Why Bajaj Finserv Large Cap Fund

Concentrated portfolio with high conviction in stock selection

High active share strategy that aims to outperform the index in the long term

Stable through economic downturn and market conditions

Focussed on companies that are a part of India’s growth story

Bottom-up investment approach

(source: bajajamc.com)

Investment Style and Portfolio Strategy

Focus on large cap companies: The fund primarily invests 80-100% of its total assets in large cap companies, ensuring a relatively stable and robust portfolio grounded in well-established Companies.

Active management: Our experienced fund managers actively manage the portfolio, making informed investment decisions to potentially maximize long-term capital appreciation.

High conviction stocks: The fund focuses on high conviction large cap companies, stock picking process follows a bottom-up approach, supported by our in-house investment philosophy identifying companies with potential for long-term growth within the large cap universe.

High active share: This approach aims to outperform the benchmark index over long-term

INQUBE Investment Philosophy: We follow our INQUBE (INformation edge + QUantitative edge + BEhavioural edge) investment philosophy.

(source: bajajamc.com)

BAJAJ FINSERV LARGE CAP FUND NFO Details:

| Mutual Fund | Bajaj Finserv Mutual Fund |

| Scheme Name | BAJAJ FINSERV LARGE CAP FUND |

| Objective of Scheme | The objective of the Scheme is to generate long term capital appreciation and income distribution to investors by predominantly investing in equity and equity related instruments of large cap companies. However, there is no assurance that the investment objective of the Scheme will be achieved. |

| Scheme Type | Open Ended |

| Scheme Category | Equity Scheme – Large Cap Fund |

| New Fund Launch Date | 29-Jul-2024 |

| New Fund Earliest Closure Date | |

| New Fund Offer Closure Date | 12-Aug-2024 |

| Indicate Load Seperately | Entry Load: Nil Exit Load: For each purchase of units through Lumpsum / switch-in / Systematic Investment Plan (SIP) and Systematic Transfer Plan (STP), exit load will be as follows: • if units are redeemed / switched out within 6 months from the date of allotment: 1% of applicable NAV. • if units are redeemed/switched out after 6 months from the date of allotment, no exit load is payable. Please refer SID |

| Minimum Subscription Amount | 500 |

| For Further Details Please Visit Website | https://www.bajajamc.com |

(source :amfiindia)

Scheme Documents

(source: bajajamc.com)

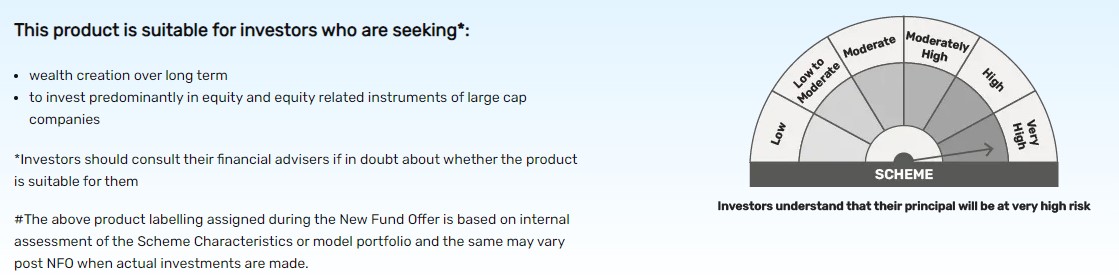

BAJAJ FINSERV LARGE CAP FUND NFO Riskometer: