Parag Parikh Large Cap Fund is a diversified large cap fund that seeks to provide broad exposure to India’s top large-cap companies, with relatively low active share and a cost-conscious approach.

It aims to mirror the Nifty 100 TRI’s performance—efficiently and affordably.

To optimize costs and achieve better prices, the scheme seeks to employ “Smart Execution Strategies”, i.e., the use of appropriate instruments & timing to manage transaction and impact costs.

For example:

- Instead of trading all at once on index reconstitution day, we may rebalance in phases to seek better prices.

- We may use instruments like stock and index futures when they’re available to trade at a discount.

- We may position the portfolio to capture valuation gaps during corporate actions like mergers.

- We may also maintain a small opportunistic active share.

(source: amc.ppfas.com)

So, what does this mean for you?

You get a fund that offers the relative stability and transparency of a large-cap index strategy, but is actively managed from a cost and execution standpoint.

This scheme suitable for you if…

- You want broad exposure to India’s top 100 companies by Market Capitalization

- You prefer lower costs compared to typical active funds

- You value a strategy that aims to deliver index-like returns

- You have a long-term investment horizon (5+ years)

- You understand that equity investments can be volatile

- You appreciate tactical efficiency in implementation

This scheme is NOT for you if…

- You seek to significantly outperform the index

- You want concentrated bets on specific stocks or sectors

- You prefer active stock selection based on fundamentals

- You have a short-term investment horizon

- You cannot tolerate equity market volatility

- You expect the fund to avoid overvalued stocks

(source: amc.ppfas.com)

Parag Parikh Large Cap Fund NFO:

| Mutual Fund | PPFAS Mutual Fund |

| Scheme Name | Parag Parikh Large Cap Fund |

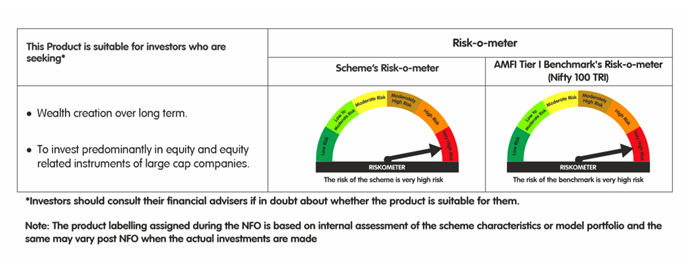

| Objective of Scheme | The objective of the Scheme is to generate long term capital appreciation and income distribution to investors by predominantly investing in equity and equity related instruments of large cap companies. However, there is no assurance that the investment objective of the Scheme will be achieved and the Scheme does not assure or guarantee any returns. |

| Scheme Type | Open Ended |

| Scheme Category | Equity Scheme – Large Cap Fund |

| New Fund Launch Date | 19 Jan 2026 |

| New Fund Earliest Closure Date | |

| New Fund Offer Closure Date | 30 Jan 2026 |

| Indicate Load Separately | NIL |

| Minimum Subscription Amount | 1000 |

| For Further Details Please Visit Website | https://amc.ppfas.com |