What is Quality Investing

Like the finest coffee beans, quality businesses are carefully cultivated – rooted in strong fundamentals, supported by enduring competitive strengths, and built to navigate changing market environments over time.

Quality Investing focuses on discipline, sound processes, and long-term viability over short-term results, guided by the belief that lasting value is defined by quality, not quantity.

(source: sbimf.com)

What defines a High-Quality Business?

High-quality business typically shows a combination of durable economic moats such as

These advantages help businesses stay resilient during market uncertainty.

Why invest in Quality Fund?

Strong Long-Term performance :

Strong Long-Term performance :Nifty200 Quality 30 Index – 93% More Profit than Nifty 50 over last 20 years

Relatively Better Peace of Mind :

Relatively Better Peace of Mind :Lower Volatility – Nifty200 Quality 30 Index ~10% less volatile than NSE 500, ~30% less volatile than Nifty 200 Value 30 Index

Lower Drawdown – Fell less than other indices in every crash

Why invest in an Actively managed quality fund

Quality Benchmark (Nifty 200 Quality 30) ignores earnings growth potential of companies. It filters based on 3 factors : ROE, Debt to Equity and Historical Earnings Volatility

Benchmark is purely number focused and backward looking. It ignores companies that have built a solid business but haven’t ticked all the boxes yet.

SBI Quality Fund NFO:

| Mutual Fund | SBI Mutual Fund |

| Scheme Name | SBI Quality Fund |

| Objective of Scheme | The investment objective of the scheme is to generate long-term capital appreciation by investing in Equity & Equity related instruments of companies identified based on the Quality Factor. However there is no guarantee or assurance that the investment objective of the scheme will be achieved. |

| Scheme Type | Open Ended |

| Scheme Category | Equity Scheme – Sectoral/ Thematic |

| New Fund Launch Date | 28 Jan 2026 |

| New Fund Earliest Closure Date | |

| New Fund Offer Closure Date | 11 Feb 2026 |

| Indicate Load Separately | For Ongoing basis: • NIL – If units purchased or switched in from another scheme of the Fund are redeemed or switched out after 6 months from the date of allotment • 1% of the applicable NAV – If units purchased or switched in from another scheme of the Fund are redeemed or switched out on or before 6 months from the date of allotment. |

| Minimum Subscription Amount | Rs. 5,000/- and in multiples of Re. 1/- thereafter |

| For Further Details Please Visit Website | https://www.sbimf.com |

(source: https://www.amfiindia.com/)

Scheme Documents

(source: sbimf.com)

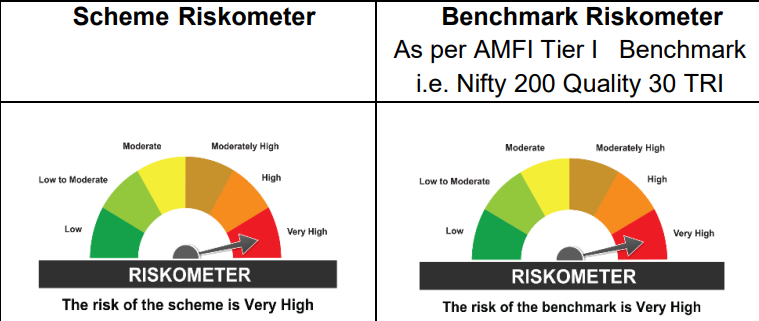

SBI Quality Fund NFO Riskometer:

(source: sbimf.com)