🔹 Alkem Laboratories – The company’s subsidiary plans to acquire a 51–55% stake in Switzerland-based Occlutech, strengthening its global healthcare presence. 🔹 KPI Green Energy – Signs a Battery Energy Storage Purchase Agreement with Gujarat Urja Vikas Nigam Limited for 445 MW / 890 MWh standalone BESS…

Market View 09th March, 2026

View on market: Volatility persists, eagerly searching for growth: Global markets remained under pressure as rising geopolitical tensions in the Middle East weakened investor confidence. Futures linked to major global indices pointed to a negative start in the US and European markets. Asian equity markets saw sharp declines…

(CMP – ₹1,507) SHORT TERM PERSPECTIVE Company Recommendation SL Target Price Horizon KIRLOSENG BUY (₹1470-1500) ₹1,420 ₹1,600-1650 1-2 weeks Kirloskar Oil Engines Ltd. (KOEL), a flagship company of the Kirloskar Group, is one of a leading manufacturer of diesel engines and generator sets with a diversified presence across…

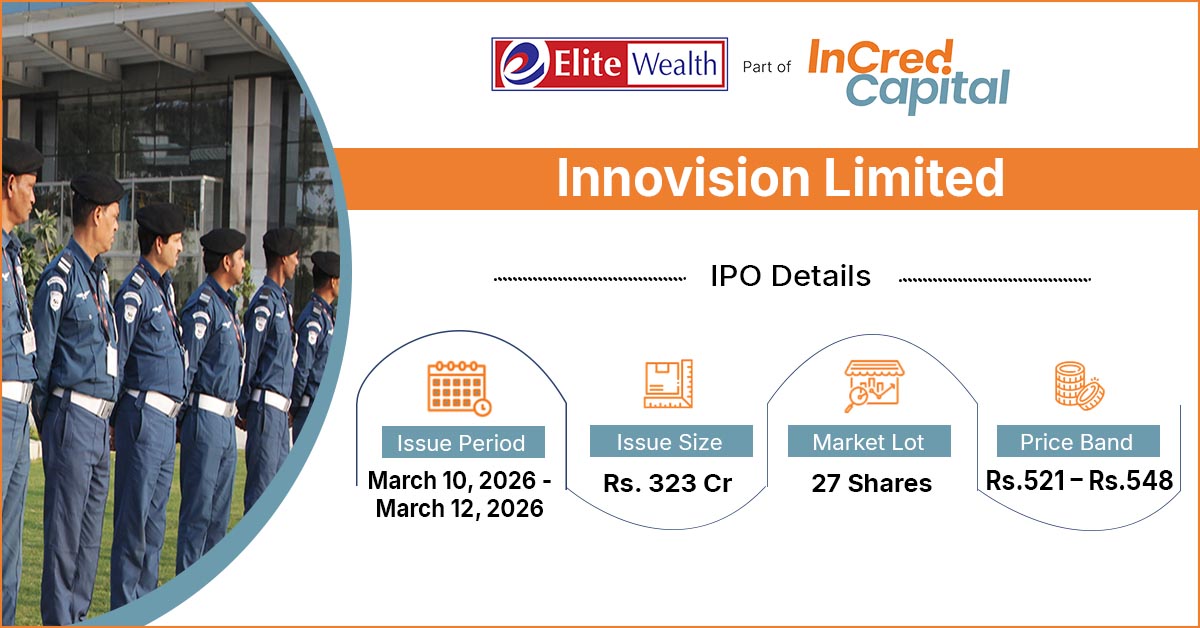

Innovision IPO Details IPO Date 10 to 12 Mar, 2026 Listing Date Tue, Mar 17, 2026T Face Value ₹10 per share Price Band ₹521 to ₹548 Lot Size 27 Shares Sale Type Fresh capital cum OFS Issue Type Bookbuilding IPO Listing At BSE, NSE Total Issue Size 58,91,284 shares (agg. up…

What is Kotak Quality Overseas Equity Omni FOF? Kotak Quality Overseas Equity Omni FOF is an open ended fund of fund investing in units of overseas equity oriented mutual fund schemes based on Quality Theme and/or ETFs based on Quality Theme. Investment objective The Investment Objective of the scheme…

The United States has granted a temporary 30-day waiver allowing Indian refiners to purchase Russian crude oil cargoes that are currently stranded at sea. The move comes at a time when global oil markets are facing uncertainty due to ongoing geopolitical tensions in West Asia that have disrupted…

Purchases of domestic equities by mutual funds declined sharply in February, touching their lowest level in the past three years. According to reports, mutual funds invested around ₹10,381 crore in equities during the month, marking a steep fall from the strong buying activity seen in January. In January,…

State-run mining company MOIL Limited has revised the prices of several grades of manganese ore for March 2026 as part of its pricing adjustments for the January–March quarter. The updated rates came into effect on March 1, 2026, and apply to multiple categories of manganese ore supplied by…

Shipping Routes Impacted by Regional Conflict The situation has intensified due to the ongoing hostilities involving Iran and Israel, which have raised safety concerns for vessels operating in the Gulf region. As a result, LNG carriers are currently unable to safely pass through the Strait of Hormuz to…

🔹 Dr. Reddy’s Laboratories receives an Establishment Inspection Report from the U.S. Food and Drug Administration for its Srikakulam facility with a Voluntary Action Indicated (VAI) classification. 🔹 Garden Reach Shipbuilders & Engineers signs an MoU with Kalyani Strategic Systems to jointly develop advanced naval systems, unmanned platforms,…