What is Shriram Money Market Fund?

Shriram Money Market Fund (SMMF) is an open-ended debt scheme with an investment objective of generating regular income through investment in a portfolio comprising of money market instruments with residual maturity up to 1 year.

(source: shriramamc.in)

Why Shriram Money Market Fund (SMMF)?

Seeks to invest primarily in money-market instruments with relatively higher credit rating, from a carefully selected universe.

May be used for up to 1-year financial goals, depending on investor objectives and risk profile.

No lock-in and no exit load, allowing investors to access or park money based on their short-term investment horizon.

Money Market Funds Witness Rising Allocations

AUM of Money Market Fund category grew by 2.6x whereas Liquid Fund category grew by 0.46x

AUM of Money Market Fund grew to ₹ 3,57,101 Crore, accounting for 18% of total Debt Funds AUM*

(source: shriramamc.in)

Benefits and Suitability

No exit load. Invests in money-market instruments with maturities up to one year. Aims to maintain a portfolio with an average maturity up to 1 year.

High-quality short-term securities. Carefully crafted universe of money market instruments.

Attempts to provide a relatively better risk—return profile compared with traditional short-term alternatives.

Efficient cash management vehicle with limited impact from interest rate changes.

This fund can be used for STP (Systematic Transfer Plan) to other funds, allowing investors to transfer a fixed amount at regular intervals.

Fund Information

Fund name

Shriram Money Market Fund

Fund category

Money Market Fund (Debt Scheme)

Benchmark

NIFTY Money Market Index A-I

Fund type

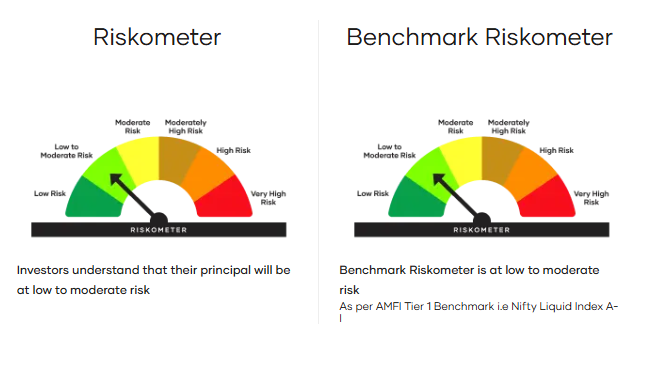

An open-ended debt scheme investing in money market instruments. A relatively low-interest rate risk and moderate credit risk

Scheme objective

The investment objective of the Scheme is to generate regular income through investment in a portfolio comprising of money market instruments with residual maturity up to 1 year. There is no assurance that the investment objective of the Scheme will be achieved.

Lock in plan/option

Regular Plan and Direct Plan

Fund manager

Mr. Amit Modani and

Mr. Sudip Suresh More

Minimum Application Amount (Lumpsum)

Rs. 1,000 and in multiples of Re. 1/- thereafter

Minimum Amount (Per SIP Installment)*

(i) Rs. 500/- and in multiples of Re. 1/- thereafter for minimum 24 installments

(ii) Rs. 1000/- and in multiples of Re. 1/- thereafter for minimum 12 installments

Maximum: No Limit

Exit load

Nil

(source: shriramamc.in)

Shriram Money Market Fund NFO:

| Mutual Fund | Shriram Mutual Fund |

| Scheme Name | Shriram Money Market Fund |

| Objective of Scheme | The investment objective of the Scheme is to generate regular income through investment in a portfolio comprising of money market instruments with residual maturity up to 1 year. There is no assurance that the investment objective of the Scheme will be achieved. |

| Scheme Type | Open Ended |

| Scheme Category | Debt Scheme – Money Market Fund |

| New Fund Launch Date | 19 Jan 2026 |

| New Fund Earliest Closure Date | |

| New Fund Offer Closure Date | 21 Jan 2026 |

| Indicate Load Separately | Exit Load – NIL |

| Minimum Subscription Amount | 1000 |

| For Further Details Please Visit Website | https://www.shriramamc.in |