Borana Weaves Ltd IPO Company Profile:

Incorporated in 2020, Borana Weaves Ltd. is manufacturer of microfilament and greige polyester woven fabrics. The company operates a fully integrated, state-of-the-art facility featuring high-speed water jet looms and manages the entire production process under one roof—from POY to PTY, including warping, sizing, and weaving. With an annual output of over 220 million metres, Borana ranks among the largest greige fabric producers in India. Its fabrics are widely used across various applications such as apparel, home textiles, and tent materials.

| IPO-Note | Borana Weaves Ltd |

| Rs.205– Rs.216 per Equity share | Recommendation: Apply |

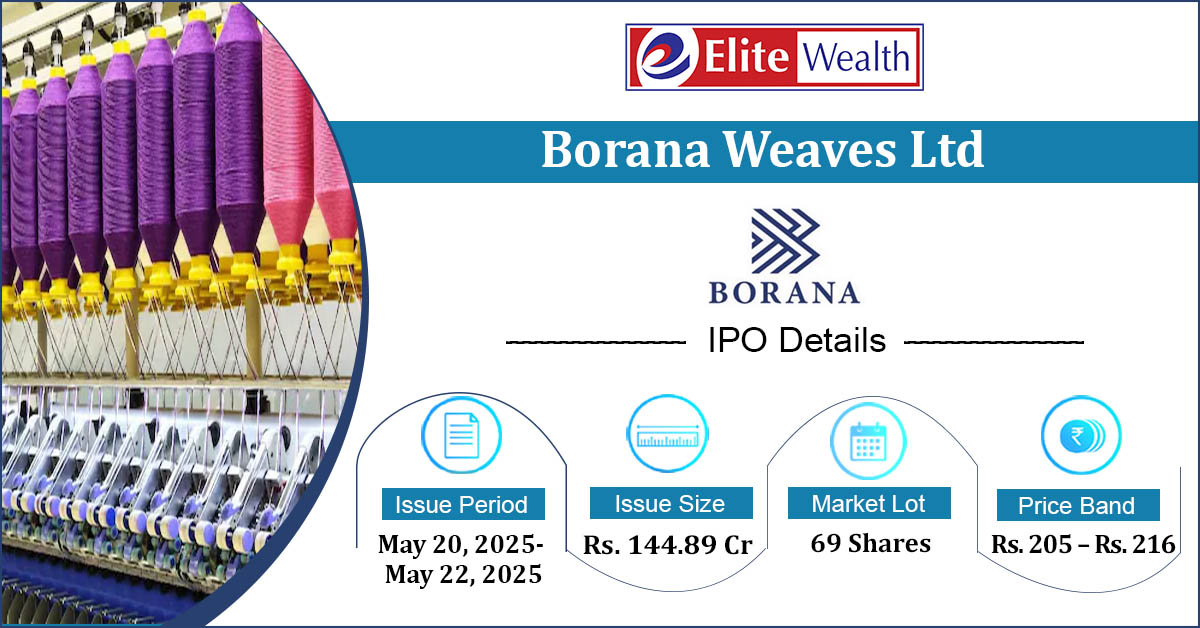

Borana Weaves Ltd IPO Details:

| Issue Details | |

| Objects of the issue |

· To finance the cost of establishing a new manufacturing Unit · For Working Capital Requirement · General Corporate Expenses |

| Issue Size | Total issue Size – Rs. 144.89 Cr

Fresh Issue – Rs. 144.89 Cr |

| Face value |

Rs .10 |

| Issue Price | Rs. 205 – Rs. 216 per share |

| Bid Lot | 69 Shares |

| Listing at |

BSE, NSE |

| Issue Opens | May 20, 2025- May 22, 2025 |

| QIB | Not Less than 75% of Net Issue Offer |

| HNI | Not More than 15% of Net Issue Offer |

| Retail | Not More than 10% of Net Issue Offer |

Borana Weaves Ltd IPO Strengths:

- As of December 31, 2024, the Company had a total of 15 texturizing machines, 6 warping machines, 700 water jet looms and 10 folding machines active at its three units.

- According to Confederation of Indian Industry (CII), the Indian textile and apparel industry is expected to grow at a 10% CAGR from 2019-20 to reach USD 190 billion by 2025-26 Whereas, domestic apparel market in India stood at USD 40 billion in 2020 and is expected to reach USD 135 billion by 2025.

- Borana Weaves has shown consistent growth in production capacity and utilization. Unit 1’s utilization increased from 96.05% in FY 2022–23 to 98.86% in FY 2023–24, maintaining 98.38% in FY 2024–25. Unit 3, launched in FY 2023–24, achieved 84.26% utilization by Q3 FY 2024–25. Unit 4, with a projected capacity of 84.56 million meters, will begin operations in FY 2025–26.

- From FY 2026-27 onwards, Borana Weaves plans to maintain a machine count of 1,048, with an annual capacity of 339.55 million meters through FY 2029-30. This strategy ensures high production efficiency and scalability, allowing the company to meet rising demand while maintaining a competitive edge in the textile market.

- Borana Weaves shows strong operational efficiency with a 21% EBITDA margin and 12% PAT margin, outperforming peers like Jindal Worldwide (8% EBITDA, 4% PAT) and Arvind Ltd. (11% EBITDA). This reflects Borana’s effective cost management and profitability, aligning with top performers like KPR Mill Ltd. in operational excellence.

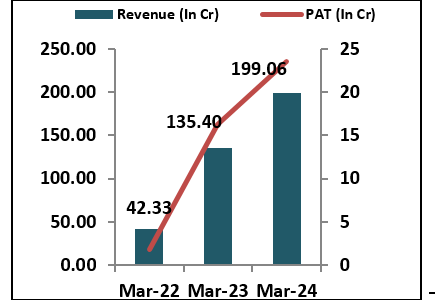

- It has posted revenue from operations of Rs 199.1 cr in FY24 up 47.04% as compare to 135.4 cr in FY23 and PAT for FY24 of RS 23.59 cr increased with 31% from 16.3 cr in FY23. As of 31st Dec 2024, reported revenue from operations of Rs 211.6 cr and PAT of Rs 29.31 cr.

- In FY24, Borana Weaves reported a strong ROE of 49.45% and ROCE of 27.42%, reflecting its efficient capital utilization and ability to generate substantial returns for its investors.

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Borana Weaves Ltd IPO Allotment Status

Borana Weaves Ltd IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Borana Weaves Ltd IPO Risk Factors:

- The volatility in raw material prices, particularly for petroleum-based synthetic fibers like polyester, poses a major challenge. Global oil price fluctuations directly affect the cost of production, impacting profit margins and operational efficiency for manufacturers.

- The company faces intense competition from established players like KPR Mill Ltd, Jindal Worldwide Limited, Arvind Ltd and Vardhman Textiles Ltd poses a significant risk to the market share of the company, pricing power, and ability to attract and retain customers in the highly competitive sector.

Borana Weaves Ltd IPO Financial Performance:

Borana Weaves Ltd IPO Shareholding Pattern:

| Particulars | Pre Issue | Post issue |

| Promoters Group | 87.19%

|

65.24% |

| Others | 12.81%

|

34.76% |

Borana Weaves Ltd IPO Outlook:

Borana Weaves Ltd. is showing sustained growth, driven by strong financial and its fully integrated manufacturing capabilities, ongoing capacity expansion, and strong operational efficiency. With the Indian textile industry projected to grow at a 10% CAGR, the company is poised to capitalize on increasing domestic demand. Its robust financial performance, including high ROE and ROCE, coupled with strategic capacity planning through FY 2029–30, enhances its competitive advantage. At the upper price band of Rs 216 per share, the issue is valued at a P/E of 18.26x based on FY24 earnings and 14.73x on expected FY25 earnings. Based on these reasonable valuations, we recommend apply to the issue both for listing gains and long-term investment.

Borana Weaves Ltd IPO FAQ:

Ans. Borana Weaves IPO is a main-board IPO of 6708000 equity shares of the face value of ₹10 aggregating up to ₹144.89 Crores. The issue is priced at ₹205 to ₹216 per share. The minimum order quantity is 69.

The IPO opens on May 20, 2025, and closes on May 22, 2025.

Kfin Technologies Limited is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Borana Weaves IPO opens on May 20, 2025 and closes on May 22, 2025.

Ans. Borana Weaves IPO lot size is 69, and the minimum amount required is ₹14,904.

Ans. The Borana Weaves IPO listing date is not yet announced. The tentative date of Borana Weaves IPO listing is Tuesday, May 27, 2025.

Ans. The minimum lot size for this upcoming IPO is 69 shares.