Shreeji Shipping Global Limited IPO Company Profile:

Shreeji Shipping Global Ltd provides of shipping and logistics solutions for dry bulk cargo across various ports and jetties in India and Sri Lanka. With a legacy spanning more than three decades, it has extensive experience in cargo handling, transportation, fleet chartering, equipment rentals, and other ancillary services. While it serves both major and non-major ports, the Company primarily focuses on non-major ports and jetties, particularly along the West Coast of India. Its comprehensive service offerings include end-to-end shipping and logistics solutions for dry bulk cargo, encompassing cargo handling and transportation. Under the cargo handling segment, the Company provides STS (Ship-to-Ship) lighterage, stevedoring, and a range of port-related services, including cargo management.

| IPO-Note | Shreeji Shipping Global Limited |

| Rs. 240 – Rs. 252 per Equity share | Recommendation: May Apply |

Shreeji Shipping Global Limited IPO Details:

| Issue Details | |

| Objects of the issue | · Acquisition of Dry Bulk Carriers in Supramax category.

· Repayment of Borrowings. · General Corporate Expenses. |

| Issue Size | Total Issue Size-Rs. 410.71 Cr

Fresh Issue Size- Rs. 410.71 Cr |

| Face value |

Rs . 10 |

| Issue Price | Rs. 240 – Rs. 252 per share |

| Bid Lot | 58 Shares |

| Listing at |

BSE, NSE |

| Issue Opens | August 19, 2025- August 21, 2025 |

| QIB | Not more than 50% of Net Issue Offer |

| HNI | Not Less than 15% of Net Issue Offer |

| Retail | Not Less than 35% of Net Issue Offer |

Shreeji Shipping Global Limited IPO Strengths:

- The Company caters to customers across diverse sectors including Oil & Gas, Energy & Power, FMCG, Coal, and Metals. As of March 31, 2025, the Company served 106 customers, compared to 102 in Fiscal 2024 and 96 in Fiscal 2023. A strong base of existing customers contributed 92.21% of revenue in Fiscal 2025, 93.87% in Fiscal 2024, and 96.59% in Fiscal 2023, while newly acquired customers accounted for 7.79%, 6.13%, and 3.41%, respectively.

- The Company operates a diversified fleet comprising over 80 vessels, including barges, mini bulk carriers (MBCs), tugboats, and floating cranes, along with more than 370 earthmoving equipment such as material handling machines, excavators, pay loaders, tippers with trailers, tankers, and other vehicles, effectively serving its clients as of March 31, 2025.

- The Company has provided its services at over 20 ports and jetties, including major Indian ports such as Kandla, non-major ports such as Navlakhi, Magdalla, Bhavnagar, Bedi, and Dharmatar, as well as the overseas port at Puttalam (Sri Lanka), as of March 31, 2025.

- Shreeji Shipping Global Ltd, as part of the NEPL-SSGPL-GKR consortium, has secured a Letter of Award from Eastern Coalfields Limited on January 1, 2025, for the Chuperbita-Simlong Opencast Project in Jharkhand. The Rs. 94,763.30 million contract (Rs. 80,307.88 million excluding GST) spans 25 years and entails mining 118.90 MT of coal and 432.31 MCuM of overburden at a peak capacity of 6 MT annually. The consortium has established an SPV, executed agreements, and provided requisite performance securities.

- For the fiscals ended 2025, 2024, and 2023, the Company handled total cargo volumes of 15.71 MMT, 13.78 MMT, and 13.87 MMT, respectively. During the same periods, cargo volumes transported by the Company stood at 2.49 MMT, 2.74 MMT, and 2.96 MMT, respectively.

- According to the D&B Report, cargo handled at Indian ports is projected to grow at a CAGR of 10.80%, increasing from 1,540 MMT in Fiscal 2024 to 2,849 MMT in Fiscal 2030. Further, cargo volumes at ports in Gujarat are expected to rise from 317.20 MMT in Fiscal 2024 to 720 MMT in Fiscal 2030, reflecting a higher CAGR of 17.50%.

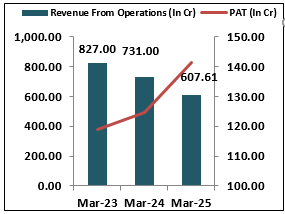

- The Company reported revenue from operations of Rs 6,07.61 crore in FY25, a decline of 16.8% from Rs 7,31.00 crore in FY24. However, profit after tax increased by 13.4% to Rs 1,41.24 crore in FY25, compared to Rs 1,24.51 crore in FY24, primarily driven by higher exceptional income.

- The Ministry of Ports, Shipping, and Waterways has formulated a comprehensive port connectivity plan aimed at bridging critical infrastructure gaps in first and last-mile linkages. This initiative is designed to enhance logistics efficiency, reduce transit delays, and ensure seamless movement of goods across the country’s port network.

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Shreeji Shipping Global Limited IPO Allotment Status

Shreeji Shipping Global Limited IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

-

Select Shreeji Shipping Global Limited IPO

-

Enter your PAN Number or Application Id or DP Client Id.

Shreeji Shipping Global Limited IPO Risk Factors:

- The Company operates in a highly competitive industry, facing significant competition from both established and emerging players, including listed and unlisted entities such as Shreyas Shipping & Logistics Ltd, Seamec Ltd, Great Eastern Shipping Company Ltd, Mercator Ltd, Ocean Sparkle Ltd, Container Corporation of India, Global dry bulk operators and Adani Ports & SEZ Ltd. This competitive environment may exert pressure on pricing, margins, and market share, thereby posing a potential risk to the Company’s business performance.

- The Company’s profitability is influenced by trade regulations and policies of countries in which it operates, including tariffs, port regulations, customs duties, and environmental compliance norms. Any adverse changes in these rules may increase operating costs, restrict cargo movement, and negatively impact overall business performance.

- The current tariff measures imposed by the USA have created uncertainty in global trade dynamics. Such policies may affect cargo volumes, increase logistics costs, and indirectly impact the Company’s operations and profitability.

Shreeji Shipping Global Limited IPO Financial Performance:

Shreeji Shipping Global Limited IPO Shareholding Pattern:

| Particulars | Pre Issue | Post issue |

| Promoters Group | 100.00% | 90.00% |

| Others | 00.00% | 10.00% |

Sources: Company Website, RHP.

Shreeji Shipping Global Limited IPO Outlook:

Shreeji Shipping Global Ltd offers shipping and logistics solutions for dry bulk cargo across ports and jetties in India and Sri Lanka. In FY25, revenue declined 16.8% YoY, while PAT rose 13.4% YoY due to exceptional items. The Company operates over 80 vessels and 370 equipment, serving 106 customers across 20 ports. It secured a major LOA from Eastern Coalfields for the Chuperbita-Simlong Opencast Project. With Indian port cargo expected to grow at a 10.8% CAGR through FY30, growth prospects remain strong. However, regulatory changes, global trade policies, U.S. tariffs, and competitive pressures pose key challenges to profitability. At the upper price band of Rs 252, the issue is valued at a P/E of 26.16x on a pre-IPO basis and 29.07x on a post-IPO basis, based on FY25 earnings. Considering the valuations and the factors outlined, we recommend subscribing to the issue only for aggressive investors, with a view toward potential listing gains as well as medium- to long-term investment opportunities.

Shreeji Shipping Global Limited IPO FAQ:

Ans. Shreeji Shipping Global IPO is a main board IPO of 1,62,98,000 equity shares of the face value of ₹10 aggregating up to ₹410.71 Crores. The issue is priced at ₹240 to ₹252 per share. The minimum order quantity is 58.

The IPO opens on August 19, 2025, and closes on August 21, 2025.

Kfin Technologies Limited is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Shreeji Shipping Global IPO opens on August 19, 2025 and closes on August 21, 2025.

Ans. Shreeji Shipping Global IPO lot size is 58, and the minimum amount required for application is ₹14,616.

Ans. The Shreeji Shipping Global IPO listing date is not yet announced. The tentative date of Shreeji Shipping Global IPO listing is Tuesday, August 26, 2025.