15, 2023.

Link Intime India Private Ltd is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The DOMS IPO opens on December 13, 2023 and closes on December 15, 2023.

Ans. DOMS IPO lot size is 18 Shares, and the minimum amount required is ₹14,220.

Ans. The DOMS IPO listing date is not yet announced. The tentative date of DOMS IPO listing is Wednesday, December 20, 2023.

Ans. The minimum lot size for this upcoming IPO is 18 shares.