Fund Facts

To generate long term capital appreciation by pursuing active management and bottom-up investing, primarily in equity and equity related instruments across sectors and market cap spectrum. The scheme will anchor to investing in growth businesses and is best suited for investors with long term investment horizon. *

*However, there is no assurance that the investment objective of the scheme will be achieved. The scheme does not guarantee or assure any returns.

(source:https://unifimf.com/)

Unifi Flexi Cap Fund NFO Details:

| Mutual Fund | Unifi Mutual Fund |

| Scheme Name | UNIFI FLEXI CAP FUND |

| Objective of Scheme | To generate long term capital appreciation by pursuing active management and bottom-up investing, primarily in equity and equity related instruments across sectors and market cap spectrum. The scheme will anchor to investing in growth businesses and is best suited for investors with long term investment horizon. However, there is no assurance that the investment objective of the scheme will be achieved. The scheme does not guarantee or assure any returns. |

| Scheme Type | Open Ended |

| Scheme Category | Equity Scheme – Flexi Cap Fund |

| New Fund Launch Date | 19-May-2025 |

| New Fund Earliest Closure Date | 30-May-2025 |

| New Fund Offer Closure Date | 30-May-2025 |

| Indicate Load Seperately | Entry Load: Nil Exit Load: In respect of each purchase of units via Lumpsum /Switch In/ Systematic Investment Plan (SIP) and Systematic Transfer Plan (STP-in), Exit Load on redemption/ switch out will be determined as follows: • In case units are redeemed/switched out within 12 months from the date of allotment: 1% of applicable NAV will be charged as Exit Load. • In case units are redeemed/switched out after 12 months from the date of allotment, no Exit Load is applicable. |

| Minimum Subscription Amount | 5000/- |

| For Further Details Please Visit Website | https://unifimf.com |

(source: https://www.amfiindia.com/)

Scheme Documents

(source: https://unifimf.com/)

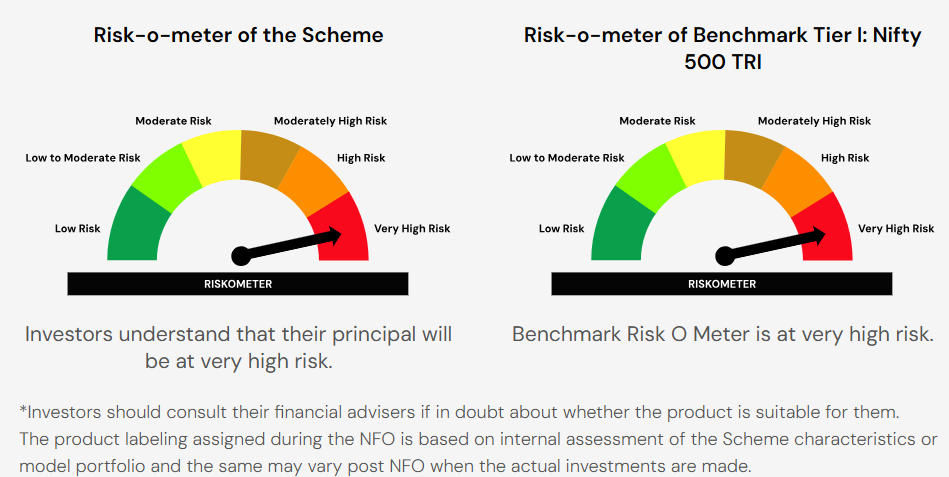

Unifi Flexi Cap Fund NFO Riskometer: