Union Consumption Fund NFO Key Features : STOCK SELECTION Combination of growth and bargain stocks CONCENTRATION Portfolio of stocks will be well diversified ASSET ALLOCATION Predominant allocation to equities CAPITALIZATION Judicious combination of large, mid and small cap stocks (source: unionmf.com) Union Consumption Fund NFO: Mutual Fund Union…

DSP Nifty Smallcap 250 Index Fund NFO Investment Objective: The investment objective of the Scheme is to generate returns that are commensurate with the performance of the Nifty Smallcap 250 Index, subject to tracking error. There is no assurance that the investment objective of the Scheme will be…

DSP Nifty Midcap 150 Index Fund NFO Investment Objective: The investment objective of the Scheme is to generate returns that are commensurate with the performance of the Nifty Midcap 150 Index, subject to tracking error. There is no assurance that the investment objective of the Scheme will be…

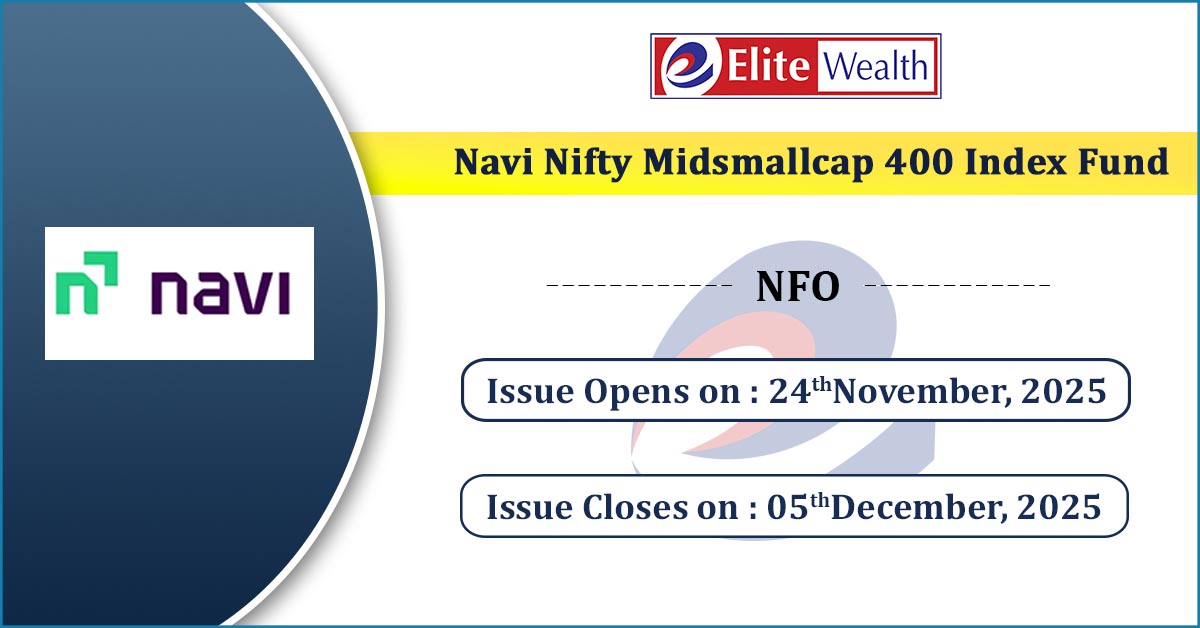

Navi Nifty MidSmallcap400 Index Fund: Navi Nifty MidSmallcap 400 Index Fund is an open-ended index fund that mirrors the performance of the Nifty MidSmallcap 400 Index, providing you a seamless, combined exposure to the entire non Large cap universe of Nifty100. The New Fund Offer (NFO) starts on…

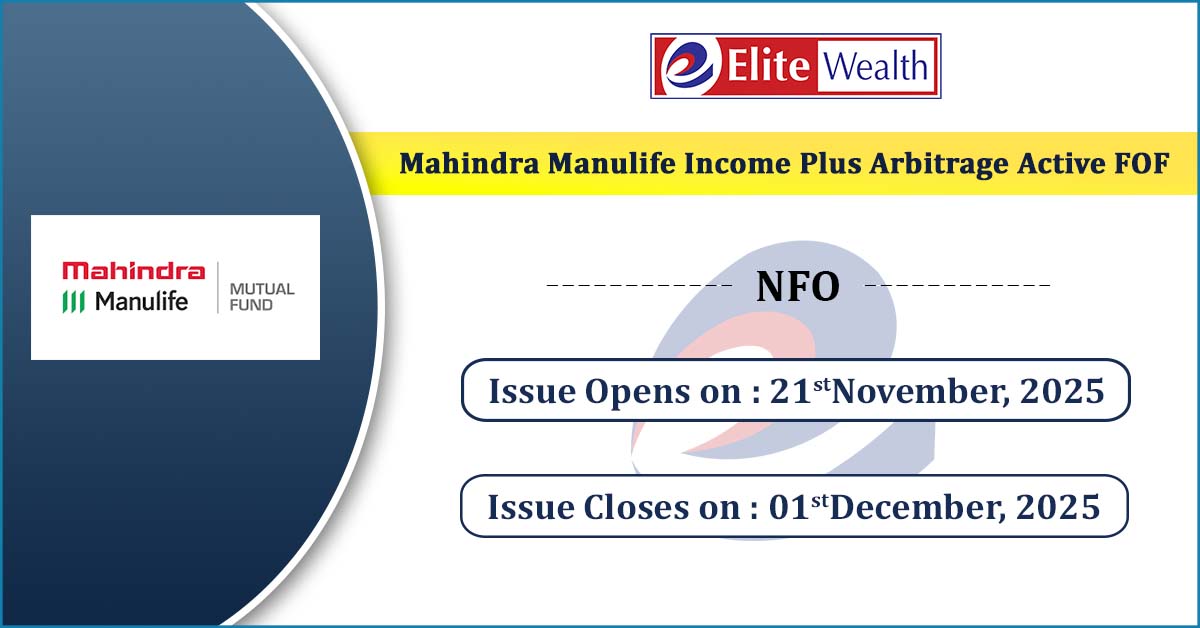

Mahindra Manulife Income Plus Arbitrage Active FOF - Regular - Growth An open-ended fund of fund scheme predominantly investing in units of actively managed debt oriented and arbitrage mutual fund schemes (source: mahindramanulife.com) Mahindra Manulife Income Plus Arbitrage Active FOF NFO: Mutual Fund Mahindra Manulife Mutual Fund Scheme…

Kotak Nifty500 Momentum 50 Index Fund : Kotak Nifty500 Momentum 50 Index Fund is an open-ended scheme replicating/tracking the Nifty500 Momentum 50 Index. Kotak Nifty500 Momentum 50 Index Fund NFO INVESTMENT OBJECTIVE: The inve(source: kotakmf.com)stment objective of the scheme is to provide returns that,before expenses,corresponds to the total returns of…

The Wealth Company Multi Asset Allocation Fund NFO Quick Reasons to Invest : (source: wealthcompanyamc.in) The Wealth Company Multi Asset Allocation Fund NFO INVESTMENT OBJECTIVE: To provide long-term growth in capital and income to investors, through active management of investments in a diversified portfolio of instruments across multiple…

Capitalmind Liquid Fund NFO Investment Objective: To generate regular Income over the short-term investment horizon by investment in debt and money market instruments with maturity upto 91 days. The Scheme does not guarantee or assure any returns. There is no assurance that the investment objective of the Scheme will be…

Mirae Asset Infrastructure Fund NFO ABOUT THE FUND: The Fund seeks to invest in a basket of stocks benefiting either directly or indirectly from infrastructure development in India. The Fund has flexibility to invest across market cap or style in selecting investment opportunities The Fund will seek to…

PGIM India Multi Asset Allocation Fund NFO Investment Objective: The investment objective of the Scheme is to seek to generate long term capital appreciation by investing in multiple asset classes including equity and equity related securities, debt and money market instruments, Gold ETFs & Silver ETFs. However, there…