SBI Dynamic Asset Allocation Active FoF NFO Fund Overview:

An open-ended fund of fund scheme investing in units of actively managed equity and debt-oriented mutual fund schemes.

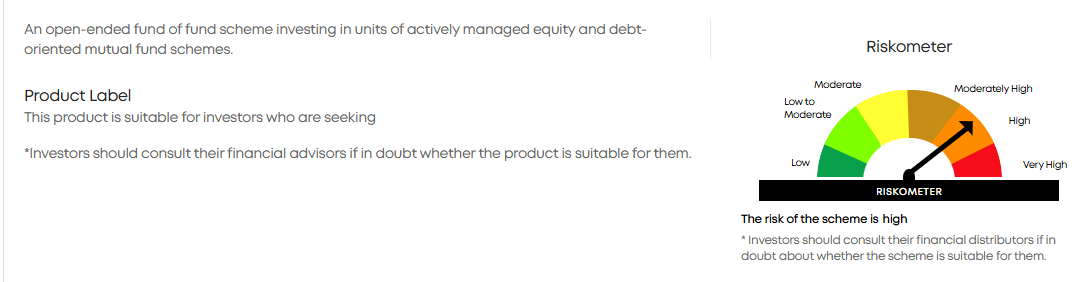

Product Label

This product is suitable for investors who are seeking

*Investors should consult their financial advisors if in doubt whether the product is suitable for them.

(source: sbimf.com/)

SBI Dynamic Asset Allocation Active FoF NFO Fund Facts:

| Type Of Scheme | : | An open-ended fund of fund scheme investing in units of actively managed equity and debt-oriented mutual fund schemes. |

| Fund Manager | : | Mr. Ardhendu Bhattacharya (Co-Fund Manager), Ms. Nidhi Chawla |

| Benchmark Index | : | Nifty 50 Hybrid composite debt 50:50 Index |

| Minimum Application | : | Rs. 5000/- and in multiples of Re. 1 thereafter* |

| Exit Load | : | –For units purchased or switched in from another scheme to the fund are redeemed or switched out on or before12 months from the date of allotment: Upto 25% of the investments – Nil; For remaining investments – 1% of applicable NAV–For exit after 12 months from the date of allotment: Nil |

(source: sbimf.com/)

SBI Dynamic Asset Allocation Active FoF NFO Scheme Details:

The investment objective of the scheme shall be to generate long-term capital appreciation by investing in actively managed equity oriented and actively managed debt oriented mutual fund schemes.

| Mutual Fund | SBI Mutual Fund |

| Scheme Name | SBI Dynamic Asset Allocation Active FoF |

| Objective of Scheme | The investment objective of the scheme shall be to generate long-term capital appreciation by investing in actively managed equity oriented and actively managed debt oriented mutual fund schemes. |

| Scheme Type | Open Ended |

| Scheme Category | Other Scheme – FoF Domestic |

| New Fund Launch Date | 25-Aug-2025 |

| New Fund Earliest Closure Date | |

| New Fund Offer Closure Date | 08-Sep-2025 |

| Indicate Load Seperately | |

| Minimum Subscription Amount | Rs. 5,000/- and in multiples of Re.1 thereafter |

| For Further Details Please Visit Website | https://www.sbimf.com |

(source: https://www.amfiindia.com/)