Denta Water and Infra Solutions Limited IPO Company Profile:

Established in 2016, (commonly known as “Denta Water”) has emerged as a leading player in the field of water engineering, procurement, and construction (EPC) services. With a distinguished track record in infrastructure project installations, particularly in groundwater recharging through recycled water, Denta Water has played a vital role in addressing the growing demand for sustainable water solutions.

| IPO-Note | Denta Water and Infra Solutions Limited |

| Rs.279– Rs.294 per Equity share | Recommendation: Apply |

Denta Water and Infra Solutions Limited IPO Details:

| Issue Details | |

| Objects of the issue |

· Working capital requirements · General Cooperate Purposes |

| Issue Size | Total issue Size – Rs.220.5 Cr

Offer for sale- Rs 220.5 Cr |

| Face value |

Rs.10 |

| Issue Price | Rs.279 – Rs.294 per share |

| Bid Lot | 50 shares |

| Listing at |

BSE, NSE |

| Issue Opens | January 22, 2025– January 24, 2025 |

| QIB | Not more than 50% of Net Issue Offer |

| HNI | Not less than 15% of Net Issue Offer |

| Retail | Not less than 35% of Net Issue Offer |

Denta Water and Infra Solutions Limited IPO Strengths:

- Denta Water specializes in the design, installation, and commissioning of water management infrastructure, with expertise in groundwater recharging using recycled water. The company also undertakes construction projects in the railway and highway sectors.

- Advances in water treatment technologies and digitalization present opportunities for the company to implement innovative solutions and stay ahead in the competitive market. The India Water and Wastewater Treatment market is expected to grow at a 6.20% CAGR, reaching USD 23.85 billion by 2033. South India, with a 6.24% CAGR, offers a key growth opportunity for the company

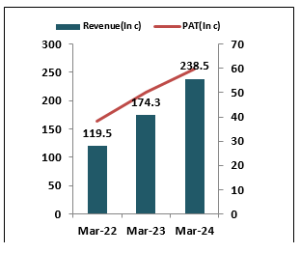

- The company reported a revenue of Rs 238.5 crores in FY24, a 36.8% increase from FY23, and a profit after tax (PAT) of Rs 59.72 crores, marking a 19.15% growth compared to FY23.

- As of November 30, 2024 Company had contact value of order book of Rs 1100.4 crores, out of which Rs 752.4 crores is yet to be realized.

ess. Its proven track record highlights the ability to execute projects efficiently, with no time or cost overruns.

- In FY24, the company reported a 36.36% ROE, indicating strong profit generation from equity, and a 76.99% ROCE, reflecting efficient capital utilization.

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Denta Water and Infra Solutions Limited IPO Allotment Status

Denta Water and Infra Solutions Limited IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Denta Water and Infra Solutions Limited IPO Risk Factors:

- The industry in which the company operates is highly competitive, with key competitor like VA Tech Wabag and EMS Limited.

- The company primarily relies on government contracts, with 63.4% of its revenue in 2024 coming from the Government of Karnataka.

Denta Water and Infra Solutions Limited IPO Financial Performance:

Denta Water and Infra Solutions Limited IPO Shareholding Pattern:

| Particulars | Pre- Issue | Post issue |

| Promoters Group | 100% | 71.91% |

| Others | – | 28.09% |

Denta Water and Infra Solutions Limited IPO Outlook:

Denta Water and Infra Solutions Limited has established itself as a prominent player in the water engineering and EPC industry. The company has demonstrated strong financial performance in the past and maintains a robust order book. On the valuation front, the company’s post-IPO P/E ratio is projected to be 16.2, based on the expected annualized FY25 EPS of 18.13, which appears reasonably priced. We recommend investors to consider applying for the issue for both listing gains and long-term profit potential.

Denta Water and Infra Solutions Limited IPO FAQ:

Denta Water IPO is a main-board IPO of 7500000 equity shares of the face value of ₹10 aggregating up to ₹220.50 Crores. The issue is priced at ₹279 to ₹294 per share. The minimum order quantity is 50.

The IPO opens on January 22, 2025, and closes on January 24, 2025.

Integrated Registry Management Services Private Limited is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Denta Water IPO opens on January 22, 2025 and closes on January 24, 2025.

Ans. Denta Water IPO lot size is 50, and the minimum amount required is ₹14,700.

Ans. The Denta Water IPO listing date is not yet announced. The tentative date of Denta Water IPO listing is Wednesday, January 29, 2025.

Ans. The minimum lot size for this upcoming IPO is 50 shares.