Healthcare is crucial for human life – its availability and affordability have significant impact on society’s well-being. In developing countries like India, healthcare services are vital for sustainable economic development. The Indian healthcare market, valued at US$ 110 billion in FY16, is projected to reach US$ 638 billion by FY25, growing at an average of 22% annually (Indian Brand Equity Foundation, February 2025). This sector seeks to offer diverse investment opportunities across the value chain.

Invest in Baroda BNP Paribas Health and Wellness Fund – designed to tap into the long-term growth potential of the Pharma and Healthcare sectors.

Healthcare: A multidecadal theme with multiple growth drivers

Rising Income and Middle-Class Expansion: An ageing population and growing middle class, with increased purchasing power will increase demand for quality healthcare services.

Changes in Demographics: The percentage of population above 45 years of age is projected to rise from 27% in 2023 to 41% in 2050^. The rise in lifestyle-related illnesses along with ageing population has increased need for healthcare services. It is estimated that the incidence of cardiac issues and diabetes would increase by ~34% from 2020 to 2030*.

Government Initiatives and Policy Support: Various government initiatives aim to provide affordable healthcare to millions of people, further driving the growth of the sector.

(source: barodabnpparibasmf.in)

Introducing Baroda BNP Paribas Health and Wellness Fund

The scheme seeks to provide investors the opportunity to capitalize on one of the most resilient and high-growth sectors.

- Focused on companies expected to benefit from growth in Pharma and Healthcare space

- Invest at least 80% of its net assets in companies in Pharma and Healthcare sector, and allied service providers to the sector

- Actively managed Scheme, with a bottom-up stock selection approach

- Best suited for those looking to hold their investments for over three years to fully benefit from the sector’s growth potential

- A thematic scheme with no market cap limit or preference

Scheme Facts

| Scheme Name | Baroda BNP Paribas Health and Wellness Fund |

| Type of the Scheme | An open ended equity scheme investing in Pharma and Healthcare sector |

| Category | Sectoral / Thematic Fund – Pharma and Healthcare Theme |

| Investment Objective | The primary objective of the Scheme is to provide long-term capital appreciation by investing predominantly in equity and equity related instruments of Pharma and Healthcare companies. The Scheme does not guarantee/indicate any returns. However, there can be no assurance that the investment objective of the Scheme will be realized. |

| Benchmark | BSE Healthcare Total Return Index |

| Fund Manager~ | Mr. Sanjay Chawla |

| Load Structure | Exit Load: Redemption/ switch out of units upto 10% of the units allotted before 1 year from date of allotment – Exit load – NIL. For redemption/switch out of units above 10% of units allotted within 1 year from the date of allotment: 1.00% of applicable NAV For redemption/switch out of units after 1 year from the date of allotment: Nil. The above load shall also be applicable for switches between the schemes of the Fund and all Systematic Investment Plans, Systematic Transfer Plans, Systematic Withdrawal Plans. No load will be charged on units issued upon re-investment of amount of distribution under same IDCW option and bonus units. There shall be no exit load levied in case of switch of investments i) between the Plans (i.e. Regular and Direct Plans); and/or ii) between the options (i.e. IDCW and Growth options), within the Scheme/Plan. For any change in load structure, the AMC will issue an addendum and display it on the website/ISCs. |

| Minimum Application Amount/switch | Lumpsum Details: A minimum of Rs. 1,000 per application and in multiples of Rs.1 thereafter. Systematic Investment Plan: (i) Daily, Weekly, Monthly SIP: Rs. 500/- and in multiples of Re. 1/- thereafter; (ii) Quarterly SIP: Rs. 1500/- and in multiples of Re. 1/- thereafter. |

| Minimum Application Amount/switch in | Lumpsum investment: Rs. 1,000 and in multiples of Rs. 1 thereafter. Systematic Investment Plan: (i) Daily, Weekly, Monthly SIP: Rs. 500/- and in multiples of Re. 1/- thereafter; (ii) Quarterly SIP: Rs. 1500/- and in multiples of Re. 1/- thereafter. There is no upper limit on the amount for application. The Trustee / AMC reserves the right to change the minimum amount for application and the additional amount for application from time to time in the Scheme and these could be different under different plan(s) / option(s). Note – The aforesaid requirement of minimum application shall not be applicable on the mandatory investments made by the Designated Employees of the AMC in accordance with clause 6.10 of SEBI Master Circular on Mutual Funds |

(source: barodabnpparibasmf.in)

Baroda BNP Paribas Health and Wellness Fund NFO Details:

| Mutual Fund | Baroda BNP Paribas Mutual Fund |

| Scheme Name | Baroda BNP Paribas Health and Wellness Fund |

| Objective of Scheme | The primary objective of the Scheme is to provide long-term capital appreciation by investing predominantly in equity and equity related instruments of Pharma and Healthcare companies. The Scheme does not guarantee/indicate any returns. However, there can be no assurance that the investment objective of the Scheme will be realized. |

| Scheme Type | Open Ended |

| Scheme Category | Equity Scheme – Sectoral/ Thematic |

| New Fund Launch Date | 09-Jun-2025 |

| New Fund Earliest Closure Date | |

| New Fund Offer Closure Date | 23-Jun-2025 |

| Indicate Load Seperately | |

| Minimum Subscription Amount | 1000 and in multiples of Re.1/- therafter |

| For Further Details Please Visit Website | https://www.barodabnpparibasmf.in/ |

(source: https://www.amfiindia.com/)

Scheme Documents

(source: barodabnpparibasmf.in)

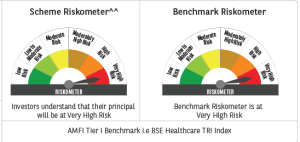

Baroda BNP Paribas Health and Wellness Fund NFO Riskometer:

(source: barodabnpparibasmf.in)

Frequently asked questions

Thematic funds are a type of open ended equity Scheme, investing in companies that are focused on a specific theme/sector.

Baroda BNP Paribas Health and Wellness Fund is an equity oriented thematic fund which invests predominantly in companies in the Pharma and Healthcare sector. The investment objective of the Scheme is to provide long-term capital appreciation by investing predominantly in equity and equity related instruments of Pharma and Healthcare companies. The Scheme does not guarantee/indicate any returns. However, there can be no assurance that the investment objective of the Scheme will be realized.

- The Scheme will invest predominantly in companies in the Pharma and Healthcare space.

- Growth opportunities across the value chain of the healthcare delivery market will be considered- from pharma and biotech companies to healthcare service providers, hospitals, and diagnostics. Companies in the wellness segment, from gyms, to manufacturers of nutraceuticals and any other business or service directly or indirectly forming part of the Pharma, Healthcare and allied sectors forming part of the Benchmark Index would be part of the investment universe. The above list is only indicative, and the Scheme will look to invest in new and emerging areas of Pharma and Healthcare sector which shall be appropriate for the theme of the Scheme.

- The Scheme will follow a bottom-up stock selection process, to choose stocks which are poised to benefit from growth in the Pharma and Healthcare sector.

We suggest investors should consult their financial advisor before investing.

This Scheme is suitable for:

- Investors with a medium-to-long investment horizon

- Investors who want focused exposure to companies in the healthcare theme

- Investors looking to diversify their portfolio through exposure to new sector/theme

We suggest investors should consult their financial advisor before investing.