What is Factor Investing?

- Factors are proven characteristics, such as momentum, quality, or value, that influence how stocks perform over time.

- Factor investing uses these traits to build smarter, data-backed portfolios that aim to grow and withstand market ups and downs.

- Common factors include Momentum (recent winners), Low Volatility (relatively stable performers), Quality (strong fundamentals), Value (undervalued picks), and Size (smaller companies with high growth potential).

- Since different factors perform better at different points in the market cycle, combining them can help enhance return potential and manage risk.

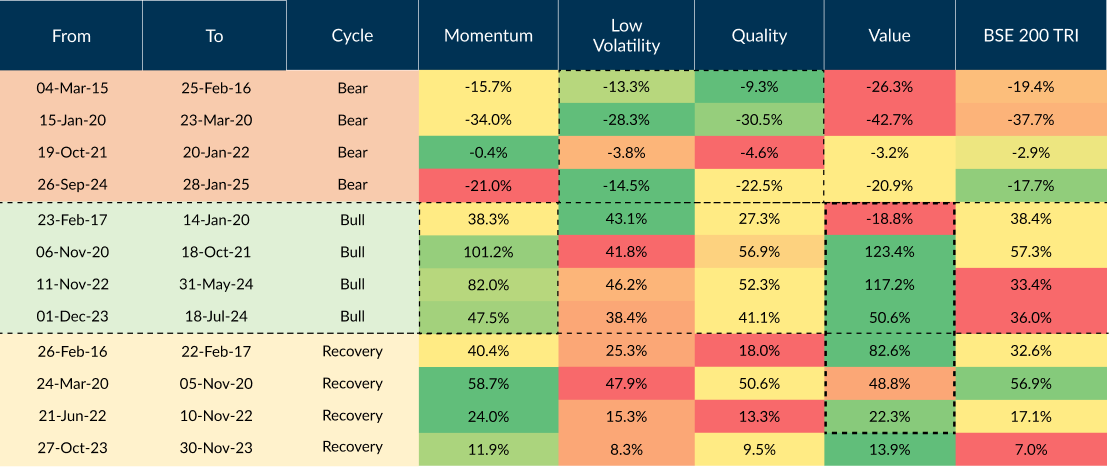

#1 Different Factors Win in Different Market Cycles

No single factor leads across all market conditions. Momentum tends to shine in bull runs, value in recoveries, quality during contractions,and low volatility in downturns.

(source: bandhanmutual.com/)

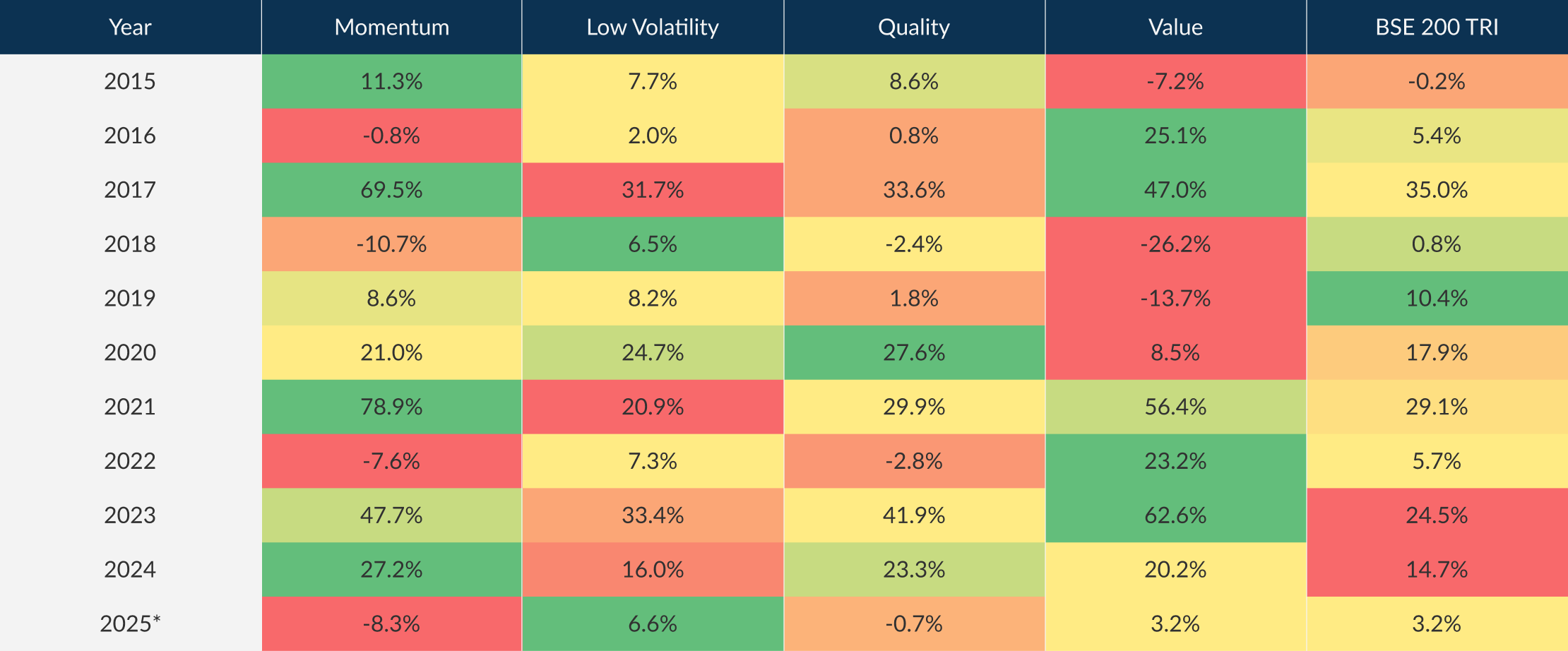

#2 Year-on-Year Factor Performance Isn’t Consistent

Factor leadership changes with market conditions; no single factor outperforms every year. Relying on one factor requires conviction andtiming, which can be difficult to sustain.

Source: NSE, BSE. The following indices are used- Momentum- Nifty 500 Momentum 50 TRI, Low Volatility- Nifty 500 Low Volatility 50 TRI, Quality- Nifty 500 Quality 50 TRI and Value- Nifty 500 Value 50 TRI. Performance results may have inherent limitations, and no representation is made that any investor will or is likely to achieve. Past performance may or may not be sustained in the future. TRI: Total Return Index. Above mentioned returns are absolute in nature. *CYTD- till 31st May 2025

(source: bandhanmutual.com)

#3 A Multi-Factor Strategy Brings Balance

Bandhan’s multi-factor strategy is a data-backed investment approach that blends multiple core factors – momentum, value, quality, and low volatility – into a single portfolio. By combining factors that perform differently across market environments, it aims to mitigate single-factor risk and enhance overall risk-adjusted returns.

(source: bandhanmutual.com)

Bandhan Multi-Factor Fund NFO Details:

| Mutual Fund | Bandhan Mutual Fund |

| Scheme Name | Bandhan Multi-Factor Fund |

| Objective of Scheme | The scheme seeks to generate medium to long term capital appreciation by investing predominantly in equity and equity related instruments selected based on a multi-factor quantitative model. Disclaimer: There is no assurance or guarantee that the investment objective of the scheme will be realised. |

| Scheme Type | Open Ended |

| Scheme Category | Equity Scheme – Sectoral/ Thematic |

| New Fund Launch Date | 10-Jul-2025 |

| New Fund Earliest Closure Date | |

| New Fund Offer Closure Date | 24-Jul-2025 |

| Indicate Load Seperately | If redeemed/switched out on or within 30 days from the date of allotment: 0.50% of the applicable NAV. If redeemed/switched out after 30 days from date of allotment – Nil. |

| Minimum Subscription Amount | Rs. 1000/- and any amount thereafter |

| For Further Details Please Visit Website | https://www.bandhanmutual.com |

(source: https://www.amfiindia.com/)

Scheme Documents

(source: bandhanmutual.com)

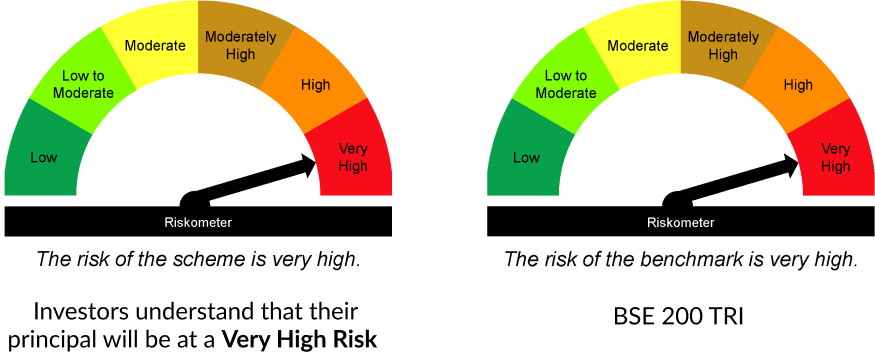

Bandhan Multi-Factor Fund NFO Riskometer:

(source: bandhanmutual.com)