On July 3, 2025, the Securities and Exchange Board of India (SEBI) issued an interim order restraining U.S.-based quantitative trading firm Jane Street—and its Indian and Singaporean affiliates—from transacting in India’s securities markets. SEBI also announced it would hold ₹48.4 billion (approx. $567 million) alleged to be “unlawful gains” accrued between January 2023 and March 2025…

Why Invest in JM Large & Mid Cap Fund? Core Portfolio Offering Invests in top-performing companies across sectors—both traditional and new-age businesses. All-Weather Approach Potential to capture upside and protect downside across different market cycles. Seamless Cap Shift Seamless shift between large and mid-cap stocks with no tax…

Axis Services Opportunities Fund NFO: Explore Investment Potential in India’s Services Sector The Axis Services Opportunities Fund NFO offers an opportunity to invest in India’s services sector, covering banking, IT, telecom, healthcare, e-commerce, and others. With services contributing 55%(Source 1) of India’s GDP and set to grow even…

View on market: Volatility persists, eagerly searching for growth Asian markets traded in a narrow range on Friday, as renewed concerns over upcoming trade tariffs overshadowed a strong rally in US markets. Despite gains in some regions, the mood remained cautious across Asia. Japan and Australia saw modest…

Adani Enterprises Limited [AEL] is a part of the Adani portfolio of companies, known for their successful execution of large-scale projects in the energy and infrastructure sectors in India. AEL is recognized as India's largest listed business incubator, with a focus on four core sectors: energy and utility, transportation…

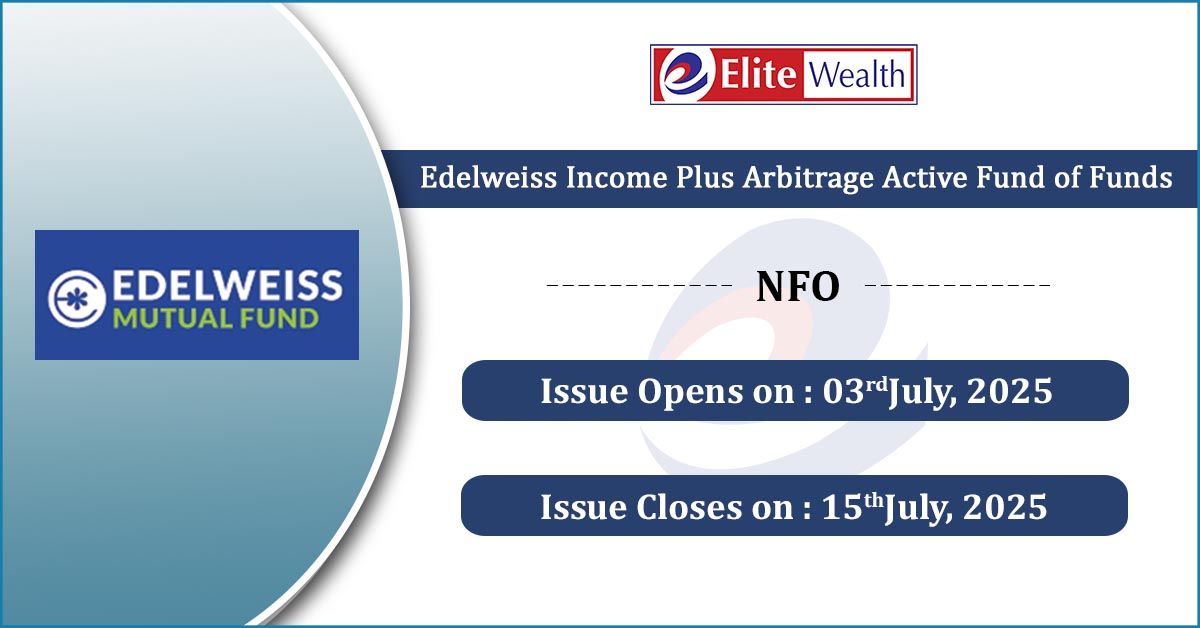

Edelweiss Income Plus Arbitrage Active Fund of Funds NFO Details: Mutual Fund Edelweiss Mutual Fund Scheme Name Edelweiss Income Plus Arbitrage Active Fund of Funds Objective of Scheme The scheme shall seek to generate long-term capital appreciation by investing in units of actively managed debt oriented mutual fund…

View on market: Volatility persists, eagerly searching for growth Asian markets showed mixed performance ahead of the U.S. jobs report. Investor sentiment was slightly positive after U.S. stocks hit new highs, driven by President Donald Trump's announcement of a trade agreement with Vietnam. This deal raised hopes of…

India’s auto industry posted a mixed performance in June 2025, closing Q1 FY26 with varied trends across segments. While domestic demand faced pressure from rural softness and macro uncertainties, exports surged for key players like Maruti Suzuki, Hero MotoCorp, and Hyundai, providing crucial support. EV sales maintained momentum,…

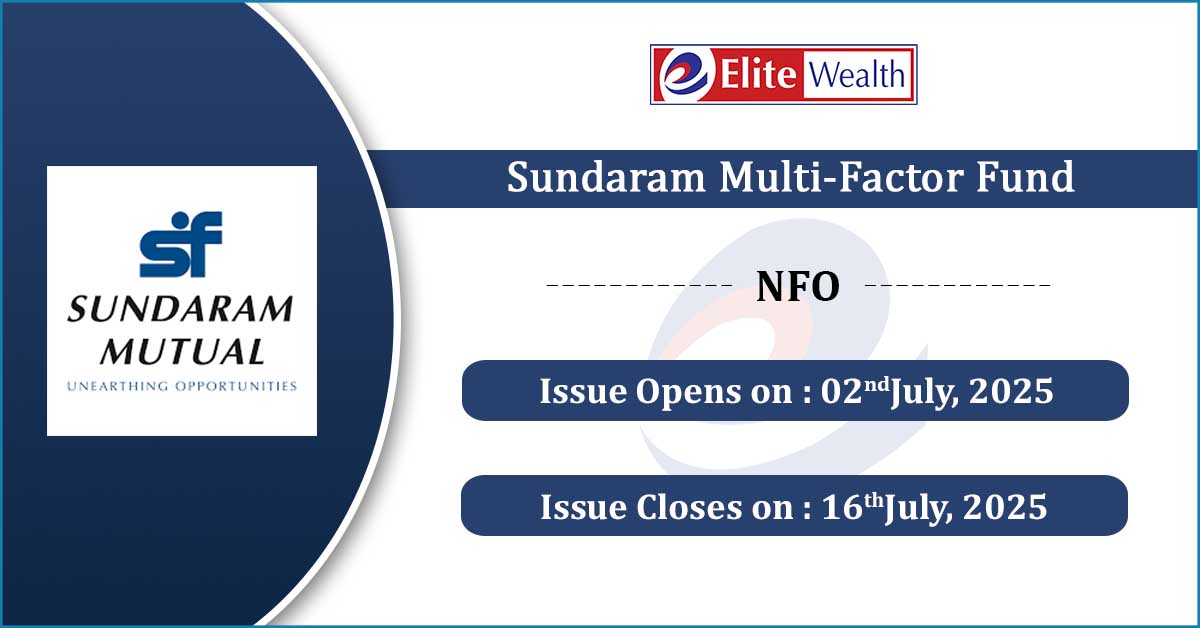

Understanding the Sundaram Multi-Factor Fund Sundaram Multi-Factor Fund brings together four proven factors - value, quality, momentum, growth, and size as on overlay into one well-diversified strategy. This approach reduces reliance on any one factor and helps mitigate the risk of underperformance in specific market conditions. Since different factors perform at…

Nippon India MNC Fund MNCs typically bring together global research, innovation, and operational excellence. When combined with India’s growth landscape, they aim to offer a meaningful recipe for long-term growth. Presenting Nippon India MNC Fund that taps into this opportunity by investing in companies that think globally and scale locally.…