Capillary Technologies India Limited IPO Company Profile:

Capillary Technologies India Limited is a software product company specializing in artificial intelligence-driven, cloud-native Software-as-a-Service (SaaS) solutions for enterprise clients. The company offers a comprehensive and diversified product portfolio, including its flagship loyalty management platform (Loyalty+), connected engagement platform (Engage+), predictive analytics platform (Insights+), rewards management platform (Rewards+), and customer data platform. These integrated solutions enable enterprises to design and manage end-to-end loyalty programs, gain deep consumer insights, and execute unified, cross-channel engagement strategies. By leveraging real-time data and advanced analytics, Capillary empowers businesses to deliver personalized, consistent, and omni-channel customer experiences, driving stronger brand loyalty, engagement, and long-term growth across diverse industries and global markets.

Strengths:

| IPO-Note | Capillary Technologies India limited |

| Rs. 549 – Rs. 577 per Equity share | Recommendation: Avoid |

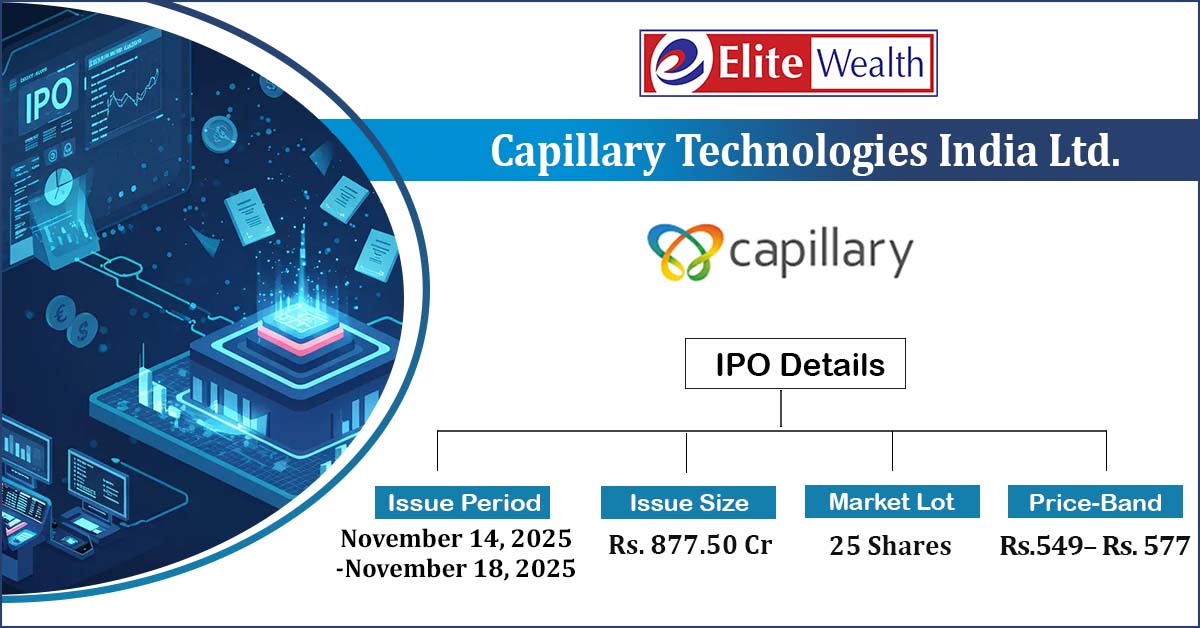

Capillary Technologies India Limited IPO Details:

| Issue Details | |

| Objects of the issue | · Funding cloud infrastructure

· Invest in R&D · Purchase of Computer systems · General Corporate Exp. |

| Issue Size | Total Issue Size-Rs. 877.50Cr

OFS Size- Rs. 532.50 Cr Fresh Issue Size- 345.00 Cr |

| Face value |

Rs. 2 |

| Issue Price | Rs. 549 – Rs. 577 per share |

| Bid Lot | 25 Shares |

| Listing at |

BSE, NSE |

| Issue Opens | November 14, 2025- November 18, 2025 |

| QIB | Not Less than 75% of Net Issue Offer |

| HNI | Not More than 15% of Net Issue Offer |

| Retail | Not More than 10% of Net Issue Offer |

| Employee Discount | Rs. 52 |

Capillary Technologies India Limited IPO Strengths:

- It has offices across the USA, UK, UAE, and several other Asian countries. As of Q1FY26, it supports 413 brands across 47 countries, helping businesses enhance consumer value through its innovative, technology-driven solutions and global expertise.

- As of Q1FY26, and FY25 the company served 110 and 98 customers, and supported 413 and 393 brands, respectively. Its customer and brand portfolio is well-diversified across multiple sectors, including conglomerates, retail, consumer packaged goods (CPG), healthcare, apparel, departmental stores, luxury and lifestyle, travel, automotive and hospitality, and energy retail verticals.

- The company aims to drive growth by increasing its New Annual Contract Value (ACV) through focused go-to-market initiatives, strategic partnerships with large system integrators and consulting firms, and a refocused sales strategy targeting large enterprises. As of September 30, 2025, and for Fiscal 2025, the company added New ACV of ₹246.16 million and ₹671.53 million, respectively, reflecting continued business growth and improved efficiency.

- As of Q1FY26, the company’s platform hosted over 1.82 billion consumers, compared to 1.46 billion a year earlier and 1.26 billion as of March 31, 2025. It processed 0.16 million and 0.18 million, loyalty transactions per hour as of Q1FY25 and FY25 demonstrating its scalability and reliability in managing large transaction volumes for global enterprises, including Fortune 500 companies.

- It’s growth strategy focuses on three core areas: maximizing organic growth by improving Net Revenue Retention (NRR) through a ‘land and expand’ approach, acquiring new customers, and pursuing inorganic growth to integrate complementary technologies and reach new customer segments, fostering expansion, innovation, and operational synergies.

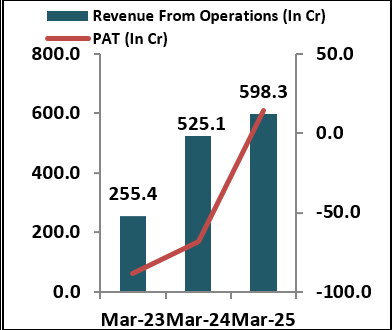

- It reported revenue from operations of ₹598.26 crore in FY25, reflecting a 14% growth from ₹525.10 crore in FY24. It achieved a PAT of ₹14.15 crore in FY25, compared to a loss of ₹68.35 crore in FY24. For Q1FY26, revenue from operations stood at ₹359.22 crore, with a PAT of ₹1.03 crore.

- As per Zinnov Report, the global loyalty market was valued at USD 16.6 billion in FY24 and is projected to reach USD 26.8 billion by 2029, reflecting a robust compound annual growth rate (CAGR) of 10% during the period from 2024 to 2029.

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Capillary Technologies India Limited IPO Allotment Status

Capillary Technologies India Limited IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

-

Select Capillary Technologies India Ltd IPO

-

Enter your PAN Number or Application Id or DP Client Id.

Capillary Technologies India Limited IPO Risk Factors:

- The company faces intense competition from both global and domestic players, including Infosys, Wipro, TCS, Salesforce, Inc., Adobe Inc., HubSpot, Inc., Braze, Inc., Affle (India) Limited, Route Mobile Limited, and Tanla Platforms Limited. This competitive landscape may impact the company’s revenue growth and profitability.

- Failure to innovate or develop new products in a timely manner may weaken the company’s competitiveness and adversely impact customer satisfaction. Additionally, significant reliance on North American customers exposes the company to regional economic, geopolitical, and market-specific risks.

Capillary Technologies India Limited IPO Outlook:

CTIL is a software product company specializing in artificial intelligence-driven, cloud-native SaaS solutions for enterprise clients. As of Q1FY26, the company supports over 413 brands across 47 countries. It served 110 customers in Q1FY26 and 98 customers in FY25, supporting 413 and 393 brands, respectively. During the same periods, CTIL added New ACV of ₹246.16 million and ₹671.53 million, respectively. As of Q1FY26, the company’s platform hosted over 1.82 billion consumers and 1.26 billion in FY25, and processed approximately 0.16 million and 0.18 million loyalty transactions per hour in Q1FY26 and FY25, respectively. It reported revenue from operations of ₹598.26 crore and a PAT of ₹14.03 crore in FY25. At the upper price band of ₹577 per share, the issue is priced at a P/E of 299.02x (pre-IPO) and 323.40x (post-IPO) based on FY25 earnings. The valuation appears significantly high compared to industry peers. Hence, we recommend avoiding the issue, but aggressive investors may consider it for potential listing gains.

Capillary Technologies India Limited IPO Financial Performance:

Capillary Technologies India Limited IPO Shareholding Pattern:

| Particulars | Pre Issue | Post issue |

| Promoters Group | 67.94% | 52.04% |

| Others | 32.06% | 47.95% |

Sources: Company Website, RHP.

Capillary Technologies India Limited IPO FAQ:

Ans. Capillary Technologies IPO is a main board IPO of 1,52,07,998 equity shares of the face value of ₹2 aggregating up to ₹877.50 Crores. The issue is priced at . The minimum order quantity is 25.

The IPO opens on November 14, 2025, and closes on November 18, 2025.

MUFG Intime India Pvt.Ltd. is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Capillary Technologies IPO opens on November 14, 2025 and closes on November 18, 2025.

Ans. Capillary Technologies IPO lot size is 25, and the minimum amount required for application is ₹14,425.

Ans. The Capillary Technologies IPO listing date is not yet announced. The tentative date of Capillary Technologies IPO listing is Friday, November 21, 2025.