Summary

An open-ended fund of fund investing in domestic mutual funds including debt oriented mutual fund schemes & arbitrage-based equity mutual fund schemes

Investment Philosophy

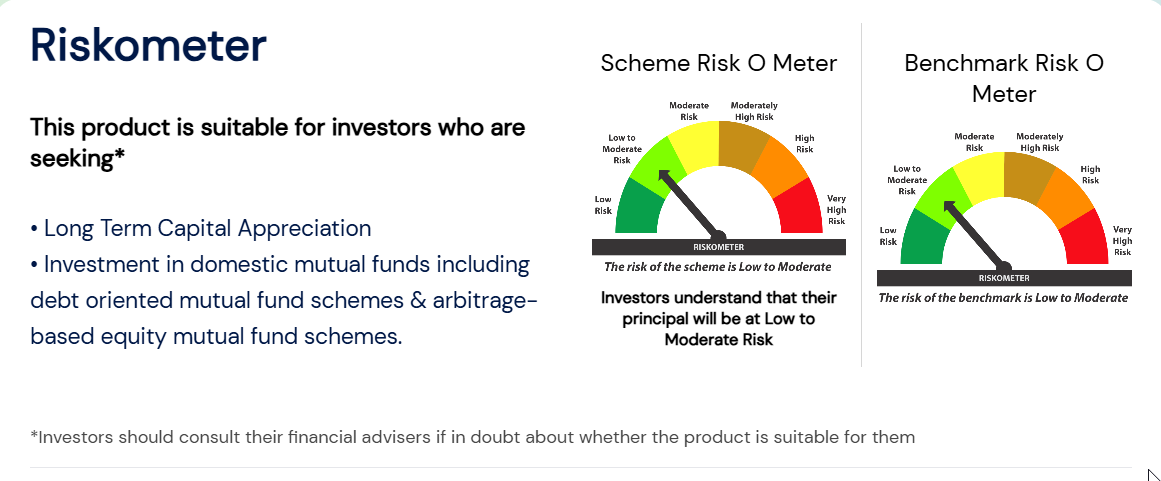

The scheme aims to provide long-term capital appreciation by investing in domestic mutual funds including debt oriented mutual fund schemes & arbitrage-based equity mutual fund schemes. However, there is no assurance or guarantee that the investment objective of the Scheme will be achieved.

Portfolio Positioning and Construction

- This Scheme aims to allocate a minimum of 55% but less than 65% in units of Debt Oriented mutual fund schemes and more than 35% but up to 40% in units of arbitrage-based equity mutual fund schemes.

- The scheme may invest in units of Tata Mutual Fund Scheme(s) or in the Scheme(s) of other mutual funds in conformity with the investment objective / asset allocation of the Scheme.

- 0-5% in direct debt and money market instruments to meet redemption/liquidity needs.

- Active allocation depending on market conditions such as interest rate trends, spreads, equity market valuations, and volatility indicators.

- Aims for potential low volatility, predictable income generation and equity taxation benefit.Portfolio rebalancing within 30 business days if asset allocation deviates passively.

Notes:

Predominantly invests in Tata Corporate Bond Fund, an open-ended debt scheme predominantly investing in AA+ and above rated corporate bonds, with flexibility of any Macaulay Duration and relatively high-interest rate risk and moderate credit risk.

Tata Corporate Bond Fund was launched in November 2021 w.e.f. 24th September 2022, Tata Medium Term Fund was merged with Tata Corporate Bond Fund.

For more information on Tata Corporate Bond Fund features, please refer to the Scheme Information Document (SID).

Investors will be bearing the recurring expenses of the scheme, in addition to the expenses of other schemes in which the Fund of Funds Scheme makes investments.

(source : https://www.tatamutualfund.com/)

Tata Income Plus Arbitrage Active FOF NFO Details:

| Mutual Fund | Tata Mutual Fund |

| Scheme Name | Tata Income Plus Arbitrage Active FOF |

| Objective of Scheme | To provide long-term capital appreciation by investing in domestic mutual funds including debt oriented mutual fund schemes & arbitrage-based equity mutual fund schemes. However, there is no assurance or guarantee that the investment objective of the Scheme will be achieved. |

| Scheme Type | Open Ended |

| Scheme Category | Other Scheme – FoF Domestic |

| New Fund Launch Date | 05-May-2025 |

| New Fund Earliest Closure Date | |

| New Fund Offer Closure Date | 19-May-2025 |

| Indicate Load Seperately | Entry Load: Not Applicable Exit Load: 0.25 % of the applicable NAV, if redeemed / switched out / withdrawn on or before expiry of 30 Days from the date of allotment. |

| Minimum Subscription Amount | Rs. 5,000 and in multiples of Re. 1 thereafter |

| For Further Details Please Visit Website | https://www.tatamutualfund.com |

(source:https://www.amfiindia.com/)

Scheme Documents

KIM – Tata Income Plus Arbitrage Active FOF NFO

(source:https://www.tatamutualfund.com/)