Overview

An active factor-based strategy that blends predictive modelling with our investment research expertise & capabilities. At its core lies the Factor Allocation Model, which dynamically allocates weight to four key investment factors: Momentum, Low Volatility, Quality, and Value. These factors not only represent distinct strategies but also synergize to create a balanced and adaptive investment approach.

Features

- Uniquely Positioned: Distinct portfolio relative to broader market indices with higher mid & small cap exposure providing potential for higher returns in long-term

- Disciplined Strategy: A disciplined well-articulated strategy to be executed continuously through market cycles aimed at achieving both higher returns & stability

- Optimal Portfolio Diversification: Stocks across sectors, sub-sectors, Styles (Growth & Value) and market capitalization

- Leverage of Research Expertise: Large Research Team tracking wide set of companies

(source : https://www.utimf.com/)

UTI Multi Cap Fund NFO Details:

| Mutual Fund | UTI Mutual Fund |

| Scheme Name | UTI Multi Cap Fund |

| Objective of Scheme | The scheme shall seek to generate long-term capital appreciation by investing predominantly in equity and equity related securities of companies across the market capitalization spectrum. However, there can be no assurance or guarantee that the investment objective of the scheme will be achieved. |

| Scheme Type | Open Ended |

| Scheme Category | Equity Scheme – Multi Cap Fund |

| New Fund Launch Date | 29-Apr-2025 |

| New Fund Earliest Closure Date | |

| New Fund Offer Closure Date | 13-May-2025 |

| Indicate Load Seperately | Entry Load – Nil, Exit Load : 1% if redeemed/ switched-out within 90 days from the date of allotment; Nil thereafter |

| Minimum Subscription Amount | Rs 1000 and in multiple of Rs 1/- thereafter |

| For Further Details Please Visit Website | https://www.utimf.com |

(source:https://www.amfiindia.com/)

Scheme Documents

(source:https://www.utimf.com/)

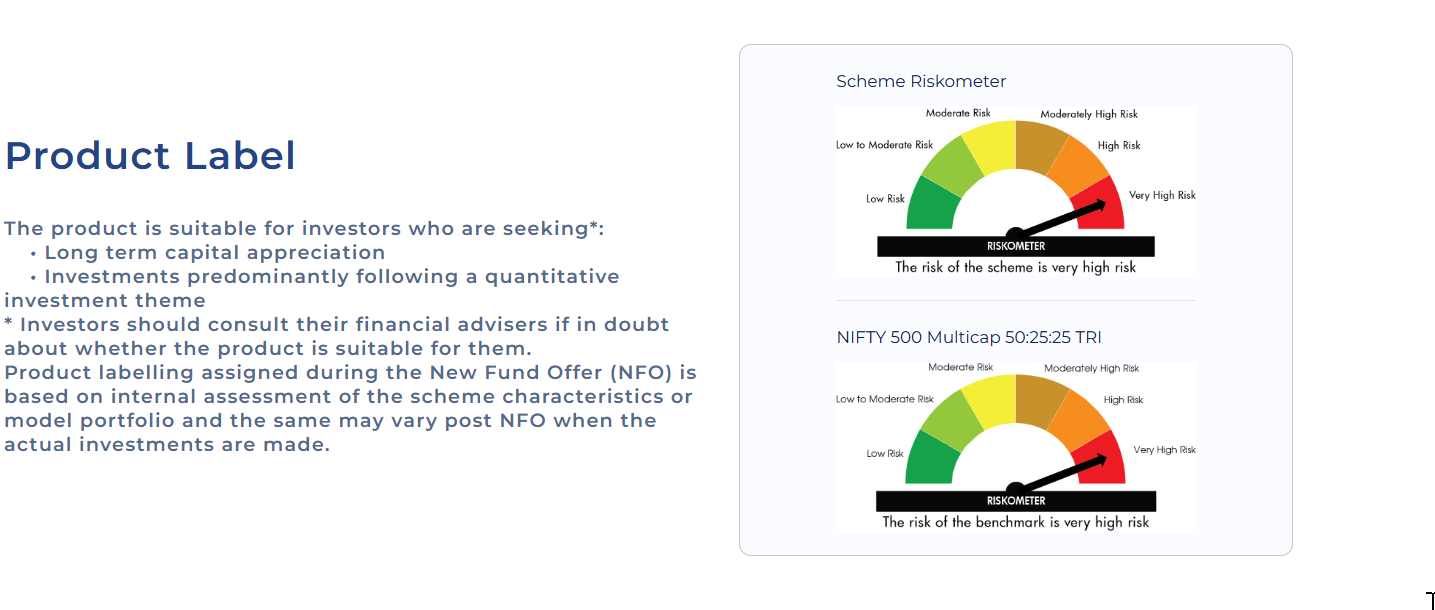

UTI Multi Cap Fund NFO Riskometer: