Emmvee Photovoltaic Power Limited (EPPL) IPO Company Profile:

Emmvee Photovoltaic Power Limited is one of India’s leading solar module manufacturers and the second-largest pure-play integrated solar photovoltaic (PV) module and solar cell producer. The company’s product portfolio includes bifacial and monofacial formats of TOPCon modules and cells, along with Mono PERC modules, catering to diverse solar energy applications. As an ALMM-enlisted manufacturer, Emmvee upholds high-quality production standards and technological innovation. It operates four advanced manufacturing facilities across two strategic locations in Karnataka, reinforcing its strong domestic presence and contribution to India’s renewable energy capacity expansion.

| IPO-Note | Emmvee Photovoltaic Power Limited (EPPL) |

| Rs. 206 – Rs. 217 per Equity share | Recommendation: May Apply |

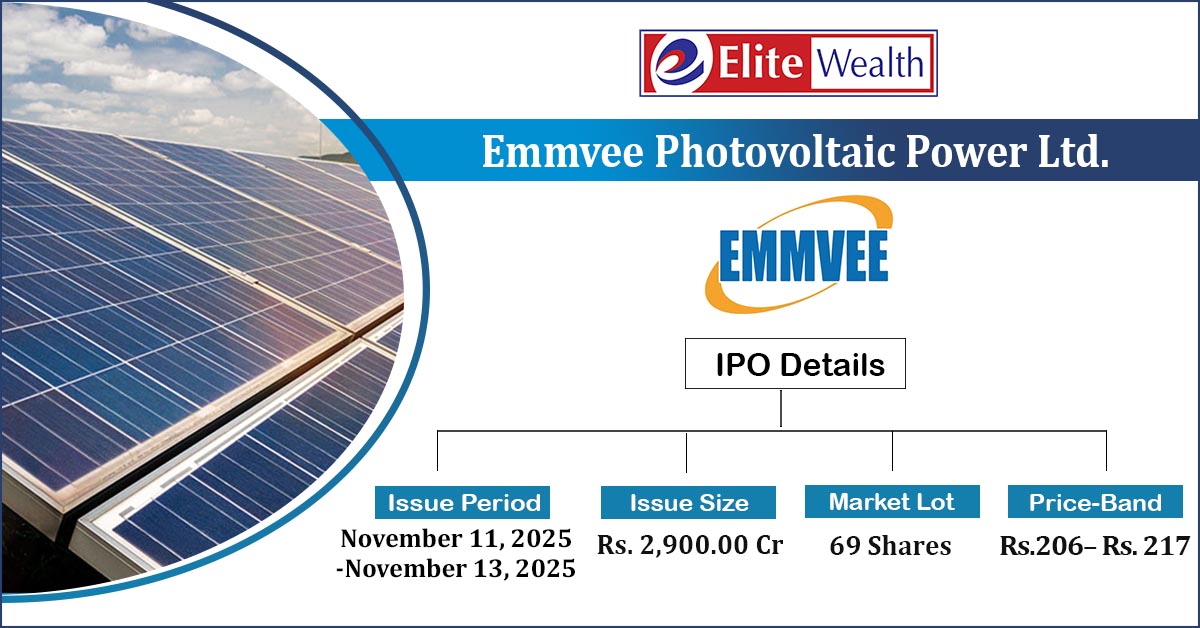

Emmvee Photovoltaic Power Limited (EPPL) IPO Details:

| Issue Details | |

| Objects of the issue | · Repayment of borrowings

· General corporate Exp. |

| Issue Size | Total Issue Size-Rs. 2,900.00Cr

OFS Size- Rs. 756.14 Cr Fresh Issue- Rs. 2,143.86 Cr |

| Face value |

Rs. 2 |

| Issue Price | Rs. 206 – Rs. 217 per share |

| Bid Lot | 69 Shares |

| Listing at |

BSE, NSE |

| Issue Opens | November 11, 2025- November 13, 2025 |

| QIB | Not less than 75% of Net Issue Offer |

| HNI | Not More than 15% of Net Issue Offer |

| Retail | Not More than 10% of Net Issue Offer |

Emmvee Photovoltaic Power Limited (EPPL) IPO Strengths:

- It operates four manufacturing units across two locations in Karnataka, spanning 22.44 acres. The close proximity of these units enables streamlined logistics and operational efficiency. Its Dobbaspet, Bengaluru facility is among India’s largest TOPCon solar cell manufacturing units by installed capacity. It also maintains a zero-liquid discharge system, achieving a 96.80% water recovery rate as of June 30, 2025.

- As of June 30, 2025, it has an installed solar PV module manufacturing capacity of 7.80 GW and a solar cell production capacity of 2.94 GW, reflecting its capability to support large-scale deployment across domestic and export markets.

- As of Q1FY26, it had an outstanding order book of 5.36 GW, including orders from utility-scale IPPs, PSUs, and C&I customers. Additional orders of 1.35 GW were secured between April and June 2025. The order book grew at a CAGR of 209.05% between Fiscal 2023 and Fiscal 2025. It diversified customer base has translated into a substantial order book, which was 4.89 GW as of March 31, 2025 and 5.36 GW as of June 30, 2025.

- It holds an estimated 5.1% market share in ALMM-enlisted solar PV module manufacturing capacity as of May 2025, underscoring its established position in the domestic market and reflecting its growing presence within India’s regulated and government-linked solar deployment ecosystem.

- It is currently adding a 2.50 GW solar PV module production line and plans to establish an additional 6 GW integrated solar cell and module manufacturing capacity in FY26. These expansions are expected to increase its solar PV module capacity to 16.30 GW and solar cell capacity to 8.94 GW by the first half of Fiscal 2028.

- It is among the early adopters of high-efficiency Tunnel Oxide Passivated Contact (TOPCon) technology for solar cell manufacturing in India. As of March 2025, the company is one of the few domestic manufacturers utilizing this advanced technology, positioning it at the forefront of next-generation solar cell production in the country.

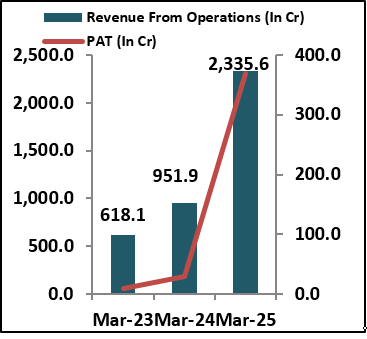

- It reported revenue from operations of ₹2,335.61 crore in FY25, reflecting a growth of 145.35% from ₹951.94 crore in FY24. Profit after tax increased to ₹369.01 crore in FY25, representing a growth of 1,177% from ₹28.90 crore in FY24. In Q1 FY26, it reported revenue of ₹1,027.82 crore and a PAT of ₹187.68 crore.

- India’s solar PV manufacturing capacity has expanded rapidly, with module and cell capacities rising to 82 GW and 23 GW by March 2025, driven by supportive government policies and renewable energy goals. By FY2030, capacities are projected to reach 175–185 GW and 85–95 GW, respectively, with integrated manufacturing improving efficiency and cost control.

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Emmvee Photovoltaic Power Limited (EPPL) IPO Allotment Status

Emmvee Photovoltaic Power Limited (EPPL) IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

-

Select Emmvee Photovoltaic Power Limited (EPPL) IPO

-

Enter your PAN Number or Application Id or DP Client Id.

Emmvee Photovoltaic Power Limited (EPPL) IPO Risk Factors:

- The company faces intense competition from established industry players such as Waaree Energies, Premier Energies, Vikram Solar, Saatvik Green Energy and Websol. This competitive landscape may exert pressure on pricing, market share, revenue growth and overall profitability.

- Increases in the prices of key raw materials, including silicon wafers, silver paste, encapsulants, backsheets, glass, aluminium frames, junction boxes and lamination materials, can significantly affect the company’s production costs. Such cost pressures may reduce margins and negatively impact overall profitability if not effectively managed.

Emmvee Photovoltaic Power Limited (EPPL) IPO Financial Performance:

Emmvee Photovoltaic Power Limited (EPPL) IPO Shareholding Pattern:

| Particulars | Pre Issue | Post issue |

| Promoters Group | 100.00% | 80.70% |

| Others | 0.00% | 19.30% |

Emmvee Photovoltaic Power Limited (EPPL) IPO FAQ:

Ans. Emmvee Photovoltaic IPO is a main-board IPO of 13,36,40,552 equity shares of the face value of ₹2 aggregating up to ₹2,900.00 Crores. The issue is priced at . The minimum order quantity is 69.

The IPO opens on November 11, 2025, and closes on November 13, 2025.

Kfin Technologies Ltd. is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Emmvee Photovoltaic IPO opens on November 11, 2025 and closes on November 13, 2025.

Ans. Emmvee Photovoltaic IPO lot size is 69, and the minimum amount required for application is ₹14,973..

Ans. The Emmvee Photovoltaic IPO listing date is not yet announced. The tentative date of Emmvee Photovoltaic IPO listing is Tuesday, November 18, 2025.

Sources: Company Website, RHP.

Disclosure in pursuance of Section 19 of SEBI (RA) Regulation 214

Elite Wealth Limited does/does not do business with companies covered in its research reports. Investors should be aware that the Elite Wealth Limited may/may not have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only information in making their investment decision and must exercise their own judgment before making any investment decision.

For analyst certification and other important disclosures, see the Disclosure Appendix, or go to www.elitewealth.in. Analysts employed by Elite Wealth Limited are registered/qualified as research analysts with SEBI in India. (SEBI Registration No.: INH100002300)

Disclosure Appendix

Analyst Certification (For Reports)

Vindhyachal Prasad, Elite Wealth Limited, vindhyachal@elitestock.com

The analyst(s) certify that all of the views expressed in this report accurately reflect my/our personal views about the subject company or companies and its or their securities. I/We also certify that no part of my compensation was, is or will be, directly or indirectly, related to the specific recommendations or views expressed in this report. Unless otherwise stated, the individuals listed on the cover page of this report are analysts in Elite Wealth Limited.

As to each individual report referenced herein, the primary research analyst(s) named within the report individually certify, with respect to each security or issuer that the analyst covered in the report, that:

- all of the views expressed in the report accurately reflect his or her personal views about any and all of the subject securities or issuers; and

- No part of any of the research analyst’s compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed in the For individual analyst certifications, please refer to the disclosure section at the end of the attached individual notes.

Research Excerpts

This note may include excerpts from previously published research. For access to the full reports, including analyst certification and important disclosures, investment thesis, valuation methodology, and risks to rating and price targets, please visit www.elitewealth.in.

Company-Specific Disclosures

Important disclosures, including price charts, are available and all Elite Wealth Limited covered companies by visiting https://www.elitewealth.in, or emailing research@elitestock.com with your request. Elite Wealth Limited may screen companies based on Strategy, Technical, and Quantitative Research. For important disclosures for these companies, please e-mail research@elitestock.com.

Options related research:

If the information contained herein regards options related research, such information is available only to persons who have received the proper option risk disclosure documents. For a copy of the risk disclosure documents, please contact your Broker’s Representative or visit the OCC’s website at https://www.elitewealth.in

Other Disclosures

All research reports made available to clients are simultaneously available on our client websites. Not all research content is redistributed, e-mailed or made available to third-party aggregators. For all research reports available on a particular stock, please contact your respective broker’s sales person.

Ownership and material conflicts of interest Disclosure

Elite Wealth Limited policy prohibits its analysts, professionals reporting to analysts from owning securities of any company in the analyst’s area of coverage. Analyst compensation: Analysts are salary based permanent employees of Elite Wealth Limited. Analyst as officer or director: Elite Wealth Limited policy prohibits its analysts, persons reporting to analysts from serving as an officer, director, board member or employee of any company in the analyst’s area of coverage.

Country Specific Disclosures

India – For private circulation only, not for sale. Legal Entities Disclosures

Mr. Ravinder Parkash Seth is the Managing Director of Elite Wealth Ltd (EWL, henceforth), having its registered office at Casa Picasso, Golf Course Extension, Near Rajesh Pilot Chowk, Radha Swami, Sector-61, Gurgaon-122001 Haryana, is a SEBI registered Research Analyst and is regulated by Securities and Exchange Board of India. Telephone: 011-43035555, Facsimile: 011-22795783 and Website: www.elitewealth.in

EWL discloses all material information about itself including its business activity, disciplinary history, the terms and conditions on which it offers research report, details of associates and such other information as is necessary to take an investment decision, including the following:

- Reports

- a) EWL or his associate or his relative has no financial interest in the subject company and the nature of such financial interest;

- EWL or its associates or relatives, have no actual/beneficial ownership of one %. or more in the securities of the subject company, at the end of the month immediately preceding the date of publication of the research report or date of the public appearance;

- EWL or its associate or his relative, has no other material conflict of interest at the time of publication of the research report or at the time of public appearance;

- Compensation

- EWL or its associates have not received any compensation from the subject company in the past twelve months;

- EWL or its associates have not managed or co-managed public offering of securities for the subject company in the past twelve months;

- EWL or its associates have not received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

- EWL or its associates have not received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

- EWL or its associates have not received any compensation or other benefits from the Subject Company or third party in connection with the research

- In respect of Public Appearances

- EWL or its associates have not received any compensation from the subject company in the past twelve months;

- The subject company is not now or never a client during twelve months preceding the date of distribution of the research report and the types of services provided by EWL