Enviro Infra Engineers Limited IPO Company Profile:

Enviro Infra Engineers Limited specializes in the design, construction, operation, and maintenance of Water and Wastewater Treatment Plants (WWTPs) and Water Supply Scheme Projects (WSSPs) for government entities. The company’s WWTP portfolio includes Sewage Treatment Plants (STPs), Sewerage Schemes (SS), and Common Effluent Treatment Plants (CETPs), while its WSSP projects encompass Water Treatment Plants (WTPs), pumping stations, and the installation of pipelines for water supply—collectively referred to as “Projects.”.

| IPO-Note | Enviro Infra Engineers Limited |

| Rs.140– Rs.148 per Equity share | Recommendation: Apply |

Enviro Infra Engineers Limited IPO Details:

| Issue Details | |

| Objects of the issue |

· Working capital requirements · Infusion in subsidiaries. · Repayment of borrowings. |

| Issue Size | Total issue Size – Rs.650.53 Cr

Fresh Issue – Rs 572.46 Cr Offer for sale- Rs 77.97 Cr Employee discount- Rs 13 per share |

| Face value |

Rs.10 |

| Issue Price | Rs.140 – Rs.148 per share |

| Bid Lot | 101 Shares |

| Listing at |

BSE, NSE |

| Issue Opens | November 22, 2024 – November 26, 2024 |

| QIB | Not more than 50% of Net Issue Offer |

| HNI | Not less than 15% of Net Issue Offer |

| Retail | Not less than 35% of Net Issue Offer |

Enviro Infra Engineers Limited IPO Strengths:

- The company participates in tenders issued by State Governments and Urban Local Bodies (ULBs) for the development of WWTPs and WSSPs on an EPC or HAM basis. As of June 30, 2024, they have successfully completed 28 WWTP and WSSP projects across India over the past seven years, including 22 projects with a capacity of 10 MLD or more.

- The company’s order book for FY24 stands at Rs 2,125.5 crores, reflecting a 42% increase compared to FY23, demonstrating confidence clients have in its capabilities.

- The projects for which the company bids for receive partial funding from central and state governments under various schemes, which helps enhance the company’s margins by reducing a portion of the project costs (Operating margin at 20% for FY24).

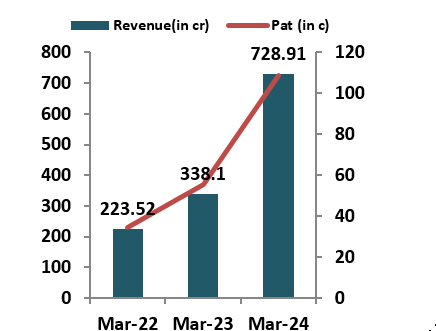

- In FY24 the company has generated revenue from operations of ₹728 crores, marking a 115.38% increase compared to FY23. The compound annual growth rate (CAGR) for revenue from FY22 to FY24 was 87%. Additionally, the profit after tax (PAT) for FY24 reached ₹108 crores, reflecting a remarkable 96%% growth compared to FY23.

Enviro Infra Engineers Limited IPO Risk Factors:

- The industry in which the company operates is highly competitive, with competition coming from a range of small to mid-sized listed and unlisted firms. Key listed players in the Indian water and wastewater treatment market include VA Tech Wabag, Ion Exchange India Ltd., EMS Ltd., and Vishnu Prakash R Punglia Ltd.

- The company reported negative cash flow from operations in FY24, with an operational cash flow of Rs- 69 crores.

- As of June 30, 2024, the company has contingent liabilities amounting to Rs 255.82 crores

Enviro Infra Engineers Limited IPO Financial Performance:

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Enviro Infra Engineers Limited IPO Allotment Status

Enviro Infra Engineers Limited IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Enviro Infra Engineers Limited IPO Shareholding Pattern:

| Particulars | Pre- Issue | Post issue |

| Promoters Group | 93.66% | 70.02% |

| Others | 6.34% | 29.97% |

Enviro Infra Engineers Limited IPO Outlook:

Enviro Infra Engineers Limited has established itself as a strong player in the water solutions industry. The majority of the company’s projects are funded by the central and state governments under various schemes, which helps the company maintain healthy profit margins by offsetting a portion of project costs. The company has demonstrated a solid financial position, with strong profitability and revenue growth. Additionally, Enviro Infra Engineers Limited maintains a robust order book as of FY24.The company’s shares are being offered at a P/E ratio of 23.94 based on FY24 earnings, which appears to be competitive within the industry. Given the company’s strong fundamentals and favorable growth outlook, we recommend that investors consider applying for the issue for potential listing gains.

Enviro Infra Engineers Limited IPO FAQ:

Ans. Enviro Infra Engineers IPO is a main-board IPO of 43,948,000 equity shares of the face value of ₹10 aggregating up to ₹650.43 Crores. The issue is priced at ₹140 to ₹148 per share. The minimum order quantity is 101 Shares.

The IPO opens on November 22, 2024, and closes on November 26, 2024.

Bigshare Services Pvt Ltd is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The The Enviro Infra Engineers IPO opens on November 22, 2024 and closes on November 26, 2024.

Ans. Enviro Infra Engineers IPO lot size is 101 Shares, and the minimum amount required is ₹14,948.

Ans. The Enviro Infra Engineers IPO listing date is not yet announced. The tentative date of Enviro Infra Engineers IPO listing is Friday, November 29, 2024.

Ans. The minimum lot size for this upcoming IPO is 101 shares.