NIFTY:

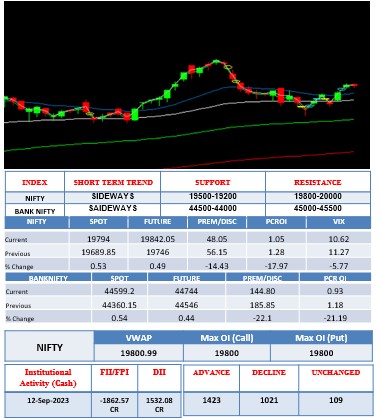

The NIFTY opened at 19822.70 with a gap up of just 11 points. Prices have recorded its intraday high at 19843.30 just above the opening tick and started drifting downwards. The down move was sharp but not in terms of point. The index recorded its intraday low at 19772.65 and then bounced up. The rally found resistance in the afternoon and prices again moved down. The NIFTY kept sliding lower until the end but could not break early morning lows. The index finally closed at 19794 near yesterday’s closing price with a loss of just 17.35 points or 0.09% down. MEDIA outperformed, saw a sharp upside move, and closed with a gain of 3.02% followed by OIL GAS, AUTO, and METAL. IT underperformed and ended with a loss of 1.67%. Support is now visible around 19500 while the resistance may emerge around 20000 levels.

BANK NIFTY:

The BANK NIFTY opened at 44571.55 with a gap up of 52 points. The index initially moved higher but found resistance quickly and started drifting downwards after recording its intraday high at 44693.05. Prices did not move much on the downside and soon started a consolidation process. The index recorded its intraday low at 44530.05 in its initial trades and remained inside its morning range for the whole day to finally end at 44570.85 with a gain of just 51 points. PSU BANK has underperformed, saw a mild downside move, and ended with a loss of just 0.09%. PVT BANK has outperformed, saw a mild up move, and closed with a gain of 0.24%. Within the index, in terms of points, HDFC BANK contributed the highest on the upside while SBIN contributed the lowest. The short-term trend is sideways. A trading range is now visible on the daily timeframe chart with support around 43800 and resistance around 44800.

TECHNICAL PICKS

| COMPANY NAME | CMP | B/S | RATIONALE |

| METROPOLISH HEALTHCARE | 1506.70 | BUY | The stock is about to give a breakout on the intraday and the daily chart. The stock can be bought above 1513.25 with a stop loss of 1494.40 and a target of 1550.25. |

| TATA COMM | 1815.80 | SELL | The stock has given a breakdown on the intraday as well as the daily chart. The stock can be sold below 1810.45 with a stop loss of 1827.20 and a target of 1774.65. |

DERIVATIVE PICKS

| Stock Name | Strike Price | Buy/Sell | CMP | Initiation | Stop Loss | Target | Remarks |

| M&M | 1570 CE | BUY | 26.30 | CMP | 23.95 | 31.00 | BREAKOUT |

| Long Buildup | Short Buildup | |||||||||

| Stocks | Price | Price% | OI % | OI | Stocks | Price | Price% | OI % | OI | |

| GAIL.23.10 Oct | 129.5 | 4.31 | 3.92 | 152219400 | TECHM.23.10 Oct | 1201.25 | -2.54 | 5.23 | 12568800 | |

| NATIONALUM.23.10 Oct | 100.2 | 4.21 | 10.24 | 64275000 | APOLLOHOSP.23.10 Oct | 5003.85 | -2.16 | 6.8 | 2548500 | |

| BOSCHLTD.23.10 Oct | 20503.3 | 4 | 12.32 | 121750 | TCS.23.10 Oct | 3540.25 | -2.08 | 15.55 | 10768100 | |

| PVRINOX.23.10 Oct | 1770.2 | 3.93 | 2.2 | 5606018 | HCLTECH.23.10 Oct | 1213.65 | -1.76 | 6.59 | 12018300 | |

| IGL.23.10 Oct | 480.3 | 3.92 | 2.22 | 11147125 | INFY.23.10 Oct | 1461.6 | -1.51 | 14.96 | 19693600 | |

| Short Covering | Long Unwinding | |||||||||

| Stocks | Price | Price% | OI % | OI | Stocks | Price | Price% | OI % | OI | |

| NMDC.23.10 Oct | 159.25 | 5.64 | -5.79 | 107284500 | MCX.23.10 Oct | 2098.1 | -2.2 | -7.73 | 1995200 | |

| METROPOLIS.23.10 Oct | 1509.05 | 3.41 | -6.98 | 1524800 | IBULHSGFIN.23.10 Oct | 175.8 | -1.62 | -0.56 | 54932100 | |

| JUBLFOOD.23.10 Oct | 543 | 2.51 | -5.02 | 20868750 | GODREJPROP.23.10 Oct | 1707.8 | -1.55 | -4.15 | 3747750 | |

| JKCEMENT.23.10 Oct | 3270.45 | 2.21 | -0.13 | 786000 | OFSS.23.10 Oct | 4103.7 | -1.53 | -2.29 | 333400 | |

| HINDCOPPER.23.10 Oct | 157.8 | 2.04 | -3.88 | 34662000 | TRENT.23.10 Oct | 2086.9 | -1.13 | -0.53 | 3346800 | |

Top Delivery Percentage

| Stocks | Price | %Chg | Total Qty | Delivery | Del % | % Change | ||||

| Sectors | Price | Change % | Quantity | |||||||

| Bharti Airtel Limited | 950.35 | -0.55 | 5544735 | 4696201 | 83.19 | Nifty50 | 19794 | -0.09 | 33698847 | |

| Max Financial Services l | 920.3 | 1.17 | 1093149 | 969175 | 78 | Niftybank | 44599.2 | 0.18 | 14965390 | |

| Pidilite Industries Ltd | 2481.9 | -0.23 | 124308 | 342252 | 76.2 | Nifty it | 32003.6 | -1.67 | 1529972 | |

| Bajaj Auto Limited | 5106.6 | 0.83 | 472168 | 434699 | 75.51 | India Vix | 10.62 | -3.28 | 616276175 | |

| Larsen & Toubro Limited | 3081.75 | -0.23 | 1870280 | 1535119 | 74.27 | Nifty Fmcg | 52363.95 | 0.21 | 379207 | |

| Alkem | 3594.95 | 1.56 | 154901 | 109426 | 74.02 | Nifty Pharma | 15186.2 | 0.06 | 43865174 | |

| Icici Lombard General In | 1324.9 | 0.86 | 477626 | 223121 | 72.82 | Nifty Realty | 610.2 | -0.18 | 1091044725 | |

| Britannia Ind Ltd. | 4560.75 | 0.13 | 518582 | 267757 | 72.72 | Nifty Auto | 16301.7 | 0.78 | 40985524 | |

| Sun Pharma Ltd | 1130.4 | 0.15 | 1221965 | 1058358 | 72.69 | Nifty Metal | 6863.05 | 0.75 | 97241374 | |

| Asian Paints Limited | 3159.1 | -0.15 | 992531 | 742862 | 72.45 | Nifty Financial Services | 19945.7 | 0.08 | 3355920 | |

Upcoming Economic Data

| Domestic International | |

| INR: WPI Inflation (YoY) (Sep) on 13th October, 2023

INR: FX Reserves, USD on 13th October, 2023 |

USD: Retail Sales (MoM) (Sep) on 17th October, 2023

USD: Building Permits (Sep) on 18th October, 2023 |

News Updates

-

Indian benchmark indices ended lower with Nifty below 19,800 in the volatile session on October 12. At close, the Sensex was down 64.66 points or 0.10 percent at 66,408.39, and the Nifty was down 17.30 points or 0.09 percent at 19,794. About 2086 shares advanced, 1459 shares declined, and 125 shares unchanged.

-

According to Nuvama Institutional Equities, Polycab’s entry will bring inflows worth $194 million into the stock. Paytm’s parent One97 Communications could see $167 million of funds flow, while it may be $170 million for Macrotech Developers , $172 million for Tata Communications and $174 million for Tata Motors DVR.

-

India’s central bank is expected to accelerate a key process of vetting IDBI Bank’s potential buyers and complete it by October end, helping speed up the sale of a majority stake in the lender, two government sources said. The federal government, which owns 45.48% of IDBI Bank, and the state-owned Life Insurance Corp of India, which holds 49.24%, together plan to sell 60.7% of the lender.

-

Ray Dalio, a prominent billionaire investor, has voiced his concerns over the high valuation of US stocks and the potential political and economic risks that the United States could face. He has warned against growing debt levels, political disagreements, and geopolitical uncertainties.

Source: Economic Times, Indian Express, Business Today, Livemint, Business Standard, Bloomberg Quint

Board Meetings

| Company Name | Purpose | Meeting Date | Company Name | Purpose | Meeting Date |

| ABHIJIT | General | 13-Oct-23 | STCORP | Quarterly Results | 13-Oct-23 |

| AMAL | Quarterly Results | 13-Oct-23 | TATASTLLP | Quarterly Results | 13-Oct-23 |

| ARTSONEN | Quarterly Results | 13-Oct-23 | UNIAUTO | General | 13-Oct-23 |

| AUTOIND | Preferential Issue of shares;Increase in Authorised Capital;General | 13-Oct-23 | VIVANTA | Quarterly Results;General | 13-Oct-23 |

| BIRLAMONEY | Quarterly Results | 13-Oct-23 | ADVLIFE | General | 14-Oct-23 |

| DEN | Quarterly Results | 13-Oct-23 | AKM | Preferential Issue of shares;General | 14-Oct-23 |

| GGL | Rights Issue;General | 13-Oct-23 | CEENIK | Quarterly Results;General | 14-Oct-23 |

| GGPL | Quarterly Results | 13-Oct-23 | DALBHARAT | Interim Dividend;Quarterly Results | 14-Oct-23 |

| GTNINDS | General | 13-Oct-23 | DARSHANORNA | Quarterly Results | 14-Oct-23 |

| GUJHOTE | Quarterly Results | 13-Oct-23 | DMART | Quarterly Results | 14-Oct-23 |

| HATHWAYB | Quarterly Results | 13-Oct-23 | GTPL | Quarterly Results | 14-Oct-23 |

| HDFCLIFE | Quarterly Results | 13-Oct-23 | POOJAENT | General | 14-Oct-23 |

| KALAMANDIR | Quarterly Results | 13-Oct-23 | SHREEPUSHK | General | 14-Oct-23 |

| MACINTR | General | 13-Oct-23 | TCC | General | 14-Oct-23 |

| MAGNUM | Right Issue of Equity Shares | 13-Oct-23 | TEXINFRA | Quarterly Results;General | 14-Oct-23 |

| MERCTRD | Increase in Authorised Capital;General | 13-Oct-23 | TEXRAIL | Quarterly Results;General | 14-Oct-23 |

| PREMCAP | Quarterly Results | 13-Oct-23 | TOKYOPLAST | General | 14-Oct-23 |

| RESGEN | General | 13-Oct-23 | ULTRACAB | Quarterly Results | 14-Oct-23 |

| SDBL | Quarterly Results;General | 13-Oct-23 | VASUDHAGAM | General | 14-Oct-23 |

| SERA | Issue Of Warrants;General | 13-Oct-23 | VIVIDM | Quarterly Results | 14-Oct-23 |

| SHEETAL | General;A.G.M. | 13-Oct-23 | VUENOW | Preferential Issue of shares;Scheme of Arrangement | 14-Oct-23 |

| SHRADHAIND | General | 13-Oct-23 | HDFCBANK | Quarterly Results | 15-Oct-23 |

Corporate Action

| Company Name | Ex-Date | Purpose | Company Name | Ex-Date | Purpose |

| ADVLIFE | 13-Oct-23 | Bonus issue 1:1 | TCIEXP | 26-Oct-23 | Interim Dividend |

| INFRATRUST | 13-Oct-23 | Income Distribution (InvIT) | ASTRAL | 27-Oct-23 | Interim Dividend |

| MRP | 13-Oct-23 | Bonus issue 2:1 | BCLIL | 27-Oct-23 | Stock Split From Rs.10/- to Rs.1/- |

| RMC | 13-Oct-23 | Bonus issue 1:2 | ICICIGI | 27-Oct-23 | Interim Dividend |

| CASPIAN | 17-Oct-23 | Final Dividend – Rs. – 0.0500 | ISEC | 27-Oct-23 | Interim Dividend |

| GENSOL | 17-Oct-23 | Bonus issue 2:1 | LTIM | 27-Oct-23 | Interim Dividend |

| GLS | 17-Oct-23 | Interim Dividend – Rs. – 22.5000 | SVRL | 27-Oct-23 | Bonus issue 1:1 |

| KAMAHOLD | 17-Oct-23 | Bonus issue 4:1 | TALBROAUTO | 27-Oct-23 | Stock Split From Rs.10/- to Rs.2/- |

| RUDRA | 18-Oct-23 | Stock Split From Rs.10/- to Rs.5/- | UNJHAFOR | 30-Oct-23 | E.G.M. |

| RUDRA | 18-Oct-23 | Bonus issue 1:1 | ELECON | 31-Oct-23 | Interim Dividend |

| BCONCEPTS | 19-Oct-23 | Final Dividend – Rs. – 0.5000 | NESTLEIND | 01-Nov-23 | Interim Dividend |

| RITCO | 19-Oct-23 | E.G.M. | HINDUNILVR | 02-Nov-23 | Interim Dividend |

| SEMAC | 19-Oct-23 | Final Dividend – Rs. – 5.0000 | ASIANPAINT | 03-Nov-23 | Interim Dividend |

| TCS | 19-Oct-23 | Interim Dividend – Rs. – 9.0000 | EMBASSY | 03-Nov-23 | Income Distribution RITES |

| ANANDRATHI | 20-Oct-23 | Interim Dividend | HPAL | 09-Nov-23 | Stock Split From Rs.10/- to Rs.2/- |

| ANGELONE | 20-Oct-23 | Interim Dividend | INSECTICID | 10-Nov-23 | Interim Dividend |

| HCLTECH | 20-Oct-23 | Interim Dividend | PGHL | 13-Nov-23 | Final Dividend – Rs. – 50.0000 |

| KPIGREEN | 20-Oct-23 | Interim Dividend – Rs. – 0.2500 | CAMS | 17-Nov-23 | Interim Dividend |

| NEOGEN | 20-Oct-23 | E.G.M. | PGHH | 17-Nov-23 | Final Dividend – Rs. – 105.0000 |

| VINNY | 23-Oct-23 | E.G.M. | GILLETTE | 21-Nov-23 | Final Dividend – Rs. – 50.0000 |

Disclosure in pursuance of Section 19 of SEBI (RA) Regulation 2014

Elite Wealth Limited does/does not do business with companies covered in its research reports. Investors should be aware that the Elite Wealth Limited may/may not have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only information in making their investment decision and must exercise their own judgment before making any investment decision.

For analyst certification and other important disclosures, see the Disclosure Appendix, or go to www.elitewealth.in. Analysts employed by Elite Wealth Limited are registered/qualified as research analysts with SEBI in India.( SEBI Registration No.: INH100002300)

Disclosure Appendix

Analyst Certification (For Reports)

Kiran Tahlani, Elite Wealth Limited, kirantahlani@elitestock.com

The analyst(s) certify that all of the views expressed in this report accurately reflect my/our personal views about the subject company or companies and its or their securities. I/We also certify that no part of my compensation was, is or will be, directly or indirectly, related to the specific recommendations or views expressed in this report. Unless otherwise stated, the individuals listed on the cover page of this report are analysts in Elite Wealth Limited.

As to each individual report referenced herein, the primary research analyst(s) named within the report individually certify, with respect to each security or issuer that the analyst covered in the report, that:

(1) all of the views expressed in the report accurately reflect his or her personal views about any and all of the subject securities or issuers; and

(2) no part of any of the research analyst’s compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed in the report.

For individual analyst certifications, please refer to the disclosure section at the end of the attached individual notes.

Research Excerpts

This note may include excerpts from previously published research. For access to the full reports, including analyst certification and important disclosures, investment thesis, valuation methodology, and risks to rating and price targets, please visit www.elitewealth.in.

Company-Specific Disclosures

Important disclosures, including price charts, are available and all Elite Wealth Limited covered companies by visiting https://www.elitewealth.in, or e-mailing research@elitestock.com with your request. Elite Wealth Limited may screen companies based on Strategy, Technical, and Quantitative Research. For important disclosures for these companies, please e-mail research@elitestock.com.

Options related research:

If the information contained herein regards options related research, such information is available only to persons who have received the proper option risk disclosure documents. For a copy of the risk disclosure documents, please contact your Broker’s Representative or visit the OCC’s website at https://www.elitewealth.in

Other Disclosures

All research reports made available to clients are simultaneously available on our client websites. Not all research content is redistributed, e-mailed or made available to third-party aggregators. For all research reports available on a particular stock, please contact your respective broker’s sales person.

Ownership and material conflicts of interest Disclosure

Elite Wealth Limited policy prohibits its analysts, professionals reporting to analysts from owning securities of any company in the analyst’s area of coverage. Analyst compensation: Analysts are salary based permanent employees of Elite Wealth Limited. Analyst as officer or director: Elite Wealth Limited policy prohibits its analysts, persons reporting to analysts from serving as an officer, director, board member or employee of any company in the analyst’s area of coverage.

Country Specific Disclosures

India – For private circulation only, not for sale.

Legal Entities Disclosures

Mr. Ravinder Parkash Seth is the Managing Director of Elite Wealth Ltd (EWL, henceforth), having its registered office at Casa Picasso, Golf Course Extension, Near Rajesh Pilot Chowk, Radha Swami, Sector-61, Gurgaon-122001 Haryana, is a SEBI registered Research Analyst and is regulated by Securities and Exchange Board of India. Telephone: 011-43035555, Facsimile: 011-22795783 and Website: www.elitewealth.in

EWL discloses all material information about itself including its business activity, disciplinary history, the terms and conditions on which it offers research report, details of associates and such other information as is necessary to take an investment decision, including the following:

- Reports

- a) EWL or his associate or his relative has no financial interest in the subject company and the nature of such financial interest;

(b) EWL or its associates or relatives, have no actual/beneficial ownership of one per cent. or more in the securities of the subject company, at the end of the month immediately preceding the date of publication of the research report or date of the public appearance;

(c) EWL or its associate or his relative, has no other material conflict of interest at the time of publication of the research report or at the time of public appearance;

- Compensation

(a) EWL or its associates have not received any compensation from the subject company in the past twelve months;

(b) EWL or its associates have not managed or co-managed public offering of securities for the subject company in the past twelve months;

(c) EWL or its associates have not received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

(d) EWL or its associates have not received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

(e) EWL or its associates have not received any compensation or other benefits from the subject company or third party in connection with the research report.

3 In respect of Public Appearances

(a) EWL or its associates have not received any compensation from the subject company in the past twelve months;

(b) The subject company is not now or never a client during twelve months preceding the date of distribution of the research report and the types of services provided by EWL

Provided that research analyst or research entity shall not be required to make a disclosure as per sub-clauses (c), (d) and (e) of clause (ii) or sub-clauses (a) and (b) of clause (iii) to the extent such disclosure would reveal material non-public information regarding specific potential future investment banking or merchant banking or brokerage services transactions of the subject company.

(4) EWL or its proprietor has never served as an officer, director or employee of the subject company;

(5) EWL has never been engaged in market making activity for the subject company;

(6) EWL shall provide all other disclosures in research report and public a