Investment Objective

The investment objective of the Scheme is to generate optimal returns for its investors through a portfolio constituted of debt and money market securities. The Macaulay duration of the portfolio is managed between 6 months and 12 months, resulting in a low duration investment with relatively high interest rate risk and moderate credit risk. The Scheme seeks to offer a short-term savings avenue with low risk while balancing yield and liquidity.

However, there is no assurance that the investment objective of the Scheme will be achieved.

Asset Allocation

| Instruments | Indicative allocations (% of total assets) | |

|---|---|---|

| Minimum | Maximum | |

| Debt and Money Market Instruments* (including Triparty Repos on Government Securities or treasury bill & Repo, units of mutual funds) such that the Macaulay duration of the portfolio is between 6 months and 12 months. | 0% | 100% |

*Money market instruments will include commercial papers, commercial bills, Triparty REPO, Reverse Repo and equivalent and any other like instruments as specified by SEBI and Reserve Bank of India from time to time.

(source: bajajamc.com)

Who Should Invest in Bajaj Finserv Low Duration Fund?

The fund may be suitable for:

- Investors who want an investment avenue for near-term goals or parking of surplus funds.

- Investors looking for the potential for regular income from their investments.

- Corporates managing short-term cash flows.

- Investors looking to park surplus funds and gradually transfer them into equity or hybrid funds through a systematic transfer plan (STP).

Fund Details

Type of Scheme

Bajaj Finserv Low Duration Fund

An open ended low duration debt scheme investing in instruments such that the Macaulay Duration of the portfolio is between 6 months to 12 months (please refer to page no. 34 of the SID)# with relatively high interest rate risk and moderate credit risk.

# Please refer to the page number of the Scheme Information Document on which the concept of Macaulay Duration has been explained.

Minimum Additional Purchase Amount

On Ongoing basis

Rs. 1000/- and in multiples of Re. 1/- thereafter.

Minimum Redemption/switch out amount

Re. 1 and in multiples of Re. 0.01/- or the account balance of the investor, whichever is less.

(source: bajajamc.com)

Minimum Application Amount

During NFO:

Minimum application amount (lumpsum): Rs. 5000/- and in multiples of Re. 1/- thereafter. Systematic Investment Plan (SIP): Rs. 1000 and above: minimum 6 instalments.

During ongoing offer

- Fresh Purchase (lumpsum): Rs. 5000/- and in multiples of Re. 1/- thereafter Systematic Investment Plan (SIP): Rs. 5000 and above: minimum 6 instalments. Minimum amount for switch-in: Rs. 5000 and in multiples of Re. 1.

- Two-Factor Authentication will be applicable for subscription as well as redemption transactions in the units of Mutual Fund.

- For more information, please refer SAI.

(source: bajajamc.com)

Load Structure/Lock-In Period

Entry Load:Nil

Exit Load:Nil

Plan

- Bajaj Finserv Low Duration Fund – Direct Plan

- Bajaj Finserv Low Duration Fund – Regular Plan

NFO Period

- NFO opens on: February 09, 2026

- NFO closes on: February 16, 2026

(source: bajajamc.com)

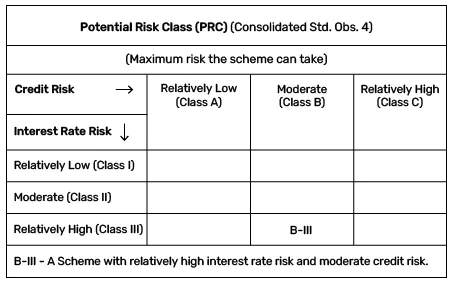

Potential Risk Class (PRC)

- The PRC matrix identifies the highest amount of potential risk that a debt mutual fund can assume.

- This regulation was implemented by SEBI on December 1, 2021, making it essential for fund houses to categorize all new and existing schemes under a potential risk class (PRC) matrix.

This product is suitable for investors who are seeking*:

- income over short term

- to generate income/capital appreciation through investments in low duration debt and money market instruments

(source: bajajamc.com)

The Bajaj Finserv Low Duration Fund is an open-ended debt scheme investing in debt and money market instruments such that the Macaulay duration of the portfolio is between 6 and 12 months. Investors who typically allocate to liquid or money market funds may consider investing incrementally in this fund to potentially benefit from market volatility or rate cut cycles, without significantly changing the duration of their portfolios.

The fund may also be suitable for investors seeking the potential to benefit from any downward movement in rates without taking exposure to long-duration instruments. The fund may also serve as an avenue to park surplus funds or for short-term goals.

How does Bajaj Finserv Low Duration Fund work?

The Bajaj Finserv Low Duration Fund will invest across money market instruments, corporate bonds, and non-convertible debentures. It will allow selective exposure to securities beyond one-year maturity (while maintaining the required Macaulay duration of 6 to 12 months) to enhance return potential. Fund managers may actively manage the portfolio by adjusting maturity, credit exposure, and instrument selection based on interest rate conditions and liquidity considerations. Low duration fund returns are influenced by factors such as interest rate movements, credit quality of holdings, and prevailing market conditions, and may vary over time.

Bajaj Finserv Low Duration Fund – Regular & Direct Plans

Those investing in the Bajaj Finserv Low Duration Fund can choose between two plans:

Regular plan

A regular plan involves investing through a mutual fund distributor who supports investors with scheme selection, application processes, and transactions. The expense ratio for this plan is typically higher, as it includes distributor commissions paid by the asset management company. However, investors receive guidance that may help them align their investments with their financial goals and risk profile.

Direct plan

A direct plan is designed for investors who are comfortable making and managing their own investment decisions. These plans generally have a lower expense ratio, which may contribute to higher net returns over the long term. However, investors need to research market conditions, make scheme selections, and monitor their investments independently.

(source: bajajamc.com)

How to invest in Bajaj Finserv Low Duration Fund NFO?

You can invest in the Bajaj Finserv Low Duration Fund during the NFO period (February 9, 2026 to February 16, 2026) in the following ways:

Online: You can visit Bajaj Finserv AMC’s official website and navigate to the transaction portal from the ‘Invest Now’ button on this page or the Login/Register tab on the home page. There, you can invest through a seamless and secure digital process. You can also invest through an aggregator platform, on MF Utility, or through a Registrar and Transfer Agent.

Offline: You can fill out the application form and submit it at the nearest official point of acceptance (OPAT) of Bajaj Finserv AMC. If you’re investing through a distributor, they will typically help you with filling out and submitting the application form.

Once the NFO period ends, the scheme will re-open for subscription in a few working days. The investment process and options will remain the same.

Taxation on Bajaj Finserv Low Duration Fund

Capital gains and income from the Bajaj Finserv Low Duration Fund will be taxable as follows:

- Capital gains: From April 1, 2023, all capital gains on debt mutual funds are deemed to be short-term capital gains, regardless of the holding period. They are taxed as per the investor’s slab rates (plus applicable surcharge and cess).

- Income Distribution cum Capital Withdrawal (IDCW): IDCW payouts are also taxed as per the investor’s income tax slab.

Explore Related Debt Funds

| Overnight Fund | Money Market Fund | Liquid Fund |

|---|---|---|

| Gilt Mutual Fund | Banking & PSU Fund |

Explore All Schemes

| Equity Funds | Debt Funds | Hybrid Funds | Index Funds |

|---|---|---|---|

| Exchange Traded Fund Funds | Savings Plus | All Mutual Funds |

(source: bajajamc.com)

Bajaj Finserv Low Duration Fund NFO:

| Mutual Fund | Bajaj Finserv Mutual Fund |

| Scheme Name | Bajaj Finserv Low Duration Fund |

| Objective of Scheme | The investment objective of the Scheme is to generate optimal returns for its investors through a portfolio constituted of debt and money market securities. The Macaulay duration of the portfolio is managed between 6 months and 12 months, resulting in a low duration investment with relatively high interest rate risk and moderate credit risk. The Scheme seeks to offer a short-term savings avenue with low risk while balancing yield and liquidity. However, there is no assurance that the investment |

| Scheme Type | Open Ended |

| Scheme Category | Debt Scheme – Low Duration Fund |

| New Fund Launch Date | 09 Feb 2026 |

| New Fund Earliest Closure Date | |

| New Fund Offer Closure Date | 16 Feb 2026 |

| Indicate Load Separately | Entry Load: Nil Exit Load: Nil The Trustee / AMC reserves the right to change the load structure any time in the future if they so deem fit on a prospective basis. The investor is requested to check the prevailing load structure of the scheme before investing. |

| Minimum Subscription Amount | 5000 |

| For Further Details Please Visit Website | https://www.bajajamc.com |