Introducing Baroda BNP Paribas Nifty Bank ETF:

Baroda BNP Paribas Nifty Bank ETF is an exchange traded fund investing primarily in equity and equity related securities comprising the Nifty Bank Total Returns index. Units will be issued in dematerialized form and will be available for trading on NSE and BSE.

(soruce: barodabnpparibasmf)

Baroda BNP Paribas Nifty Bank ETF Details:

The investment objective of the scheme is to provide investment returns closely corresponding to the total returns of the securities as represented by the Nifty Bank Total Returns Index before expenses, subject to tracking errors, fees and expenses. However, there is no assurance that the objective of the Scheme will be realized, and the Scheme does not assure or guarantee any returns.

| Mutual Fund | Baroda BNP Paribas Mutual Fund |

| Scheme Name | Baroda BNP Paribas Nifty Bank ETF |

| Objective of Scheme | |

| Scheme Type | Open Ended |

| Scheme Category | Other Scheme – Other ETFs |

| New Fund Launch Date | 31-May-2024 |

| New Fund Earliest Closure Date | |

| New Fund Offer Closure Date | 14-Jun-2024 |

| Indicate Load Seperately | |

| Minimum Subscription Amount | 5000 |

(soruce: amfiindia)

Risk Factors & Disclaimer

Risk factors: The risks associated with investments in equities include fluctuations in prices, as stock markets can be volatile and decline in response to political, regulatory, economic, market and stock-specific development etc. Please refer to scheme information document for detailed risk factors, asset allocation, investment strategy etc.

Further, to the extent the scheme invests in fixed income securities, the Scheme shall be subject to various risks associated with investments in Fixed Income Securities such as Credit and Counterparty risk, Liquidity risk, Market risk, Interest Rate risk & Re-investment risk etc., Further, the Scheme may use various permitted derivative instruments and techniques which may increase the volatility of scheme’s performance. Also, the risks associated with the use of derivatives are different from or possibly greater than, the risks associated with investing directly in securities and other traditional investments. Investor should consider their risk appetite at the time of investing in index funds.

Please refer to Scheme Information Document available on our website (www.barodabnpparibasmf.in) for detailed Risk Factors, assets allocation, investment strategy etc.

NSE Disclaimer: It is to be distinctly understood that the permission given by NSE should not in any way be deemed or construed that the Scheme Information Document has been cleared or approved by NSE nor does it certify the correctness or completeness of any of the contents of the Scheme Information Document. The investors are advised to refer to the Scheme Information Document for the full text of the Disclaimer Clause of NSE.

BSE Disclaimer: It is to be distinctly understood that the permission given by BSE Limited should not in any way be deemed or construed that the SID has been cleared or approved by BSE Limited nor does it certify the correctness or completeness of any of the contents of the SID. The investors are advised to refer to the SID for the full text of the Disclaimer Clause of the BSE Limited.

(soruce: barodabnpparibasmf)

Scheme Documents

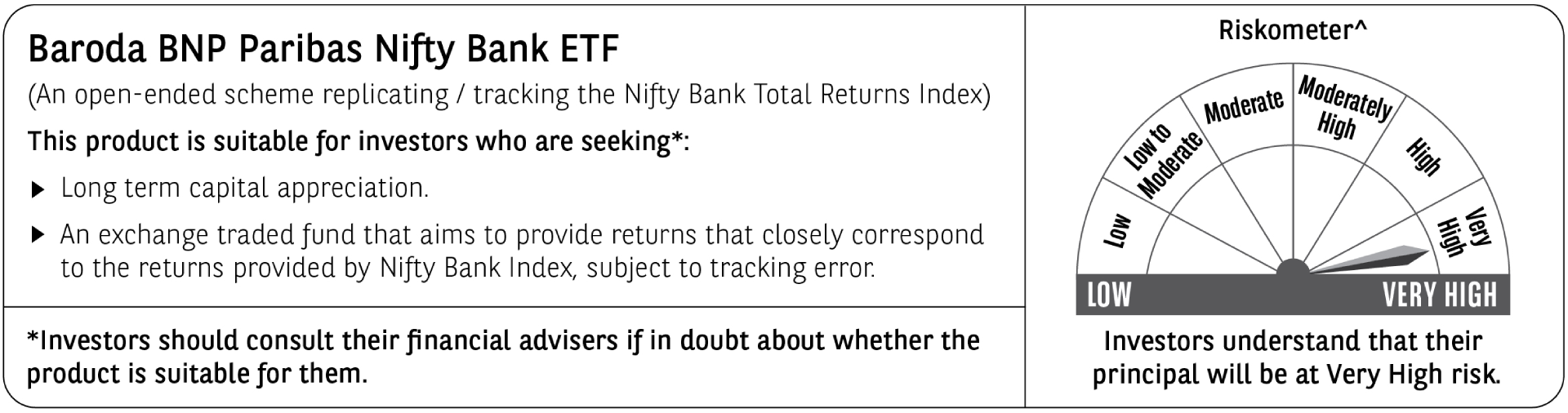

Baroda BNP Paribas Nifty Bank ETF NFO Riskometer:

^The riskometer assigned is based on internal assessment of the scheme characteristics and the same may vary post NFO when actual investments are made