IValue InfoSolutions Limited IPO Company Profile:

IValue InfoSolutions Limited is an enterprise technology solutions provider in India, focused on securing and managing digital applications and data for large enterprises. The company partners with System Integrators (SIs) and Original Equipment Manufacturers (OEMs) to design, recommend, and deploy customized solutions that ensure performance, scalability, availability, and security across enterprise digital ecosystems. Positioned as a critical link in the technology value chain, iValue enables OEMs to reach their target customers effectively while supporting enterprises in their digital transformation journey, thereby strengthening its role as a trusted enabler of next-generation IT infrastructure and business continuity.

segments.

| IPO-Note | IValue InfoSolutions Limited |

| Rs. 284 – Rs. 299 per Equity share | Recommendation: May Apply |

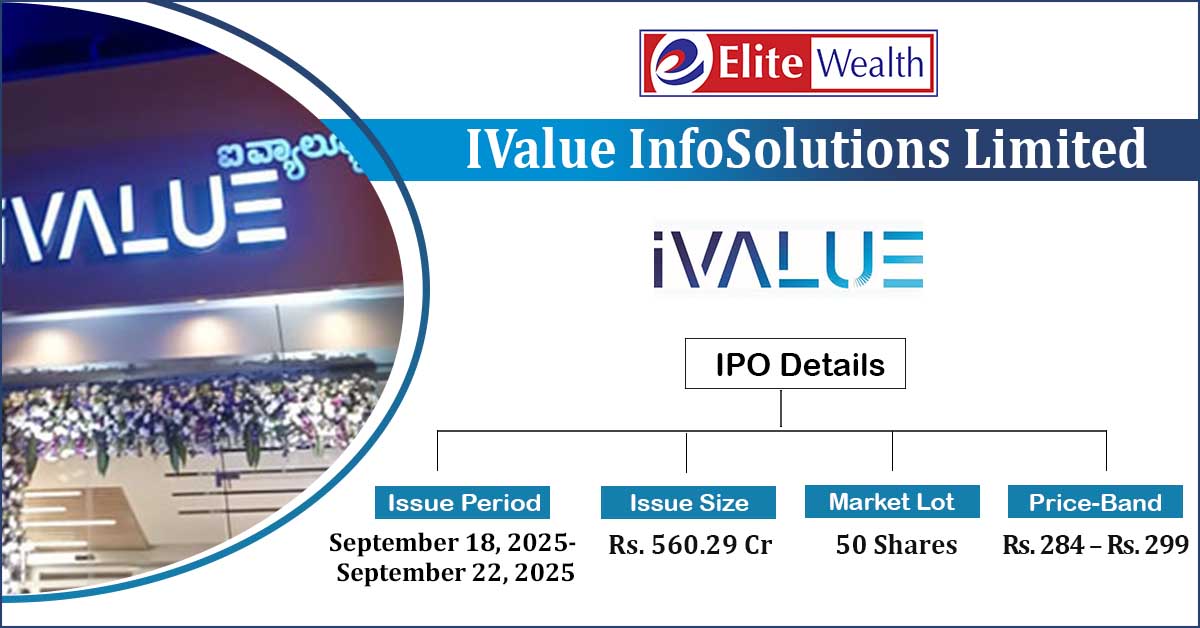

IValue InfoSolutions Limited IPO Details:

| Issue Details | |

| Objects of the issue | · For Listing Benefits

|

| Issue Size | Total Issue Size-Rs. 560.29 Cr

Offer for Sale Size- Rs. 560.29 Cr |

| Face value |

Rs . 2 |

| Issue Price | Rs. 284 – Rs. 299 per share |

| Bid Lot | 50 Shares |

| Listing at |

BSE, NSE |

| Issue Opens | September 18, 2025- September 22, 2025 |

| QIB | Not More than 50% of Net Issue Offer |

| HNI | Not Less than 15% of Net Issue Offer |

| Retail | Not Less than 35% of Net Issue Offer |

IValue InfoSolutions Limited IPO Strengths:

- It operates through eight offices across India, with its headquarters in Bengaluru, and maintains an international presence across six locations—Singapore, Bangladesh, Sri Lanka, the UAE, Cambodia, and Kenya. Additionally, through its teams in Bangladesh and Singapore, the company also serves customers in the Bhutan and Nepal markets.

- In FY2025, the company engaged with 37 Global System Integrators (including Regional System Integrators), 97 National System Integrators, and 670 Local System Integrators. Its network of OEM partners expanded from 93 as of March 31, 2023, to 101 as of March 31, 2024, and further to 109 as of March 31, 2025. Of these 109 OEM partners, 19 have been associated with the company for over 10 years, 38 for six or more years, and 84 for three or more years, underscoring the depth and longevity of its strategic relationships.

- The company has established agreements with leading OEMs such as Check Point, Forcepoint, Hitachi, Tenable, Yubico, Imperva, and Arista. Further, in line with its strategy to strengthen Application Lifecycle Management (ALM) and cloud offerings, it has recently partnered with marquee OEMs including Splunk, Nutanix, and Google Cloud.

- With the objective of becoming the preferred partner for System Integrators, the company follows a multi-pronged business development strategy encompassing product life cycle adoption, customer life cycle adoption, focused account practices, multi-OEM solution stacks, and its proprietary iValue CoE—a hybrid cloud-based platform for technology decision-making. This approach enables System Integrators to effectively identify, address, and fulfill the evolving technology requirements of their enterprise customers.

- The company has partnered with an Information Lifecycle Management (ILM) OEM, through which it has extended products and solutions to 211 System Integrators, serving 332 enterprise customers since the partnership’s inception.

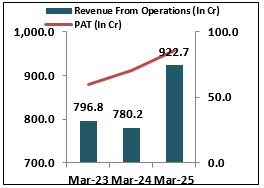

- In FY2025, the company reported revenue from operations of Rs 922.68 crore, reflecting a growth of 18.25% compared to Rs 780.23 crore in FY2024. Profit After Tax (PAT) stood at Rs 85.30 crore in FY2025, marking a 20.8% increase from Rs 70.57 crore in FY2024.

- In India, the Total Addressable Market (TAM) for cybersecurity, information lifecycle management, data centre infrastructure, application lifecycle management, and professional & managed services is expanding rapidly. The market is projected to grow at a CAGR of 23.1% between 2024 and 2030, increasing from USD 22.7 billion in 2024 to USD 78.9 billion by 2030. This growth is driven by strong government initiatives and enterprises’ increasing focus on digitalization, cloud adoption, and cybersecurity measures.

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check IValue InfoSolutions Limited IPO Allotment Status

IValue InfoSolutions Limited IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

-

Select IValue InfoSolutions Limited IPO

-

Enter your PAN Number or Application Id or DP Client Id.

IValue InfoSolutions Limited IPO Risk Factors:

- The company faces intense competition from direct and indirect players and domestic and international. Key competitors include Exclusive Networks SA, Multi Chem Limited, TCS, HCL, Infosys, Quick Heal Technologies Ltd., Wipro Ltd., Tech Mahindra Ltd., Zensar Technologies Ltd., and Aurionpro Solutions Ltd.. This competitive landscape may impact pricing and market share, necessitating continuous innovation, operational efficiency, and differentiated service offerings to maintain and strengthen the company’s position in both domestic and global markets.

- The company faces intense competition from resellers and value-added distributors (VADs). Failure to maintain and strengthen relationships with existing System Integrators, or to attract new System Integrators, could materially and adversely impact its business operations and growth prospects.

IValue InfoSolutions Limited IPO Financial Performance:

IValue InfoSolutions Limited IPO Shareholding Pattern:

| Particulars | Pre Issue | Post issue |

| Promoters Group | 39.92% | 32.73% |

| Others | 60.08% | 67.27% |

Sources: Company Website, RHP.

IValue InfoSolutions Limited IPO Outlook:

IValue InfoSolutions Limited is an enterprise technology solutions provider in India, specializing in securing and managing digital applications and data for large enterprises. In FY25, the company reported an 18.25% growth in revenue from operations and a 20.8% increase in profit after tax, reflecting strong business momentum. With the objective of becoming the preferred partner for System Integrators, the company adopts a multi-pronged business development strategy, including product and customer life cycle adoption, focused account practices, multi-OEM solution stacks, and its proprietary iValue CoE. Serving both domestic and international markets, the company operates in a highly competitive landscape, which continues to exert pressure on its profitability. At the upper price band of Rs 299, the issue is priced at a P/E of 18.77x, both on a pre-IPO and post-IPO basis, based on FY25 earnings. Considering the valuations and listed factors, we recommend this issue only for aggressive investors, both for potential listing gains and for medium- to long-term investment.

IValue InfoSolutions Limited IPO FAQ:

Ans. Ivalue Infosolutions IPO is a main-board IPO of 1,87,38,958 equity shares of the face value of ₹2 aggregating up to ₹560.29 Crores. The issue is priced at . The minimum order quantity is 50.

The IPO opens on September 18, 2025, and closes on September 22, 2025.

Kfin Technologies Ltd. is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Ivalue Infosolutions IPO opens on September 18, 2025 and closes on September 22, 2025.

Ans. Ivalue Infosolutions IPO lot size is 50, and the minimum amount required for application is ₹14,950.

Ans. The Ivalue Infosolutions IPO listing date is not yet announced. The tentative date of Ivalue Infosolutions IPO listing is Thursday, September 25, 2025.

Disclosure in pursuance of Section 19 of SEBI (RA) Regulation 214

Elite Wealth Limited does/does not do business with companies covered in its research reports. Investors should be aware that the Elite Wealth Limited may/may not have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only information in making their investment decision and must exercise their own judgment before making any investment decision.

For analyst certification and other important disclosures, see the Disclosure Appendix, or go to www.elitewealth.in. Analysts employed by Elite Wealth Limited are registered/qualified as research analysts with SEBI in India. (SEBI Registration No.: INH100002300)

Disclosure Appendix

Analyst Certification (For Reports)

Vindhyachal Prasad, Elite Wealth Limited, vindhyachal@elitestock.com

The analyst(s) certify that all of the views expressed in this report accurately reflect my/our personal views about the subject company or companies and its or their securities. I/We also certify that no part of my compensation was, is or will be, directly or indirectly, related to the specific recommendations or views expressed in this report. Unless otherwise stated, the individuals listed on the cover page of this report are analysts in Elite Wealth Limited.

As to each individual report referenced herein, the primary research analyst(s) named within the report individually certify, with respect to each security or issuer that the analyst covered in the report, that:

- all of the views expressed in the report accurately reflect his or her personal views about any and all of the subject securities or issuers; and

- No part of any of the research analyst’s compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed in the For individual analyst certifications, please refer to the disclosure section at the end of the attached individual notes.

Research Excerpts

This note may include excerpts from previously published research. For access to the full reports, including analyst certification and important disclosures, investment thesis, valuation methodology, and risks to rating and price targets, please visit www.elitewealth.in.

Company-Specific Disclosures

Important disclosures, including price charts, are available and all Elite Wealth Limited covered companies by visiting https://www.elitewealth.in, or emailing research@elitestock.com with your request. Elite Wealth Limited may screen companies based on Strategy, Technical, and Quantitative Research. For important disclosures for these companies, please e-mail research@elitestock.com.

Options related research:

If the information contained herein regards options related research, such information is available only to persons who have received the proper option risk disclosure documents. For a copy of the risk disclosure documents, please contact your Broker’s Representative or visit the OCC’s website at https://www.elitewealth.in

Other Disclosures

All research reports made available to clients are simultaneously available on our client websites. Not all research content is redistributed, e-mailed or made available to third-party aggregators. For all research reports available on a particular stock, please contact your respective broker’s sales person.

Ownership and material conflicts of interest Disclosure

Elite Wealth Limited policy prohibits its analysts, professionals reporting to analysts from owning securities of any company in the analyst’s area of coverage. Analyst compensation: Analysts are salary based permanent employees of Elite Wealth Limited. Analyst as officer or director: Elite Wealth Limited policy prohibits its analysts, persons reporting to analysts from serving as an officer, director, board member or employee of any company in the analyst’s area of coverage.

Country Specific Disclosures

India – For private circulation only, not for sale. Legal Entities Disclosures

Mr. Ravinder Parkash Seth is the Managing Director of Elite Wealth Ltd (EWL, henceforth), having its registered office at Casa Picasso, Golf Course Extension, Near Rajesh Pilot Chowk, Radha Swami, Sector-61, Gurgaon-122001 Haryana, is a SEBI registered Research Analyst and is regulated by Securities and Exchange Board of India. Telephone: 011-43035555, Facsimile: 011-22795783 and Website: www.elitewealth.in

EWL discloses all material information about itself including its business activity, disciplinary history, the terms and conditions on which it offers research report, details of associates and such other information as is necessary to take an investment decision, including the following:

- Reports

- a) EWL or his associate or his relative has no financial interest in the subject company and the nature of such financial interest;

- EWL or its associates or relatives, have no actual/beneficial ownership of one %. or more in the securities of the subject company, at the end of the month immediately preceding the date of publication of the research report or date of the public appearance;

- EWL or its associate or his relative, has no other material conflict of interest at the time of publication of the research report or at the time of public appearance;

- Compensation

- EWL or its associates have not received any compensation from the subject company in the past twelve months;

- EWL or its associates have not managed or co-managed public offering of securities for the subject company in the past twelve months;

- EWL or its associates have not received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

- EWL or its associates have not received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

- EWL or its associates have not received any compensation or other benefits from the Subject Company or third party in connection with the research

- In respect of Public Appearances

- EWL or its associates have not received any compensation from the subject company in the past twelve months;

- The subject company is not now or never a client during twelve months preceding the date of distribution of the research report and the types of services provided by EWL