Concord Enviro Systems Limited Company Profile:

Incorporated in 1992, Concord Enviro System is a global provider of water and wastewater treatment and reuse solutions, specializing in zero liquid discharge (“ZLD”) technology. The company has in-house capabilities to develop solutions across the entire value chain, including design, manufacturing, installation, and commissioning. Additionally, the company offers operations and maintenance (“O&M”) services, as well as digitalization solutions such as Internet of Things (“IoT”) integration. The company’s revenue is generated through three main sources: (i) the sale of systems and plants, (ii) the operation and maintenance of installed plants, and (iii) the supply of consumables and spare parts for installed plants.

| IPO-Note | Concord Enviro Systems Limited |

| Rs.665– Rs.701 per Equity share | Recommendation: Avoid |

Concord Enviro Systems Limited IPO Details :

| Issue Details | |

| Objects of the issue |

· Funding Capital Expenditure Requirement · Investment in Technology · General Corporate Purposes |

| Issue Size | Total issue Size – Rs.500.33 Cr

Fresh issue Size – Rs. 175 Cr Offer for sale- Rs.325.33 Cr |

| Face value |

Rs.5 |

| Issue Price | Rs.665 – Rs.701 per share |

| Bid Lot | 21 Shares |

| Listing at |

BSE, NSE |

| Issue Opens | December 19, 2024- December 23, 2024 |

| QIB | Not more than 50% of Net Issue Offer |

| HNI | Not less than 15% of Net Issue Offer |

| Retail | Not less than 35% of Net Issue Offer |

Concord Enviro Systems Limited IPO Strengths:

- The company’s integrated approach, with in-house manufacturing and O&M services, positions it to capitalize on the rapidly growing global water reuse and ZLD markets, which are expected to expand at a CAGR of 10.1% from US$ 30B in 2023 to US$ 48.6B in 2028.

- As of August 31, 2024, the company’s Order Book stood at ₹ 501.746 crore, with 74.50% from system and plant orders and 25.50% from after-sales revenue, including consumables, spares, and O&M services orders.

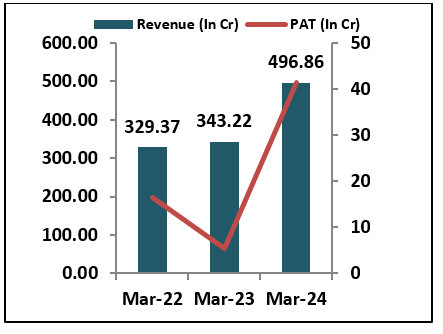

- The company reported a revenue of Rs 496.86 crores in FY24, marking an 44.76% increase compared to FY23. During the same period, the company posted a profit after tax (PAT) of Rs 41.44 crores, reflecting a 654.82% growth over FY23.

- As of August 31, 2024, the company serves over 289 domestic and 21 international customers across various industries, including pharmaceuticals, chemicals, food and beverage, defense, energy, automotive, steel, and textiles.

- As industries globally adopt stricter environmental standards, the demand for wastewater treatment and ZLD solutions is on the rise, presenting significant growth opportunities for the company.

Concord Enviro Systems Limited IPO Risk Factors:

- The company faces intense competition from established players like Thermax, Praj Industries, and Ion Exchange, poses a significant risk to the company’s market share, pricing power, and ability to attract and retain customers in the highly competitive sector.

Concord Enviro Systems Limited IPO Financial Performance :

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Concord Enviro Systems Limited IPO Allotment Status

Concord Enviro Systems Limited IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Concord Enviro Systems Limited IPO Shareholding Pattern:

| Particulars | Pre Issue | Post issue |

| Promoters Group | 60.93% | 51.39% |

| Others | 39.07% | 48.61% |

Concord Enviro Systems Limited IPO Outlook:

Concord Enviro System is a global provider of water and wastewater treatment and reuse solutions, specializing in zero liquid discharge (“ZLD”) technology, and is strategically positioned for significant growth. The industry in which the company operates is expected to perform strongly in the future, driven by increasingly stringent environmental regulations. However, the company faces competitive pressures from well-established players, and its order book is not yet robust. Furthermore, despite the emerging opportunities in the sector, the company’s net profit remains relatively low. Based on our analysis, we recommend that only aggressive investors consider applying for the issue and other investor should avoid the issue.

Concord Enviro Systems Limited IPO FAQ:

Ans. Concord Enviro IPO is a main-board IPO of 7137321 equity shares of the face value of ₹5 aggregating up to ₹500.33 Crores. The issue is priced at ₹ 665 to ₹ 701 per share. The minimum order quantity is 21.

The IPO opens on December 19, 2024, and closes on December 23, 2024.

Link Intime India Private Ltd is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Concord Enviro IPO opens on December 19, 2024 and closes on December 23, 2024.

Ans. Concord Enviro IPO lot size is 21, and the minimum amount required is ₹ 14,721

Ans. The Concord Enviro IPO listing date is not yet announced. The tentative date of Concord Enviro IPO listing is Friday, December 27, 2024.

Ans. The minimum lot size for this upcoming IPO is 21 shares.